Aims Rongying Securities Pit, you did not discuss: $ 24,000 offshore soul arrays, trusting the dog, investors directly calling the pit father!

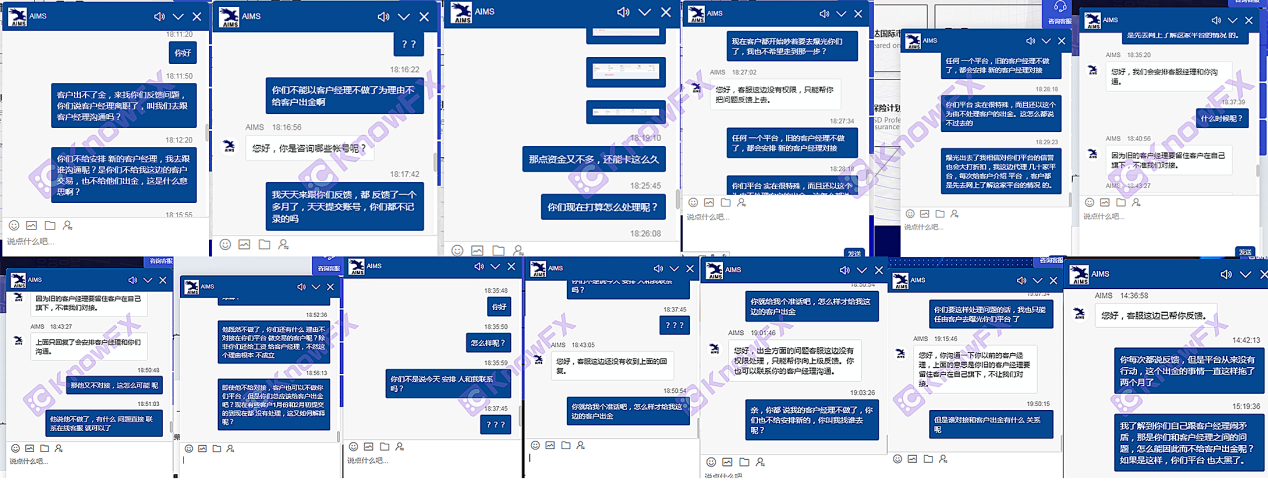

Recently, a Chinese investor broke the news that a journey to defending rights on the Aims platform is a long and difficult journey.

After more than a year of unremitting efforts, the US $ 24,000 in the investor's account is still out of reach like a mirror flower moon.

So what happened to this investor?Intersection

In 2019, investors will associate with a business manager on the Internet because of fate, and then enter the platform's trading world.

At first, all trading activities were in an orderly manner, and the resignation of business managers had become the starting point of investors' funding dilemma.

Time was pushed to August 2023. The investor tried to withdraw 4,000 US dollars for the first time, but encountered a long wait for the backstage "to be approved" ... Unwilling investors, then subsequently launched two consecutive funds,But they all fell into the same deadlock.

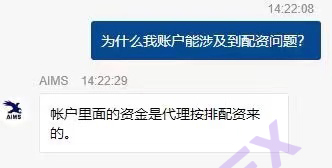

In the face of the platform's indifferent response, "accounts were suspended due to the issue of agency funding."

Investors feel both confusing and helpless, and always cannot understand why their accounts are involved in such disputes;

What is even more difficult to accept is that even if the problem exists, the resignation of the former agent should never become an excuse for the platform's responsibility.

The indifference and inaction of the subsequent platform are simply a record of investors on the road to defending their rights.

Investors have requested customer service to give the clues to the agent and customer manager countless times, but they only exchanged the empty "feedback", as if this was the nightmare of the investor, and it would never wait for the dawn of dawn.

Mail communication?But throwing stones in the abyss, unable to stir up ripples, responding to thinness as air.

In a blink of an eye, more than a year has passed,

And the investor account's reasonable blockade is even more likely, which makes people can't help but question the integrity and responsibility of this platform.

