ATFX proxy operating customer accounts lead to liquidation!Cooperative launching "Customer Fund Insurance" is a short check!

Recently, some investors accused the ATFX agent Su a high -risk strategy during the trading, resulting in a serious loss of their accounts.Today, I will talk to everyone about the guest complaints of the agent trading. Have you ever encountered such problems?

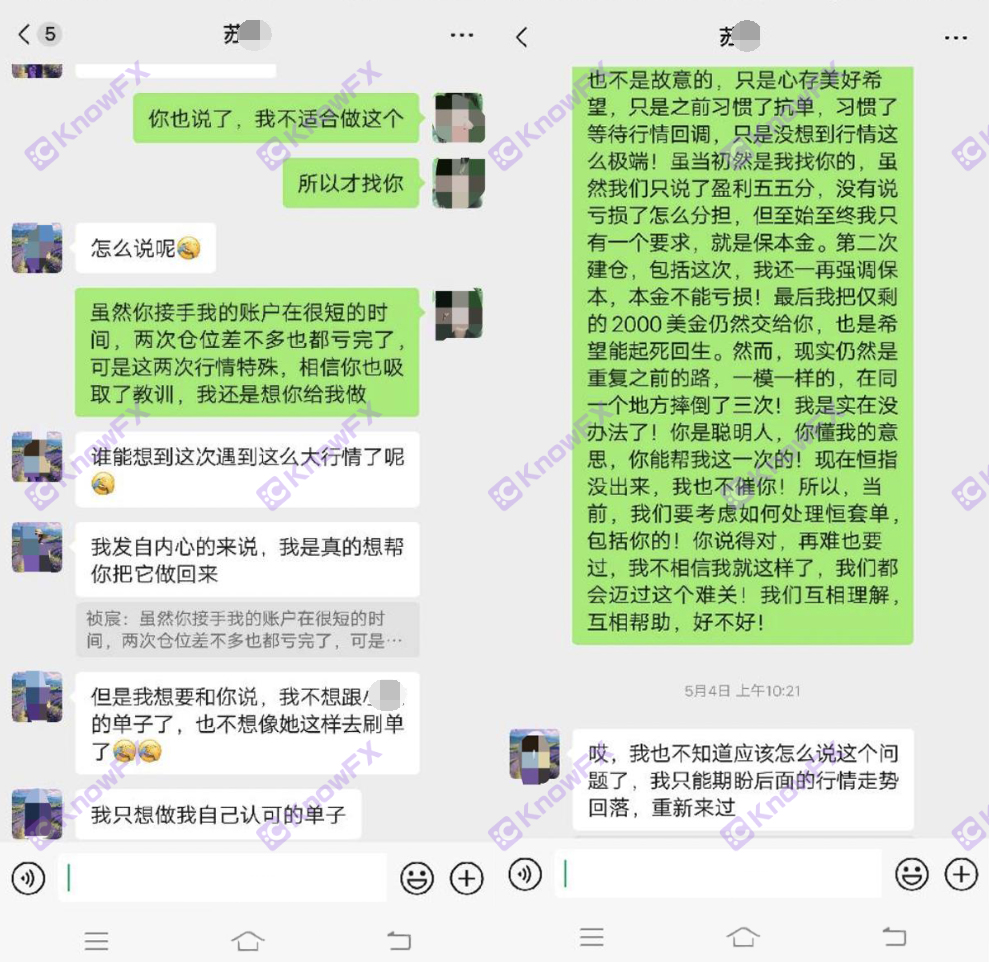

In February this year, investor and ATFX agent Su reached an agreement to hand over $ 5,000 in his account to Su Mou's full management operation.According to the agreement content agent and Su Mou's agreed transaction profit, Su Mou must ensure the safety of principal and positions to the maximum extent.However, the ATFX agent Su Mou's heavy position (5000 accounts placed an order 1.6 hand) and resisted the order. Investors have been entering the Jinbao Warehouse, and they cannot resist it. The principal loss reaches more than $ 2,6300!

However, under the premise of "guaranteeing the security of principal and position", Su Mou adopted a high -risk trading strategy during the trading process. As a result, the account loss was serious!

