Brokerage OxSecurities funds are doubtful!

Australian ASIC license is suspected of over -limit operation!

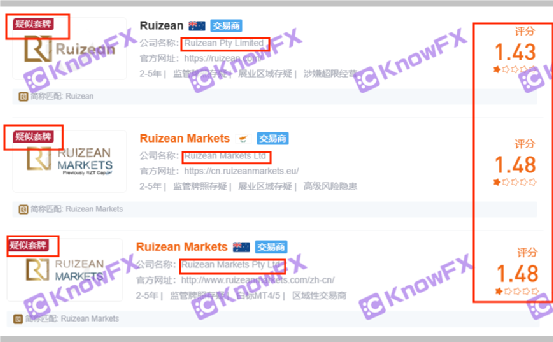

Ruizeanmarkets has been established as early as 2013, but it is obviously immature. There are many leaks in operations. From its low score, it can be seen that it can be seen in the high hat that has been under the high hat of "suspected decks".

until!In June 2020, RuizeanMarkets officially changed its name to OxSecurities to start its new chapter!Intersection

On the official website, he claimed to be a financial service company based on integrity, honesty and transparency.Since its establishment in 2013, it also provides opportunities to enter the world's most transactions, including foreign currency pairs, differential contracts, goods and indexes.Through various platforms and equipment, provide customers with top technologies and excellent customer services in an honest and integrity way.

Understand this, you will smile naturally!Thinking about it after three days, let's take a look at the "growth" of OxSecurities today.

First, let's take a look at whether OxSecurities holds a formal license!

It can be seen from its official website that OxSecurities has been regulated by two places, namely:

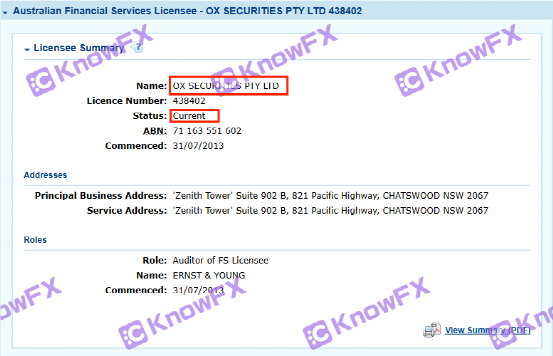

1. OxSecuritiesPTyltd, ASIC supervision

2. OxSecuritiesLimited by San Vincent FSA

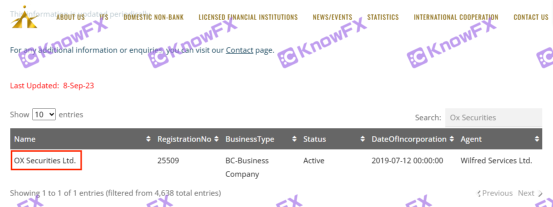

St. Vincent FSA

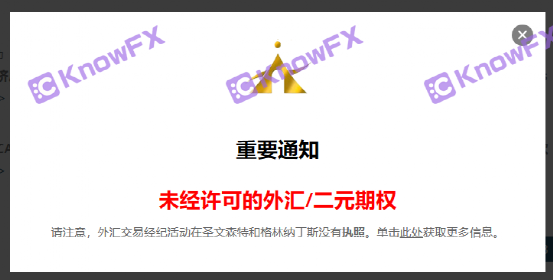

The latter is indeed on the list of St. Vincent FSA registration list!But St. Vincent FSA does not supervise foreign exchange, binary options and cryptocurrencies.Therefore, these transactions through the company cannot be regulated and protected.

By the way, the license plate of San Vincent's FSA license is limited because of its limited regulatory scope, and it is still relatively easy to apply for, and allows offshore supervision.Therefore, there are often bad securities firms using their characteristics to avoid effective supervision!San Vincent FSA was also disturbed, so when he entered its official website, he would definitely jump out of the pop -up window to remind investors.

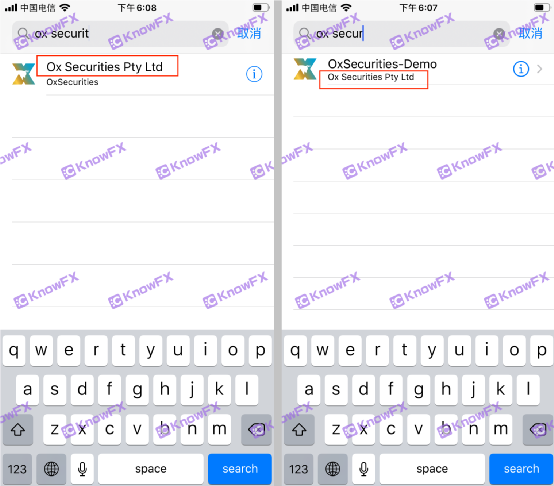

But on the matter, OxSecurities did not use the St. Vincent FSA license to avoid supervision.Both the main trading platform MT4 and MT5 only traded the company in Australia through OxseCURITIESPTYLTD.

Australia ASIC

So whether OxSecuritiesPTYLTD holds Australian ASIC licenses, is effectively supervised, and whether it is operated compliant!It became the key to today.

After a little verification of my understanding, I learned on the Australian ASIC official website that OxseCuritiesPtyltd was seriously held Australian ASIC license.

And it has been nearly 10 years, and its operating authority has been consistent.