Now, let's focus on the latest developments of Aims Rongying Securities.

Interestingly, their trading partners also seem to change quietly -from the former German power brigade Dortmund Football Team, instead joined hands with England's giants

This change can't help but guess whether Aims Rongying Securities has been adjusted in strategic direction or market positioning.

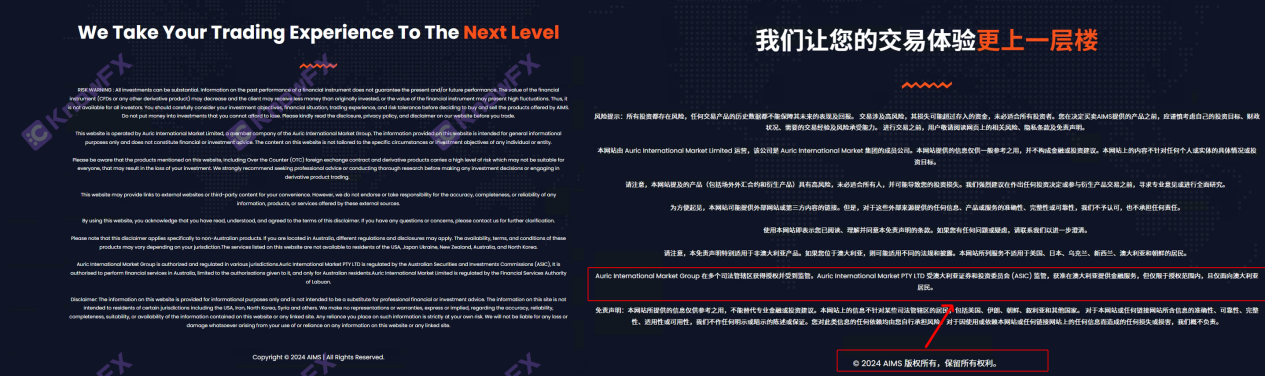

As shown in the figure above, on the official website of 2024Aims:

AuricInternationalMarketgroup has been authorized and supervised in multiple jurisdictions.

AuricInternationalMarketPtyLTD is supervised by the Australian Securities and Investment Commission (ASIC) and has been allowed to provide financial services in Australia, but it is limited to the scope of authorization and only for Australian residents.

AuricInternationalMarketlimited, supervised by the Native Financial Services Administration.

