Etomarkets is trapped in the scandal: investors have evaporated, and the risk of corporate structure!Intersection

Etomarkets, a well -known international online trading platform founded in Australia in 2013, provides a variety of derivative tool trading services such as foreign exchange, goods, energy and stock indexes.

However, the platform has recently fallen into a major investment dispute, and its reputation is suffering unprecedented challenges.

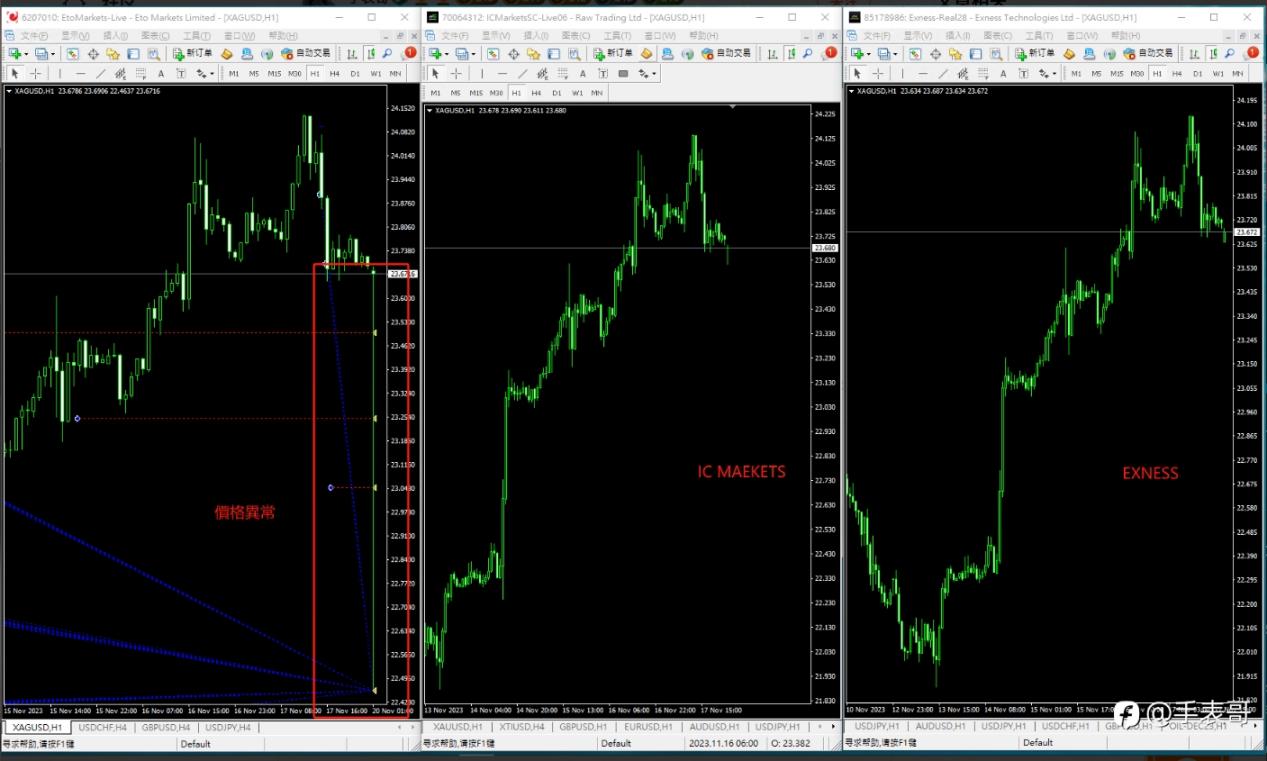

According to the latest news, when an investor conducted an XAG/USD (silver against the US dollar) in November 2023, it encountered abnormal quotation, which led to its instantly evaporated by its $ 350,000.

After more than a year of in -depth investigation, the Australian Securities and Investment Commission (ASIC) has officially involved the case and launched a comprehensive review of Etomarkets.

It is reported that ASIC's survey may cause Etomarkets's business license to be suspended.

Facing the pressure of public opinion, Etomarkets quickly took countermeasures, replaced the company's logo and brand name, and tried to erase the negative news in the past.

However, the reporter warned that Etomarkets may face more stringent regulatory punishments, including ASIC's possibility of revoking its financial operation licenses.

