Recently, the detectives have seen many exposure posts about MogafX and USGFX coalition. Many investors' hard -earned money was deceived by these two black -hearted companies. It was really shocking.In fact, these two black -hearted companies are the same scam company!But some investors are unwilling to believe this fact and prepare a small bench!Come now 818!

First, Mogafx and USGFX are actually the same company!

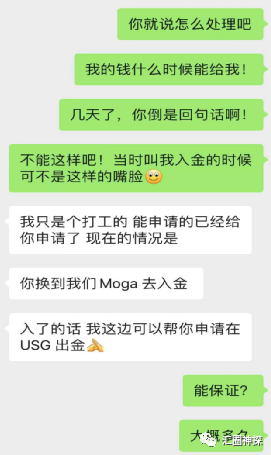

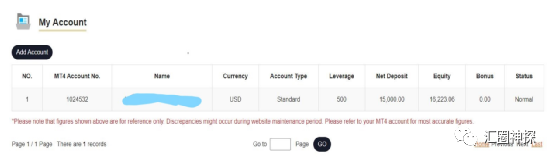

The picture above is provided by the deception

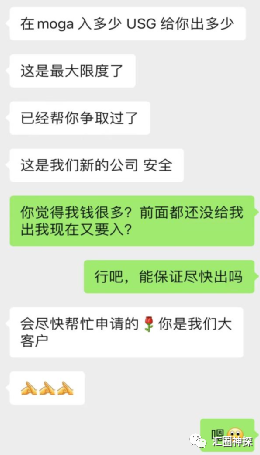

1. The business personnel induced investors from the USGFX to MOGAFX. At the beginning, USGFX could not be issued. The USGFX business staff induced investors to deposit $ 10,000 in MogafX, and USGFX made $ 10,000.In the middle stage, $ 10,000 in MOGAFX, USGFX 5,000 US dollars.Finally, no matter how much money is income in mogafx, USGFX cannot be deposited!Intersection

The picture above is provided by the deception

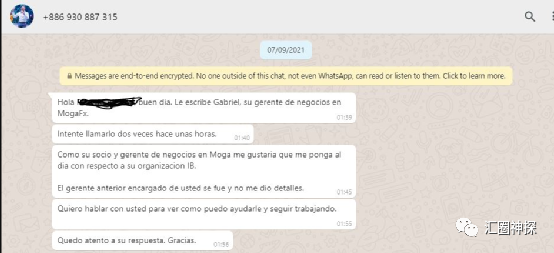

The picture above is provided by the deception

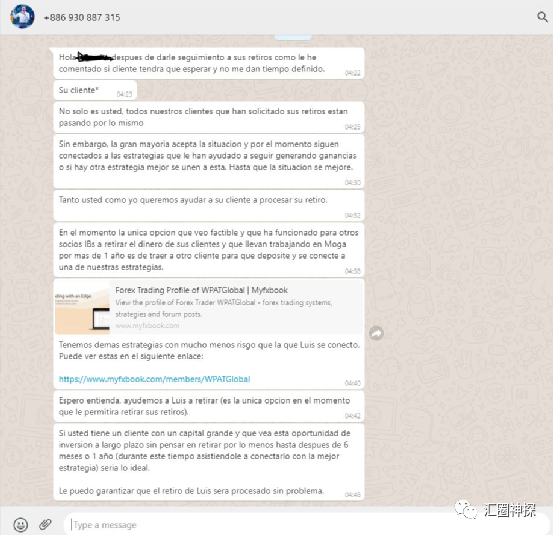

The picture above is provided by the deception

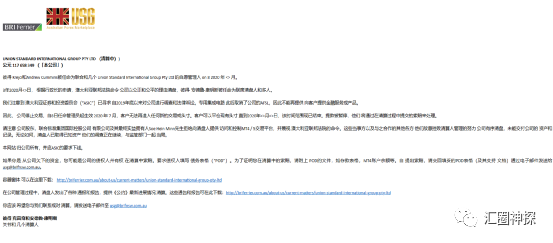

The picture above is provided by the deception 2. In the email of the deceived in Mogafx, MogafX and USGFX are also mentioned. This is enough to prove that the two are closely related. They are two companies in the same group!