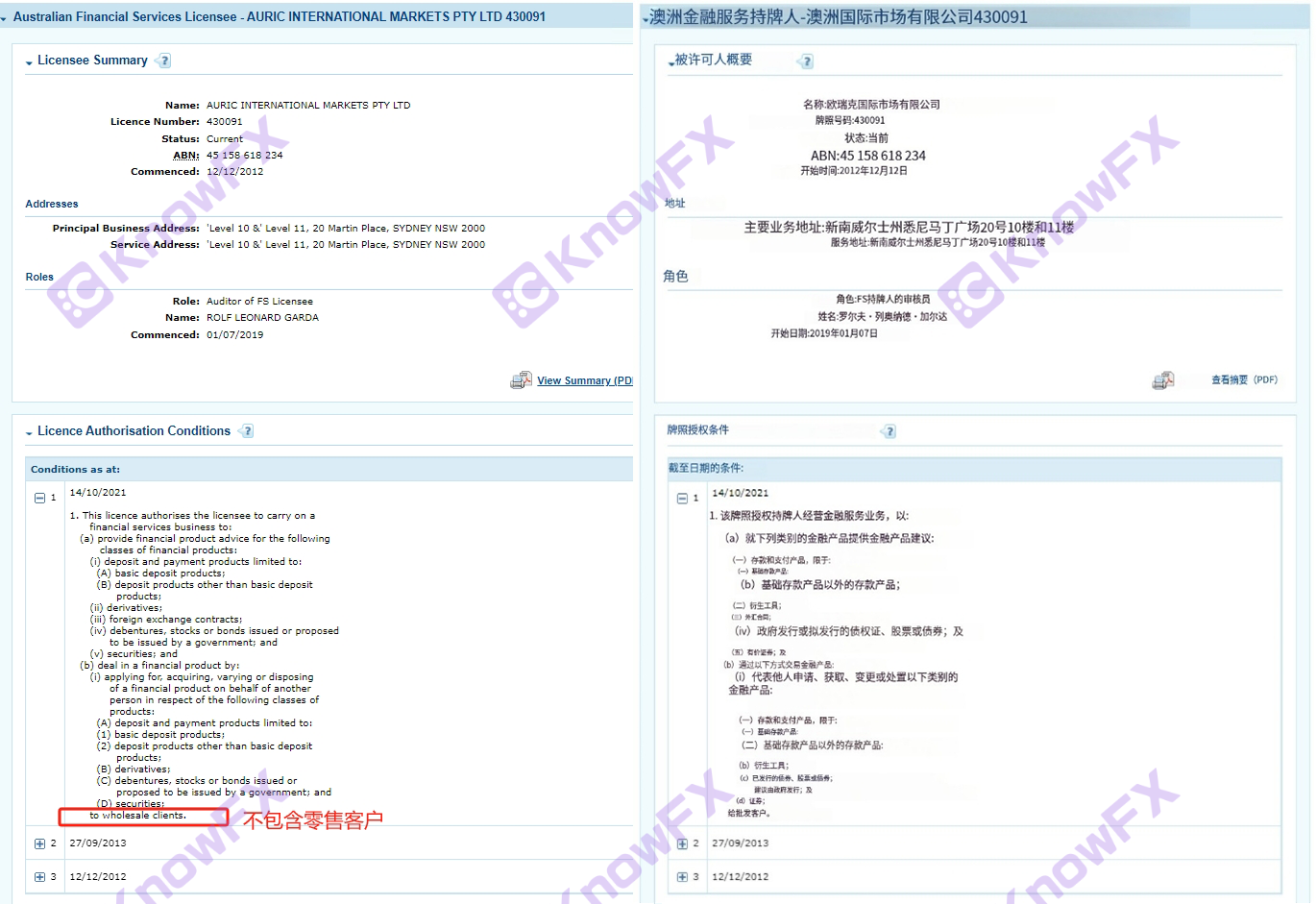

Subsequently, the truth brother found that the Australian company named AuricintemlMarketPtyLtd, which was named AuricinternationalmarketPtyLtd,

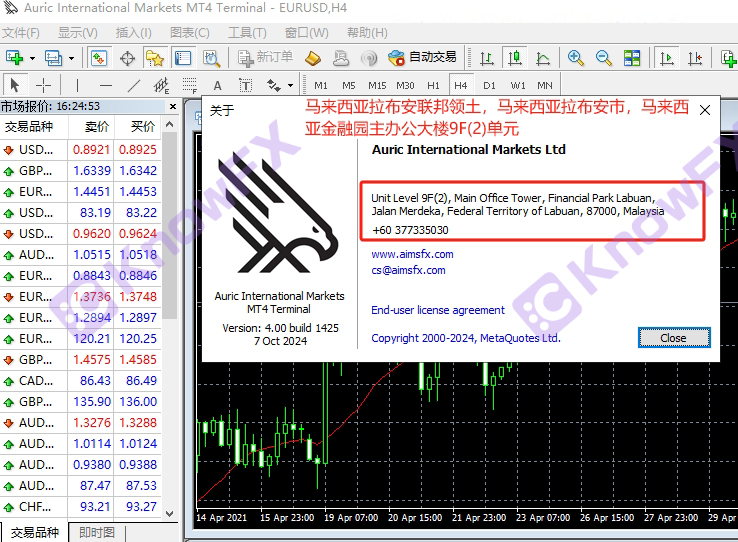

Secondly, by downloading the PC's transaction software and the MT4/5 query on the mobile phone, Aims Rongying Securities is now only one AuricinternationalMarketsLtd supervised by the Labuanfsa.