On the FollowME platform, an article written by the watch brother records the malicious modification of Etomarkets maliciously modifying the price of silver, causing investors to burst out in an instant, and the capital loss is as high as US $ 377,000.

The article has attracted widespread attention and provided in -depth analysis and evidence.

Interested readers can view the original text through the following link:

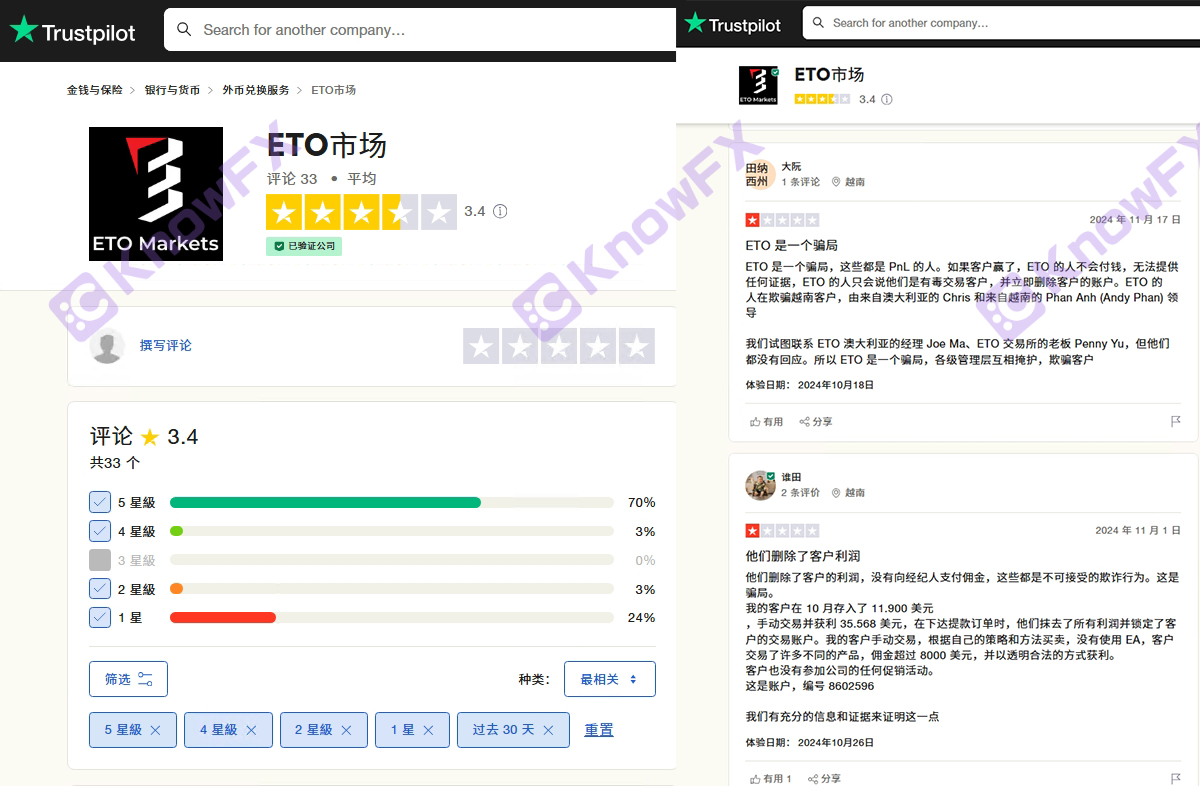

With the continuous exposure of Etomarkets's series of scandals, more and more victims have begun to stand up bravely to share their unfair treatment and personal experience.

Some investors point out that when they make a profit in the transaction, Etomarkets not only refuses to pay, but also cannot provide any reasonable interpretation or evidence.

Instead, they will also mark these profitable customers as "toxic trading customers" and immediately delete their accounts.

What is even more shocking is that Etomarkets' fraud is not limited to Australia, but also involves deceiving Vietnamese customers.

This behavior leaders from Chris from Australia and Phananh (AndyPhan) from Vietnam.

The victims tried to contact Etomarkets's Australian manager Joema and the exchange owner of the exchange, Pennyyu, but did not get any response.