The picture above is provided by the deception. 3. Because the USGFX cannot be issued, the investors who have cooperated with USGFX to be sued by investors. Although these technology companies that cooperate with them have won the lawsuit, they still have a reputation impact. In factHelpless ~!

4. The official website of USGFX has been blocked, and it is determined to be a black heart fraud platform!

5. The investigation of the Detective learned that the USGFX team members had run to Taiwan before the accident.Everyone should have heard a lot of scam running routines, and USGFX is the same.

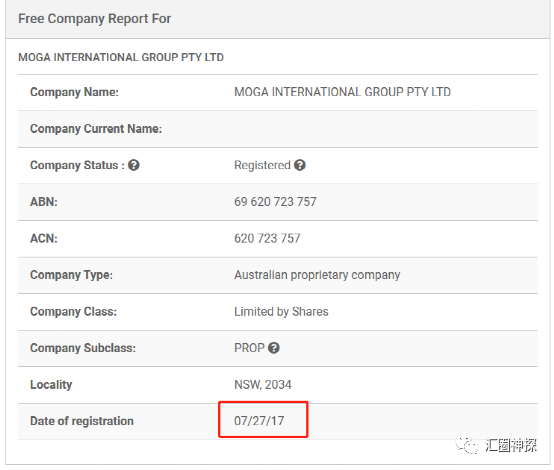

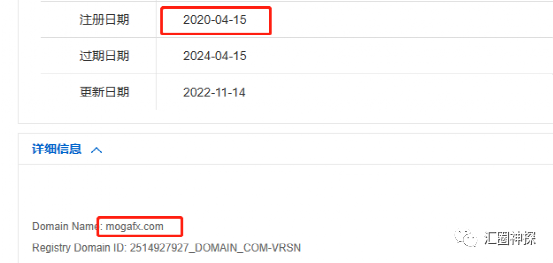

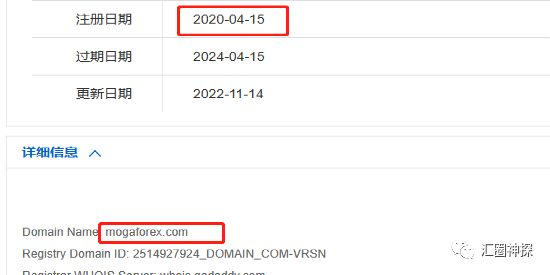

6. MOGAFX is clearly registered in 2017.7.27, but MogafX's official website domain name was registered in 2020!USGFX Federation was running in 2021.It seems that at the beginning, I was deliberately prepared for the second company!Prepare from time to time!Isn't this a proper conspiracy!In summary, Mogafx and USGFX Federality actually registered a new company in the same group and replaced a new company name. USGFX Feds has been hammered as a black heart fraud platform. Where can MogafX be better?Someone really believes that they have a noodles?Anyway, the detective does not believe it!

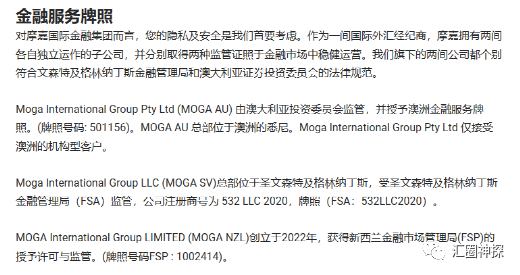

Second, the strength and authenticity of the mogafx theory of regulatory licenses!

