Zhihui ThinkMarkets to avoid supervision and change data can be called the "triple trap" for Chinese people!

Detective today hear a confession of Zhihui ThinkMarkets.

Investors have been deducted from investors due to third -party quotation errors, and investors find platforms to negotiate. After negotiating compensation for investors for $ 120, the customer service staff has openly threatened the investor, claiming that if the truth is disclosed in the mediaThe situation will be regarded as a discredit Zhihui platform. Therefore, investors must be reported to use large funds to speculate in foreign exchange, and questioned that investors' funds are unknown.

The platform deducts the profitability of the customer's book as you want, but just responded to the email that he was sorry for the inconvenience. After that, he did not give Jin and there was no reply or later.

Let's take a look at why the Zhihui ThinkMarkets can "deduct the deduction" of investors?

Zhihui ThinkMarkets

Zhihui ThinkMarkets is a foreign exchange broker. It was established in 2010 and is headquartered in Australia. It mainly provides investors with transaction services for foreign exchange, metal, goods, stocks and indexes.

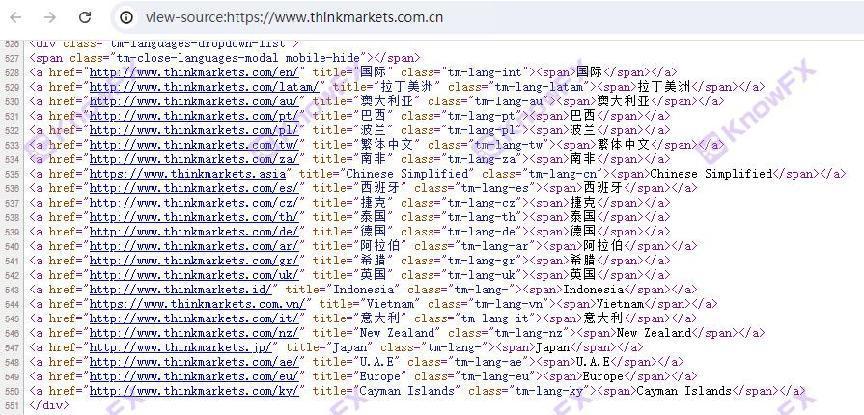

Official website: https://www.thinkmarkets.com.cn/

Although Zhihui ThinkMarkets emphasizes that there are no offices and employees in Taiwan, Hong Kong or mainland China in the official website pop -up window, the official website has set up a complete subtle Chinese webpage, and simplified Chinese is added to the source code. It can be seen that ThinkMarkets intends to face facing facing facing facingChina has formed a comprehensive financial market.

The financial products displayed on the simplified Chinese website include a large amount of digital currency?

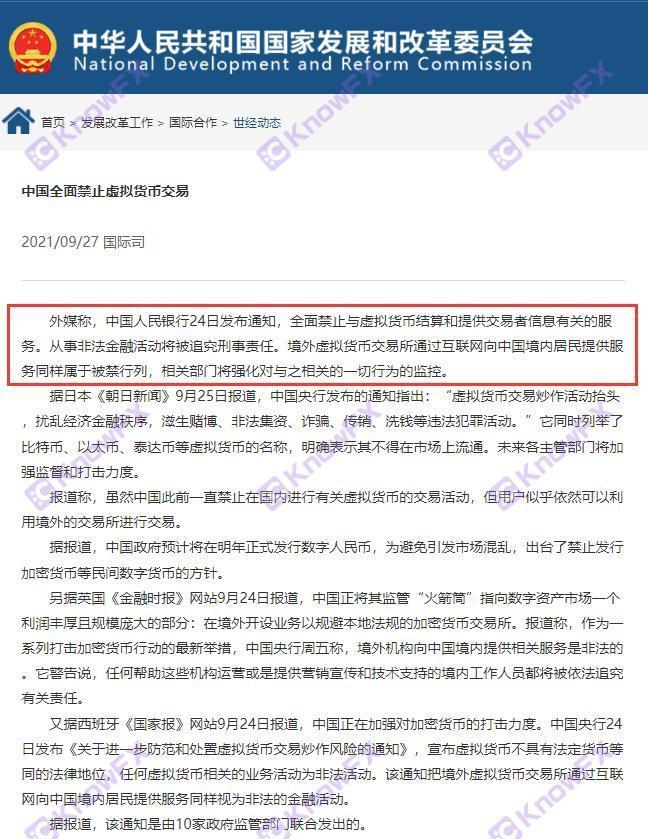

Because financial products in the country have no financial licenses that have no trading cryptocurrency, cryptocurrency blockchain is illegal in China!

The National Development and Reform Commission's "China Comprehensive Prohibition of Virtual Currency Transactions" issued a notice on September 24, 21, 21: Comprehensive prohibition of services related to the settlement of virtual currencies and providing transaction information.Entering illegal financial activities will be investigated for criminal responsibility, and Chinese banks have been banned from engaging in cryptocurrency business as early as 2013.