After the high -risk trading strategy explodes the investor account, it emphasizes that "just want to be a list of recognition" with investors, "I don't know what's going on", "looking forward to re -responsible" and other irresponsible speeches.In an attempt to cover up the fact that investors $ 6,300 earned $ 20,000!

First of all, I know that Brother does not recommend investors to hand over their accounts to other people, and the market risk is high.Investment is impossible to ensure stable profit.Do not easily believe that the platform salesperson's "packing ticket" is recommended.

As early as January, Dubai knew that Brother was briefly interviewed by ATFX Chinese investors' funding security issues?ATFX's answer avoidance is light, only to promise that their platforms are safe, because there are branches in Dubai, Hong Kong, and Britain, you can already see at the exhibition site that the avoidance of the core issues of investors is light, and it is also lightly described for "fund security".

Then let's take a look at what "protection measures" have taken in ATFX's so -called "capital security".

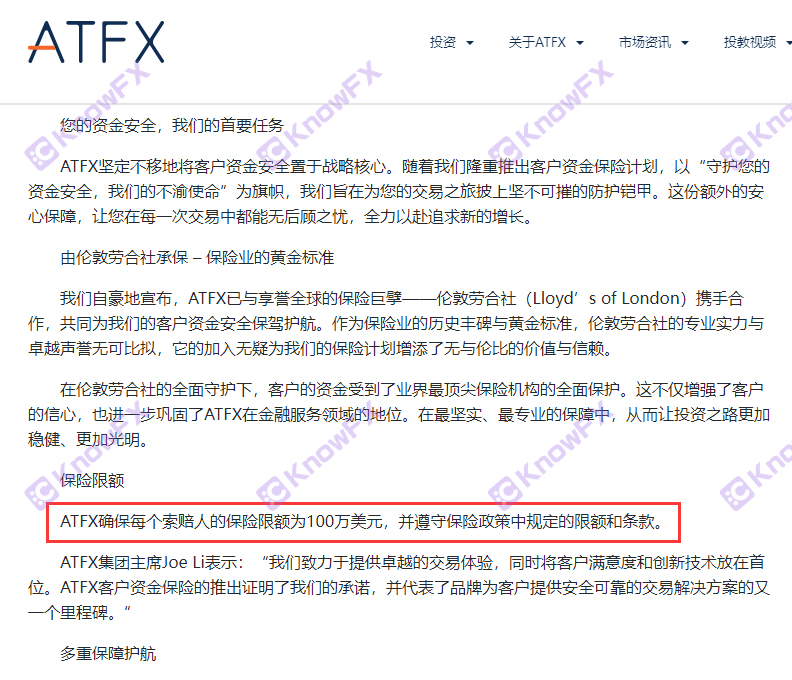

ATFX promises to make insurance for customer funds. Many novice investors should feel that they can put 10,000 hearts, thinking that losses will make insurance companies pay for it, and they may even get $ 100W!So everyone will get the insurance company's compensation?ATFX is really so sincere?

Let's take a look at the contents of this insurance.

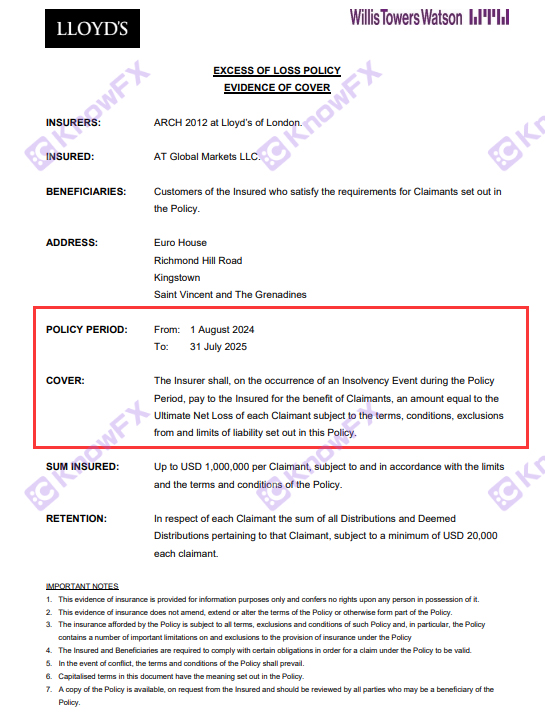

This is an insurance company: ARCH2012 of London Labor Society, to the insured: [ATGLOBALMARKETSLLC] (St. Vinsont and Greennin).The beneficiary is the insured customers who meet the claims required by the insurance policy.