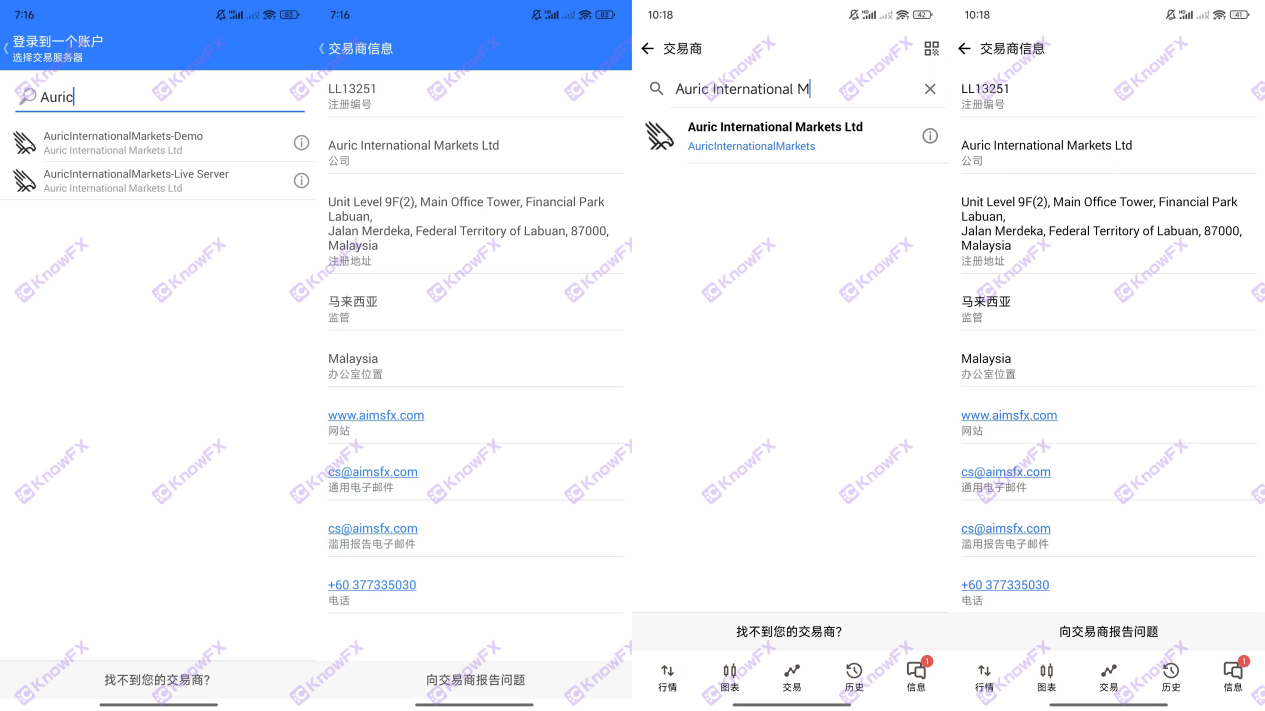

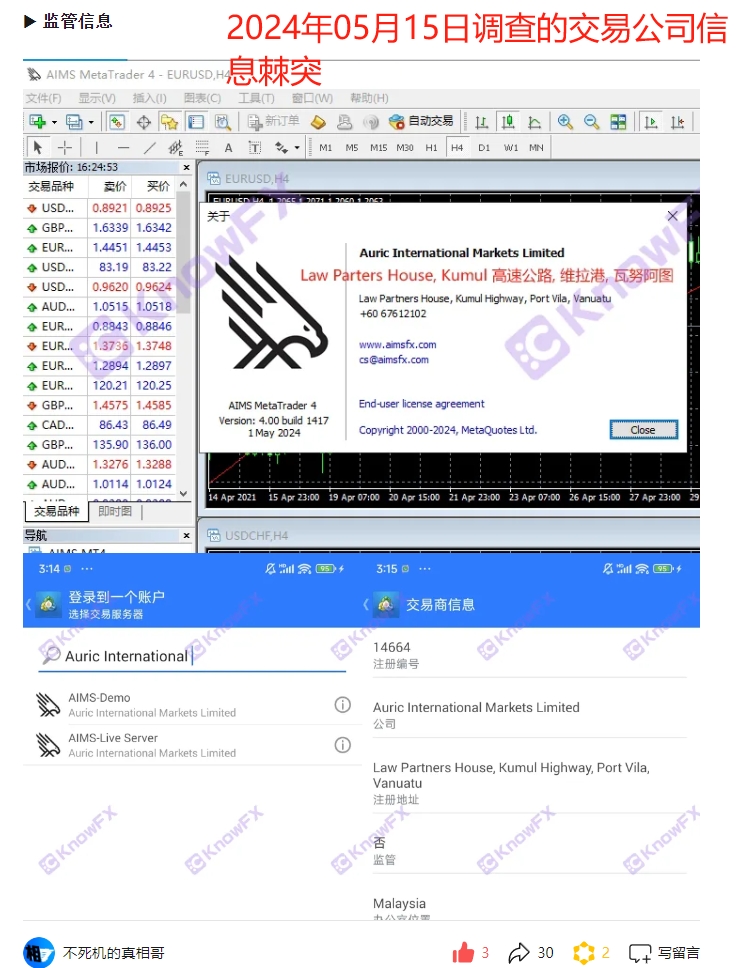

In the investigation in May this year, the truth brother found that Aims Rongying Securities used in actual transactions in the information is still the AuricInternationalMarketslimity regulated by the Vanuatu Financial Service (VFSC).

It has been replaced by AuricInternationalMarketsLtd, which is supervised by Labuanfsa.

Aims Rongying Securities turns behind the speed of light, how much unknown secrets and risks are hidden?

People can't help but put a big question mark on the true face and operation transparency of Aims Rongying Securities!