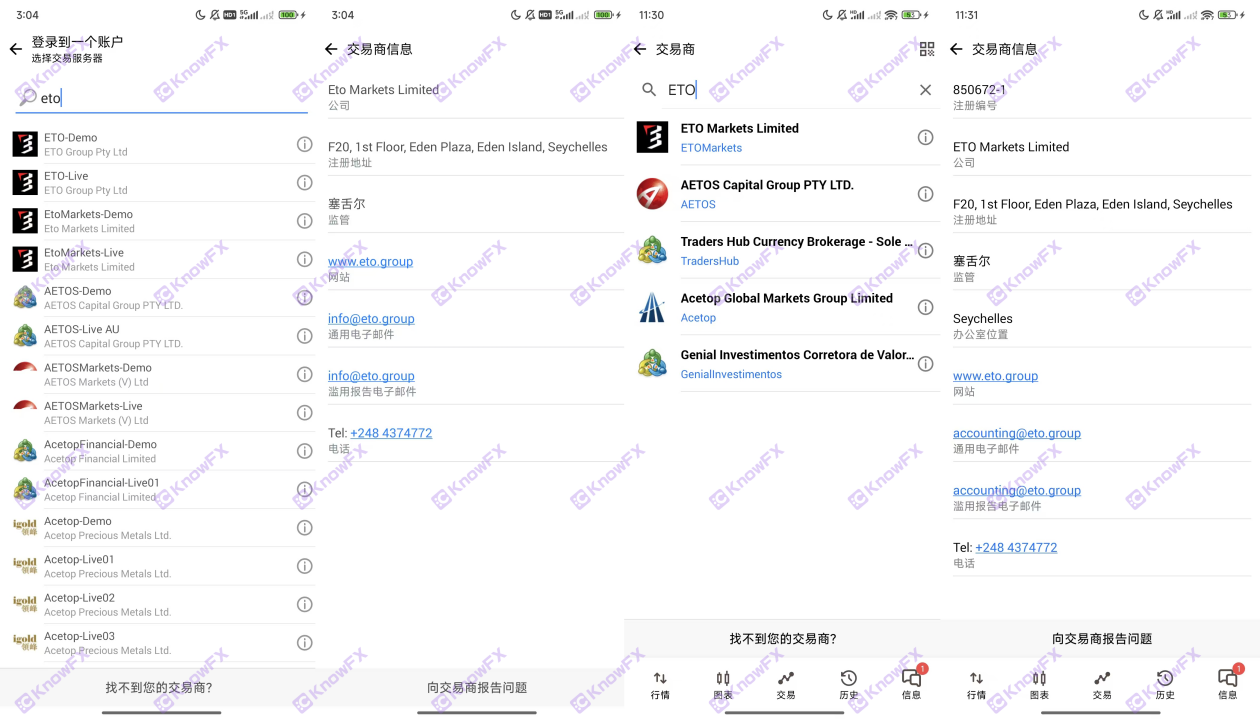

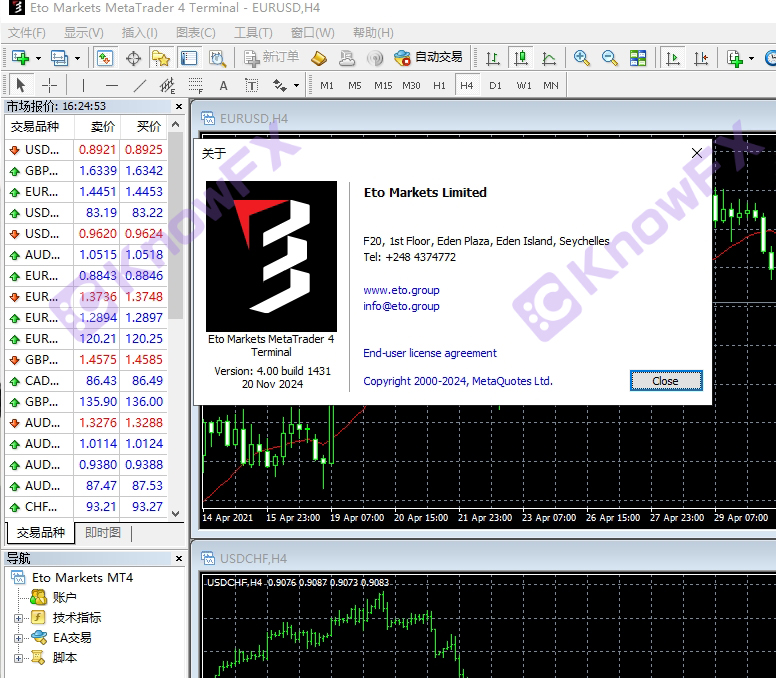

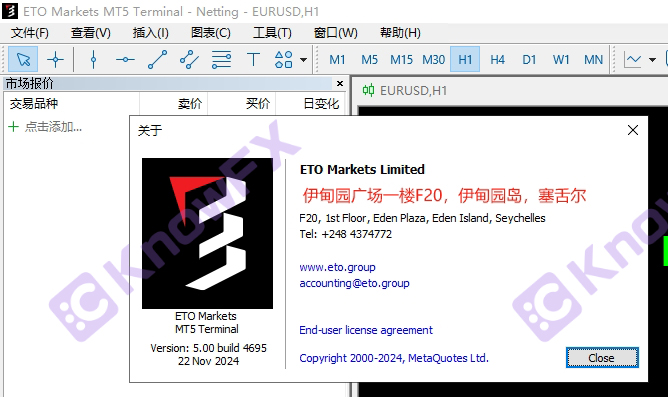

Through the MT4/5 company registration information, we can find that Etomarkets actually used only one company that actually used in trading.