Betting period: From August 1st, 2024 to July 31, 2025

Scope of insurance: If the bankruptcy incident occurs during the policy period, the insurance company will pay the insured to the insured's final net loss in accordance with the terms, conditions, elimination terms and liability limit of this policy, for the claimerBenefit.

Let's understand that the condition of triggering insurance claims is premise that the "bankruptcy incident occurs during the policy". The bankruptcy incident refers to the object of the insurer [ATGLOBALMARketsllc]] The insurance company will pay the insurance company to the insured [ATGLOBALMARKETSLLC] insurance premium to benefit the claimer.

Therefore, even if investors burst, they could not get the compensation of this insurance.Instead, attract many novice investors to the money!

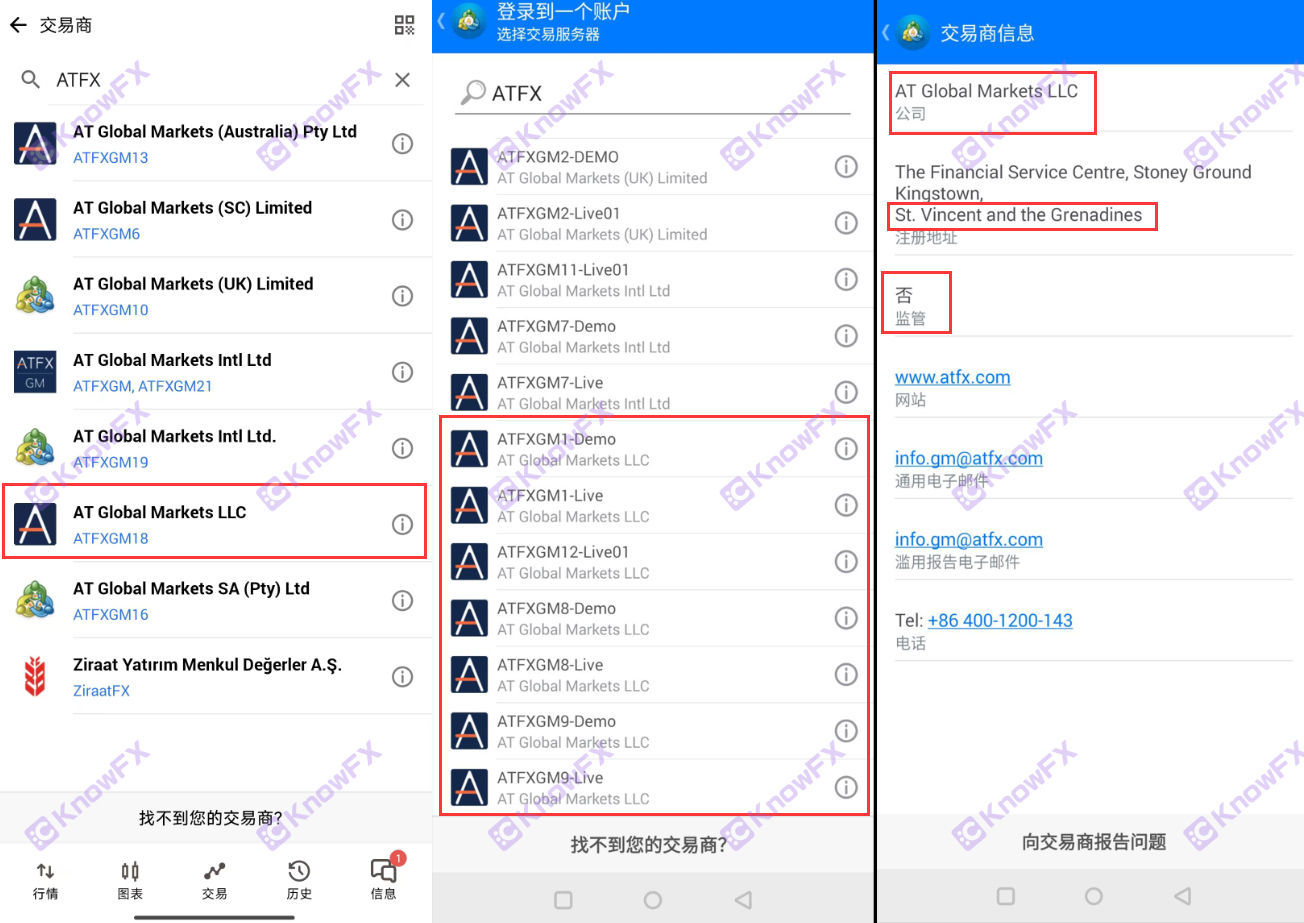

This [ATGLOBALMARKETSLLC] St. Vinson also used a large number of real transactions at ATFX's MT4/MT5 platform account!

ATFX obviously claims that there are multiple high gold content supervision, but guide investors to open the account in this [AtglobalMarketsllc] St. Vinsont?

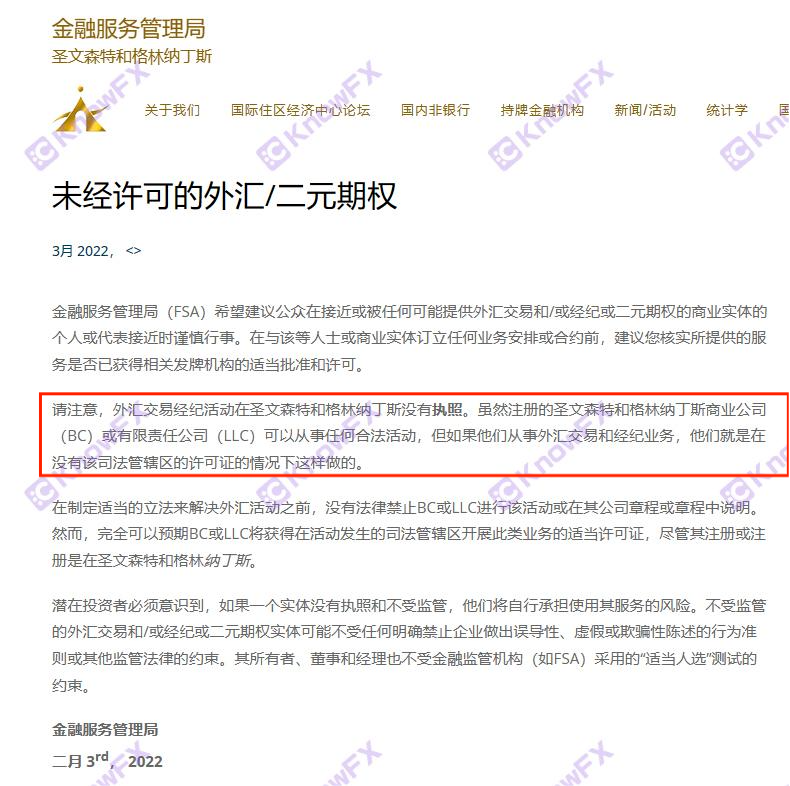

St. Vincent's FSA has been posted as early as 22 years, and St. Vincent did not regulate foreign exchange transactions.

Is the ATFX, a broker, does not know whether the regulatory agency announced two years ago, of course, not.ATFX not only deliberately chose to avoid supervision with St. Vincent!This is completely belonging to the "capital security insurance" in disguise to seduce investors to enter the gold without regulatory entities. The order of not being regulated will inevitably become a mystery. What ATFX wants to do, you don't have to say more about your brother!

Detective convening order !!

Share this news, every more person forwards, the sin will spread less than one point ~

If it is expected, it will explode.

探 Scan the code directly through the detective background, leave a message to reach ~

If the detective becomes your smart navigation,

May wish to leave "like" and "watching 'to let this justice detective,

Continue to illuminate the road ~

导言:在当今的投资领域里,我们时刻都需要保持警惕,因为投资市场的复杂...

海汇国际诈骗案深度解析:资金盘DRCFX复出传闻背后的真相导言:近年...

据“富途”官方消息:富途拟于2023年5月19日起在中国境内线上应用...

海汇国际资金盘风云再起?DRCFX即将复出,8亿惊天大案细节大揭秘!...

提问:Moomoo资金盘割韭菜:提现不到账,危机初现要懂汇温馨提示:...