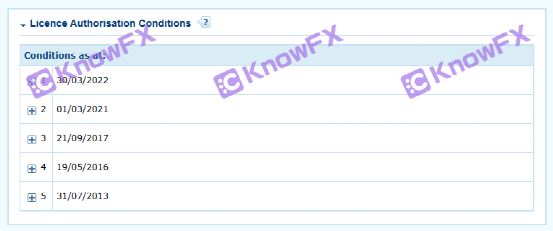

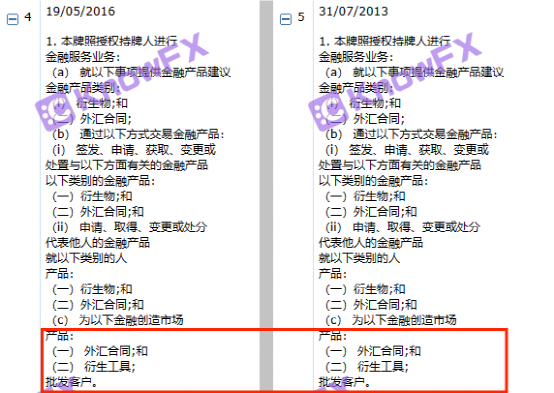

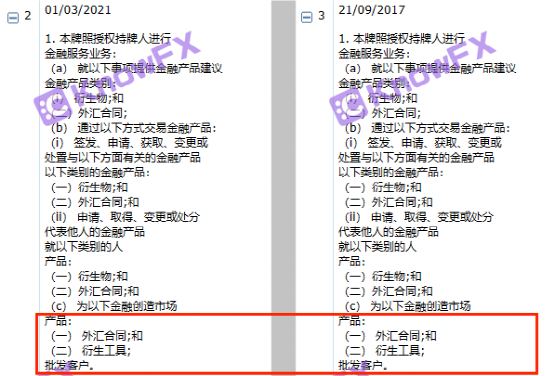

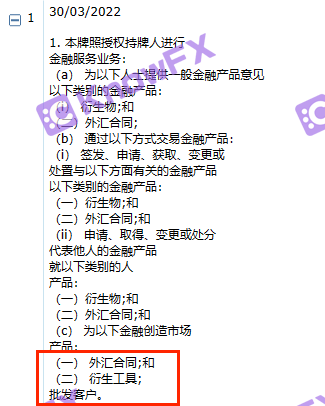

However, this license only authorizes financial derivatives and foreign exchange contract transactions, and can only face wholesale customers from beginning to end.

In other words, OxSecuritiesPtyLTD cannot be traded with ordinary personal investors.The three major sectors of large commodities and stocks and cryptocurrencies mentioned on the official website of OxseCURITIES are not within the scope of its licenses.Therefore, understanding that I dare to say that OxSecurities is allegedly over -limit operation is basically a matter of nailing.

Financial security

Then I understand my doubts about the security of OxseCURITIES funds!Intersection

Whether it is a brokerage company or investors, it should pay special attention to the aspects of funding and security!But rarely mentioned this on the official website of OxseCurities.Especially for the isolation account, it is obviously a critical part of capital security!IntersectionEven the name of the bank where the account is located has not been mentioned.By the way, this is not specifically referring to OxSecurities. Today this phenomenon is extremely common in securities firms!Intersection

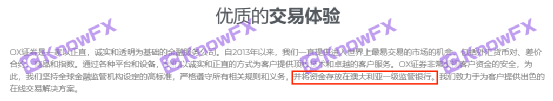

Know that I will read all the information of OxSecurities official website, and I know that the funds are stored in Australia.But what follows is a greater doubt:

Where did Chinese customers go?

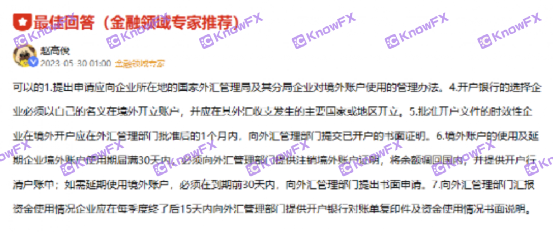

You must know that Australian ASIC made clear in 2019: Foreign exchange and differential contract brokers under the supervision of ASIC prohibit the acceptance of overseas customers, and the current customers' accounts will also need to be closed for a limited time.And domestic investors obviously belong to overseas customers?IntersectionYou must know that due to the special national conditions of our country, it is very difficult and cumbersome to open an overseas account to open an overseas account, and you must handle it yourself!If the platform helps customers perform these operations, it is illegal!It will be subject to the corresponding warning or even punishment!

Knowing brother is curious!Will domestic investors' funds also enter this so -called Australian first -class bank?in the case of!So what channels do you enter?What kind of account does you enter?if not!Where does the funds of domestic investors go?What is Saint Vincent?

Summarize

Today, it seems that from RuizeanMarkets to OxseCURITIES, obviously did not complete gorgeous turns.

Oxsecurities now holds two licenses.However, the St. Vincent FSA license is not used for transactions. Only OxSecuritiesPtyltd, which is supervised by Australia ASIC, traded through MT4/5Z, but this license has limited types of transactions and can only serve wholesale customers!Knowing that Brother seriously suspects that he is suspected of over -limit operation!

Coupled with the opaque information of its isolation account, the official website description is rough.Let my brother, I have a series of questions and concerns.Here I remind investors who traded in OxSecurities. It is necessary to pay attention to the specific information of trading accounts and funds.

Finally, if you want to know more secrets or complaints of brokers

Or exchange experience together to understand the latest developments in the industry

You can add QQ: 3464399446

Or enter the QQ group of Huiwei power: 762516501

导言:在当今的投资领域里,我们时刻都需要保持警惕,因为投资市场的复杂...

海汇国际诈骗案深度解析:资金盘DRCFX复出传闻背后的真相导言:近年...

据“富途”官方消息:富途拟于2023年5月19日起在中国境内线上应用...

海汇国际资金盘风云再起?DRCFX即将复出,8亿惊天大案细节大揭秘!...

提问:Moomoo资金盘割韭菜:提现不到账,危机初现要懂汇温馨提示:...