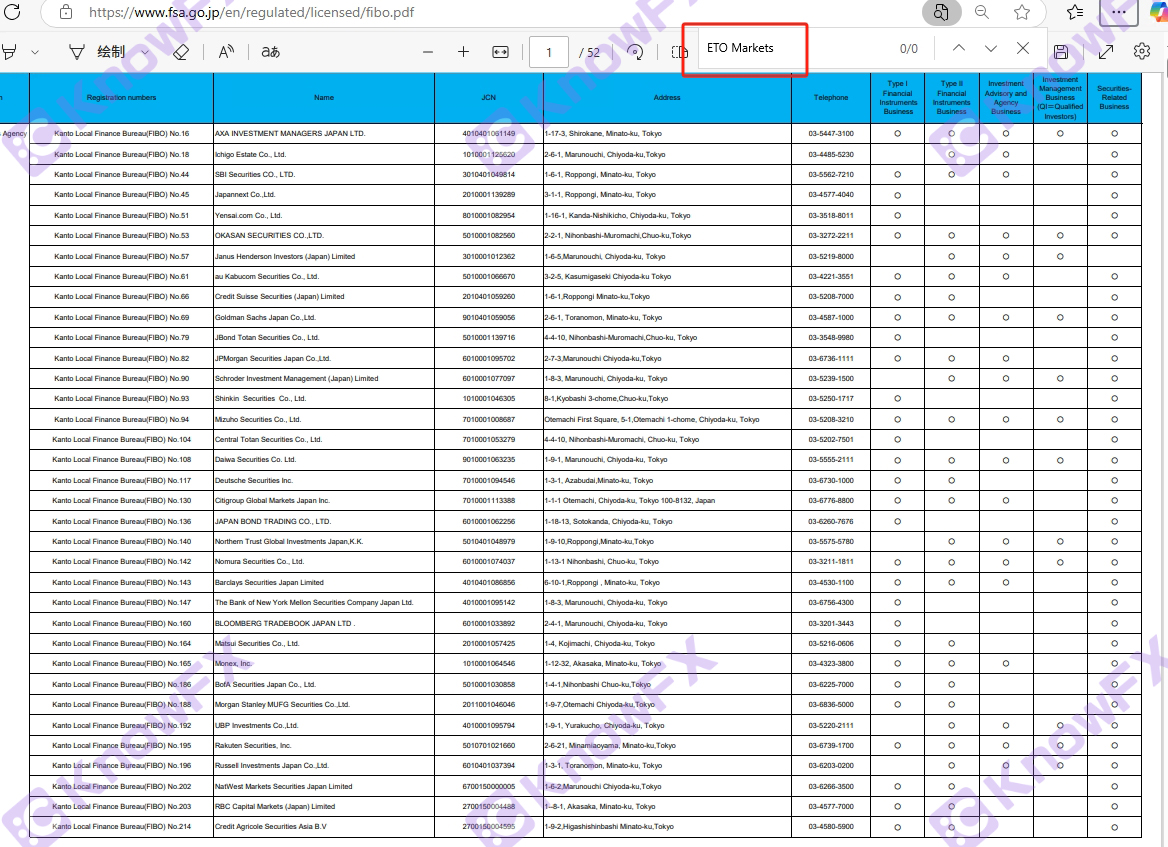

Although Etomarkets claimed on the official website that he had been authorized by the Seychel Financial Services Authority (FSA) and provided the license number SD062.