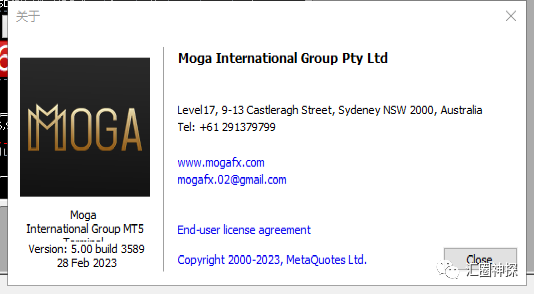

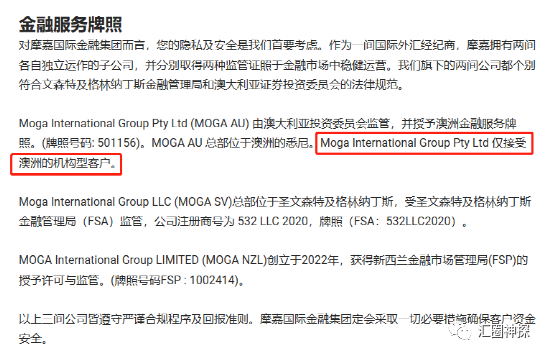

Detective found on the official website of mogafx (https://www.mogaforex.com/ and https://www.mogafx.com/). Mogafx claims that he has the triple supervision of Australia ASIC, St. Vincent FSA, New Zealand FSP!Is these triple supervision reliable?Does it really exist?Let's take a look together ~

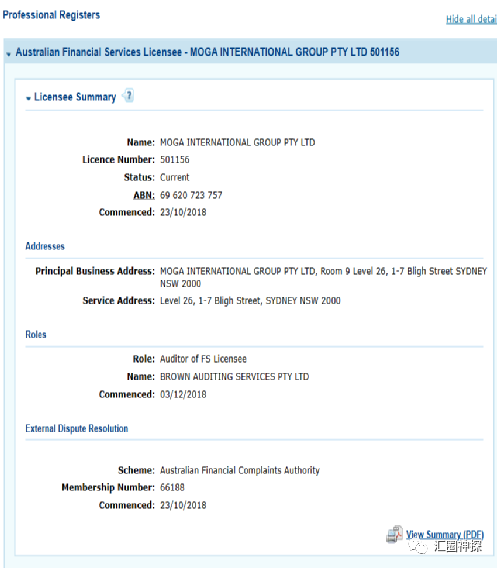

Australian ASIC: False supervision of companies in the same name!IntersectionIntersectionIntersectionIntersectionIntersection

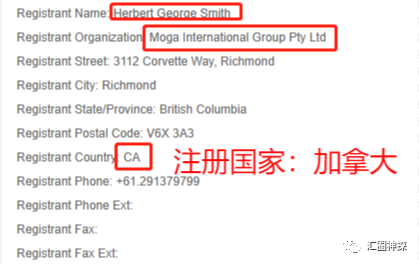

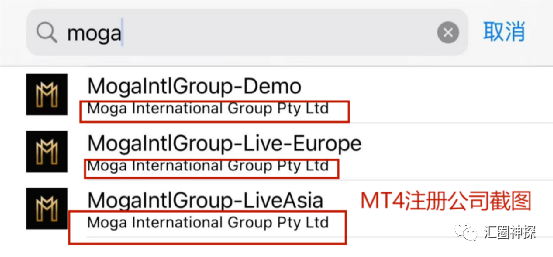

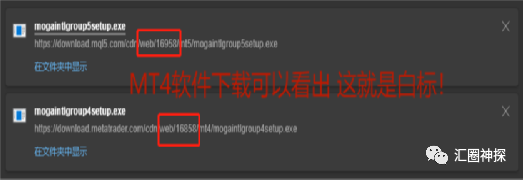

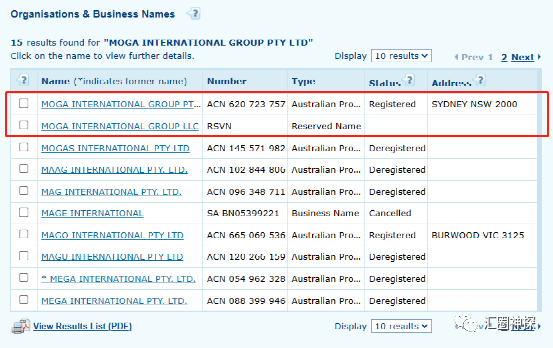

After checking the MOGAFX official website domain name registration company, it was found that: MogafX actually registered two companies with the same name, that is, the same name, both of which were called Mogain TrainingalGroupPTDDD.