The self -developed platform Thinktrader and TradingView.

The large -scale layout of ThinkMarkets's official website is combined with the introduction of the large -scale development of the self -developed trading software, Thinktrader and the third -party chart platform TradingView, so they will become the first choice platform for investors to recommend to investors.

This activity also mentioned in the guest complaint: Investors in the ThinkMarkets encountered the platform of Europe, America, the United States, Japan, and the pound of pounds on the platform. The European and American singles 799, 531, 403, and 395 US dollars.The US -Japan and British pounds were ranging from tens of dollars in stop loss. The losses were given by third -party quotation errors, but the result was that the profit funds were deducted.

Obviously, the investor has joined ThinkMarkets's self -developed trading platform. The ThinkMarkets platform avoids the supervision of financial institutions. As a background broker, it can change the data and dispose of investors' funds.

So does the ThinkMarkets have real trading entities and accounts in MT4/MT5?

In addition to the ThinkMarkets self -developed platform Thinktrader, ThinkMarkets supports MT4 and MT5 platform transactions at the same time.

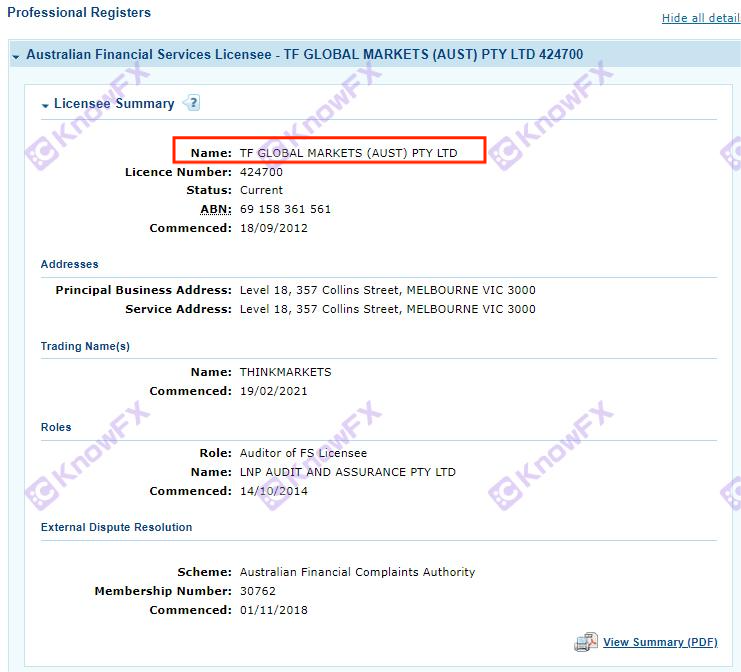

Thinkmarkets is only one entity used on MT4 and MT5 for transactions, named [TFGLOBALMARKETS (Aust) PTYLTD], which is an Australian entity.

[TFGLOBALMARKETS (Aust) PTYLTD] It is indeed regulated by Australia ASIC, but as early as 2019, the Australian Securities and Investment Commission (ASIC) issued an announcement to stop serving Chinese customers.Australian ASIC regulatory licenses have no role in regulatory transactions for Chinese customers!

Therefore, no matter which platform wants to open an account, the transaction will not be supervised.

The self -developed transaction software mentioned above lacks third -party supervision and review.

It is impossible to ensure the fairness and fairness of the transaction. There may be problems such as fakes and slippery points, resulting in losses of investors.

Due to the opaque transaction data and rules, it is difficult for investors to obtain accurate and comprehensive information, and it is difficult to make correct investment decisions.

When using the software for transactions, investors need to deposit funds into the platform's account, but the platform may have fund security issues, such as misappropriating customer funds and false publicity, resulting in damage to investors' funds.

The software may not be able to provide timely and effective customer services, and may not be resolved in time when investors encounter problems, which will affect the investor's investment experience.

If you need to check the platform, disclose clues, complain

Please scan the code to add QQ!

Exchange Circle Detective: 3464399446

You need business cooperation, please scan the code and leave the aircraft number to cooperate!

Inquiry platforms, complaints, more information, please read the code to understand the exchange app or search for major application markets and mobile stores

Keyword "To understand" download

导言:在当今的投资领域里,我们时刻都需要保持警惕,因为投资市场的复杂...

海汇国际诈骗案深度解析:资金盘DRCFX复出传闻背后的真相导言:近年...

据“富途”官方消息:富途拟于2023年5月19日起在中国境内线上应用...

海汇国际资金盘风云再起?DRCFX即将复出,8亿惊天大案细节大揭秘!...

提问:Moomoo资金盘割韭菜:提现不到账,危机初现要懂汇温馨提示:...