However, the company's authorized information and license number was not found in the list of institutions of the Japanese Financial Agency (FSA) official website.

On the official website of the Seychelles Financial Services Authority (FSA), we did find the regulatory information of Etomarketslimited.

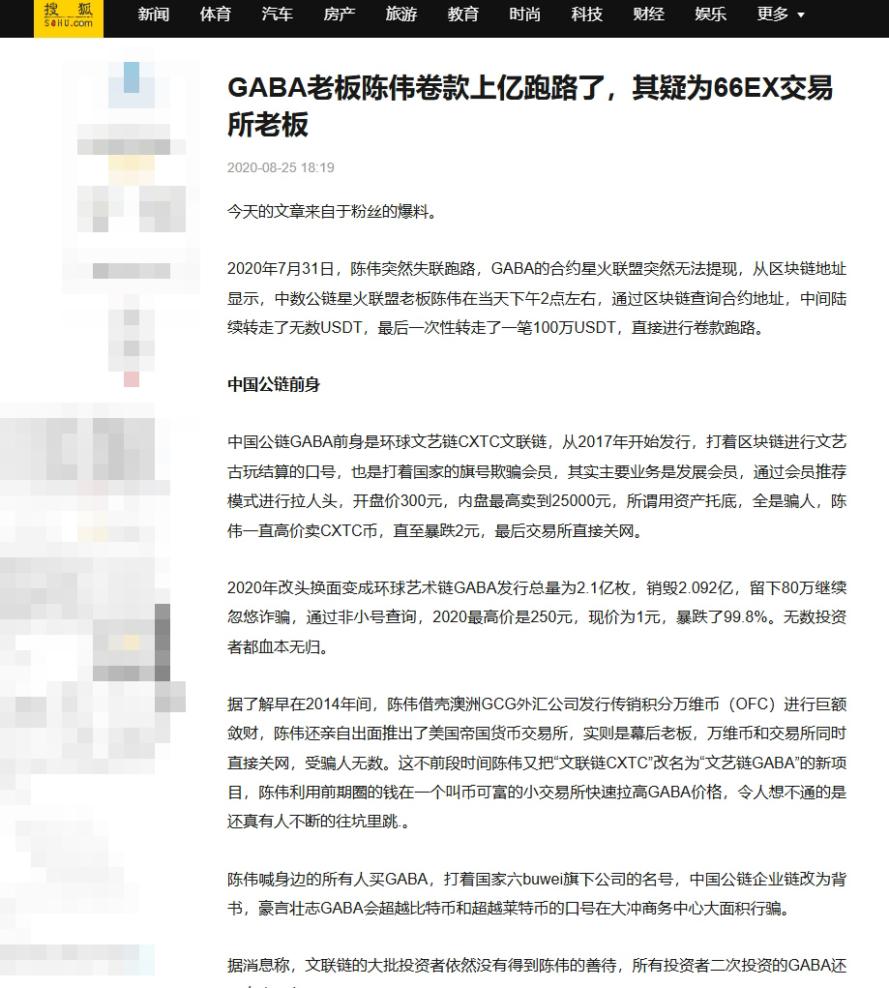

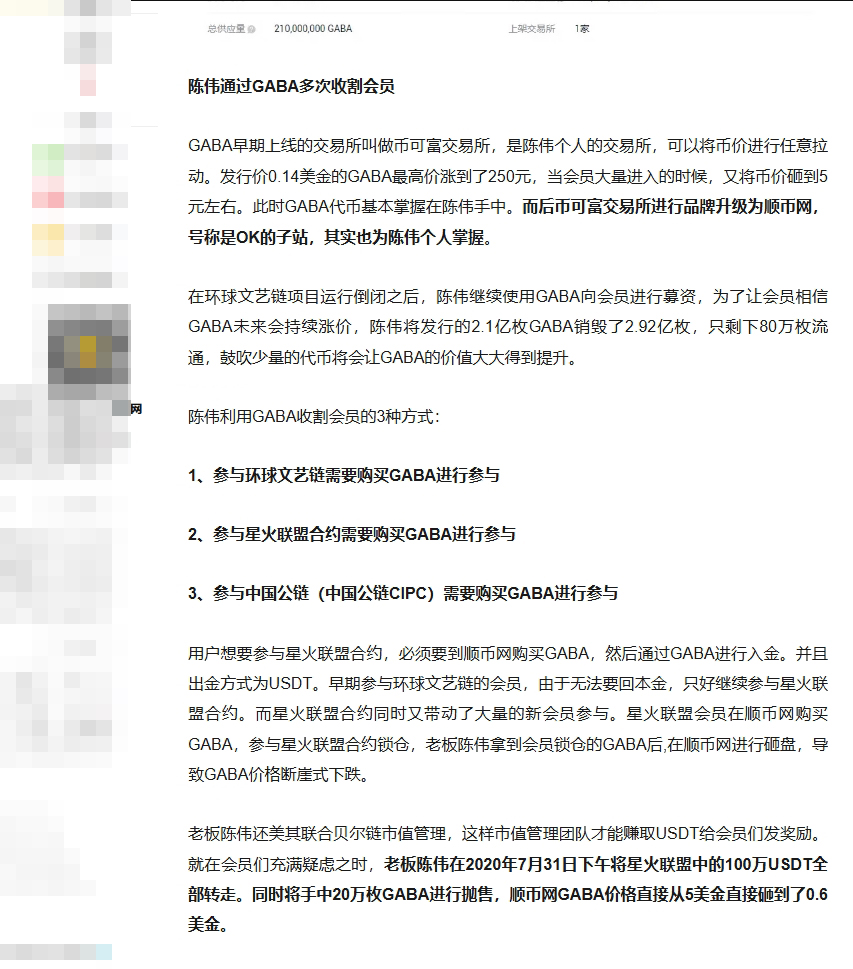

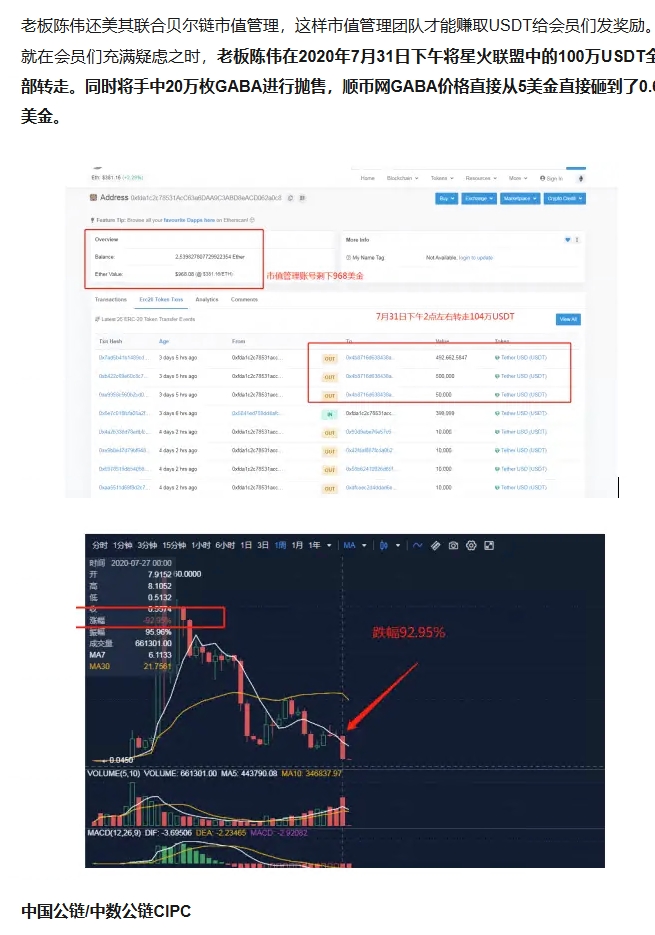

However, it is even more shocking that through the news of the watch brother, we can see that the owner of Etomarkets, Mr. Weichen (Chen Wei), is a desire to escape in China for doing capital fraud.