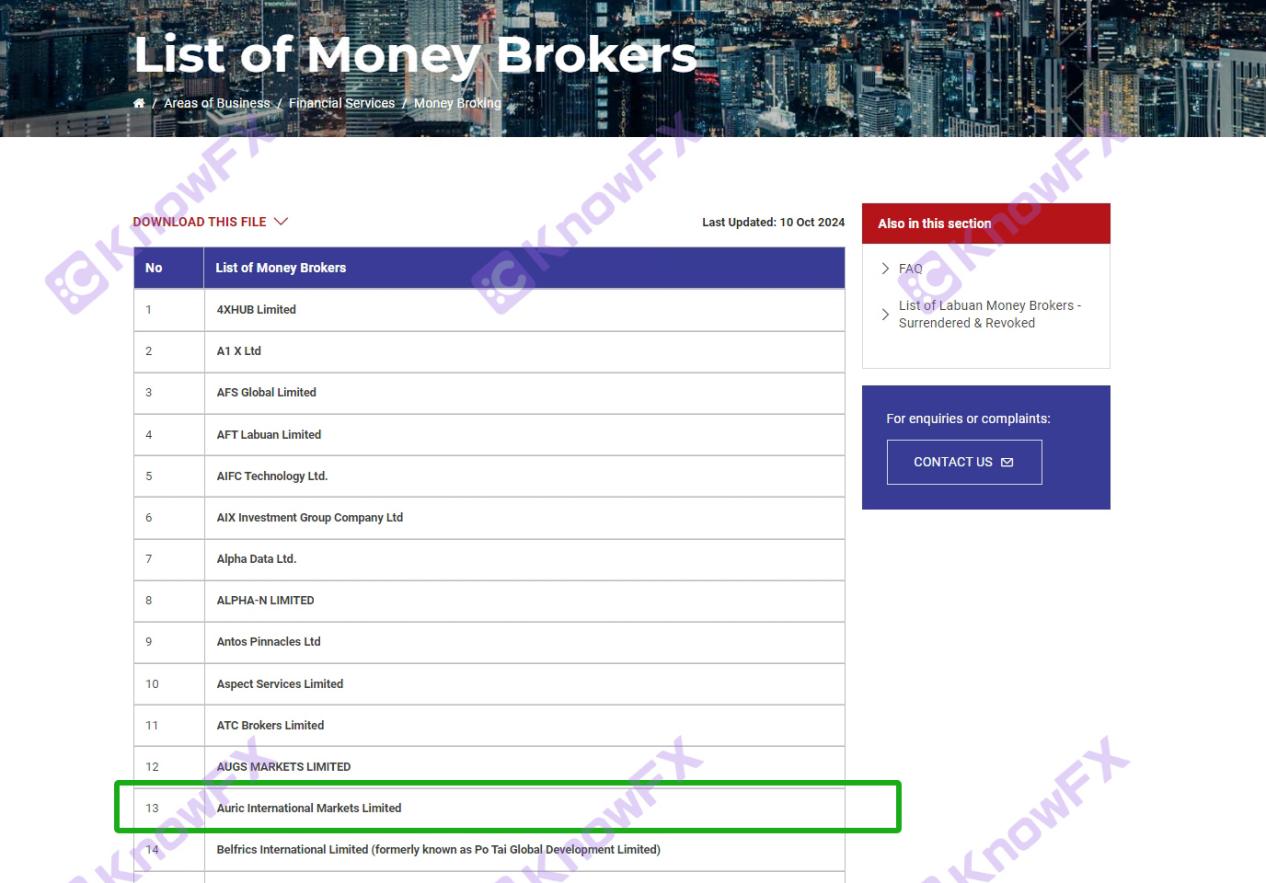

Through the inquiries of the official website of the Labuanfsa (Labuanfsa), as shown in the figure above, the AuricinternationalMarketslimity is MoneyBroker, a monetary broker under the regulatory of the FSA, is a STP foreign exchange broker.

Although its STP foreign exchange brokerage status has been conclusive, unfortunately, it is still shrouded in the shadow of offshore supervision.The offshore attributes of the Nawin FSA often make people question the strictness and effectiveness of their supervision. After all, offshore supervision is often associated with the lower regulatory threshold and weaker law enforcement.

What is even more worrying is that when a broker is not only limited by the framework of offshore supervision, but also accompanied by a negative evaluation of the market reputation, this will undoubtedly lays heavy hidden dangers for investors' financial security and trading experience.

Poor word -of -mouth means that the opaque operations, customer service defects, or capital security issues in history are all red lights that investors must be vigilant when choosing brokers.

Therefore, for the AuricInternationalMarketslimited, we cannot blindly trust with its STP model and the regulatory label of the Naman FSA.Spend.

In the field of investment, cautiousness is always king, and for those brokers with poor reputation and being regulated by offshore supervision, investors need to think twice to avoid being caught in unnecessary risks.

Truth small bulbs, turn all the way !!

One more repost, one less person is fooled!

Reveal the truth, you and I are all sober men !!

扫 Submitting complaints, scanning the code

The message area is waiting for you to build the truth city ~

导言:在当今的投资领域里,我们时刻都需要保持警惕,因为投资市场的复杂...

海汇国际诈骗案深度解析:资金盘DRCFX复出传闻背后的真相导言:近年...

据“富途”官方消息:富途拟于2023年5月19日起在中国境内线上应用...

海汇国际资金盘风云再起?DRCFX即将复出,8亿惊天大案细节大揭秘!...

提问:Moomoo资金盘割韭菜:提现不到账,危机初现要懂汇温馨提示:...