He has left the notorious news in Asia and Southeast Asian countries. The large -scale capital disks he participated in include GCG and Wanwei Coins, and Etomarkets is his latest "masterpiece".

Regarding the related news reports of the GABA project collapse, the big guy went to the Internet to read it. The truth brother here won't go into details.

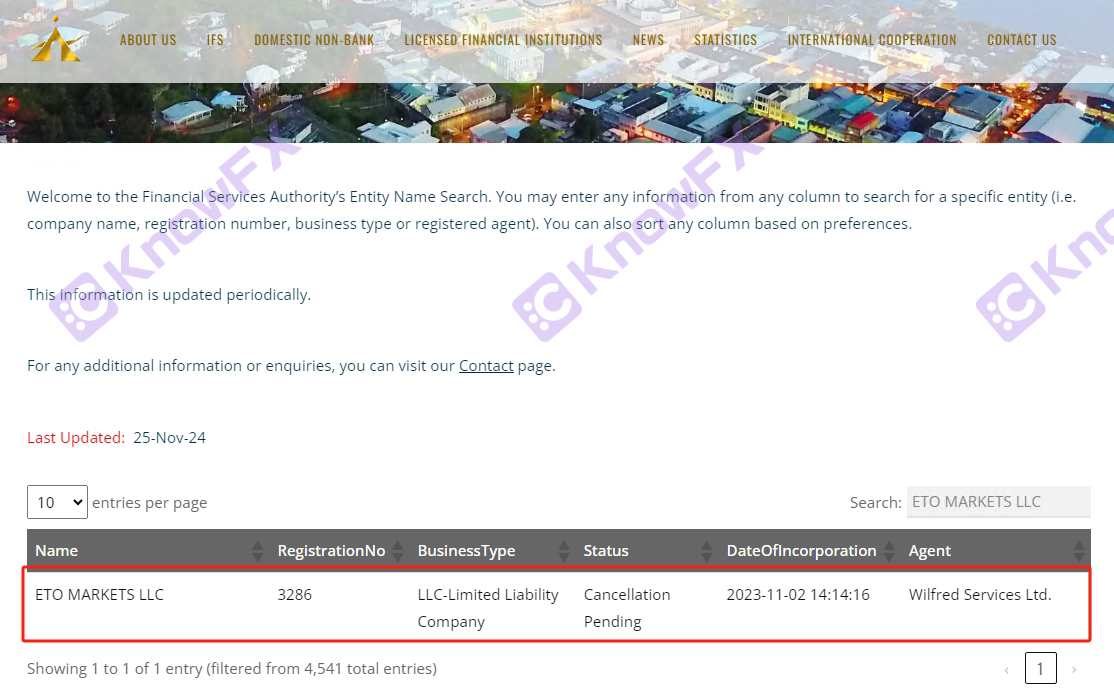

Finally, the company used by Etomarkets for actual transactions is Seisma EtomarketsLimited, and its platform's privacy policies, risk disclosure, and customer protocols were opened by St. Vincent Etomarketsllc.

This corporate architecture configuration undoubtedly brings certain confusion and potential legal risks to investors.

First, this arrangement may make investors difficult to understand the legal framework of platform operations.

Because the registered place and regulatory environment of the two companies may be different, investors need to spend more time and energy to study and understand compliance requirements under different legal systems.

This not only increases the learning cost of investors, but also may cause misunderstandings or misjudgments due to asymmetric information.

Therefore, the truth brother reminds the guys to carefully evaluate their risks and take corresponding protection measures when choosing the platform to ensure that their rights and interests are not damaged.

导言:在当今的投资领域里,我们时刻都需要保持警惕,因为投资市场的复杂...

海汇国际诈骗案深度解析:资金盘DRCFX复出传闻背后的真相导言:近年...

据“富途”官方消息:富途拟于2023年5月19日起在中国境内线上应用...

海汇国际资金盘风云再起?DRCFX即将复出,8亿惊天大案细节大揭秘!...

提问:Moomoo资金盘割韭菜:提现不到账,危机初现要懂汇温馨提示:...