The Australian regulatory license is a MogainternationalGroupPTyltd registered in Australia.

There is only one company that actually occurs on MT4.Intersection

The two companies are just the same as their names, whether in law or in all aspects, there is no connection!

As we all know, only the company's company and MT4 actually operated companies in the same family are the same. Funding funds for foreign exchange transactions really accept regular supervision!IntersectionIntersection

MogainworkalGroupPTYLTD, registered in Australia, obtained ASIC's regulatory license. The detective found that: 1. MogaintemgroupPTD registered in Australia obtained ASIC's regulatory license. Ben is also low,This shows the perfunctory of MOGAFX for this license!Because this is a guise, the company of the same name, to avoid supervision, and to spread it for fraud!IntersectionIntersection

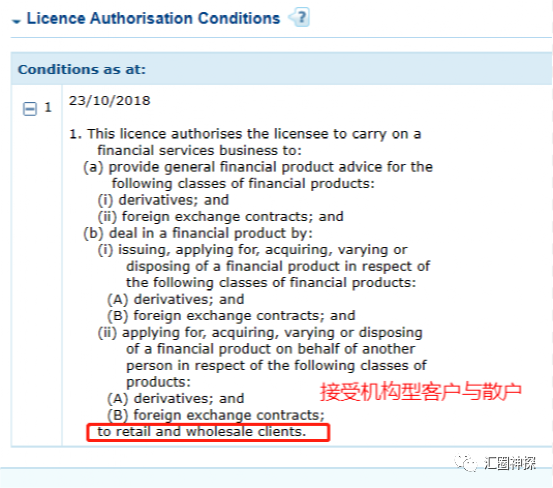

2. MOGAFX official website declares that this MOGAINTERNATIONALGROUPPTYLTD registered in Australia can only operate institutions customers and do not accept retail investors, but ASIC official website shows that institutional customers and retail investors can do it.Why is this? The business that can be done clearly does not mention it?Is this forgotten?Or they are not professional at all!Is there a difference between institutional customers and retail investors at all?

St. Vincent FSA: The company of the same name × 2, and San Vinson does not regulate foreign exchange transactions!IntersectionIntersectionIntersectionIntersectionIntersection

1. MOGAFX registered two companies named: MogAINTERNATIONALGROUPLLC, one registered in Australia, and the other was registered in St. Vincent to create an illusion and want to disturb the investors' thinking!

2. The official website of the St. Vincent Financial Services Administration has clearly stated: San Wendans does not regulate foreign exchange transactions!What's more, San Vincent is just a small country. Many small countries sell regulatory licenses to make money. In fact, there is no supervision at all!

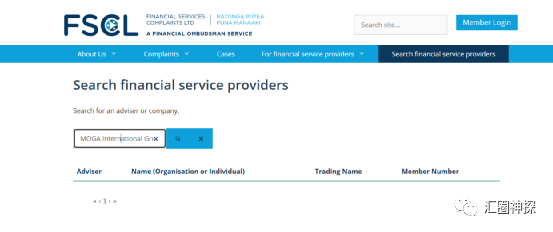

New Zealand FSP: There is no regulatory license at all, but there is a company registered in New Zealand!Intersection

On the FSCL website in New Zealand, you can't search for regulatory information of MogaintleonationalGrouplimited!Just a company registered in New Zealand!IntersectionIntersectionCompany register 管 regulatory license!IntersectionIntersectionAnd even if there is a license in New Zealand, it only allows foreign exchange business in New Zealand, let alone he has no New Zealand license at all!

After watching the analysis of the detective, will investors give their hard -earned money to mogafx?IntersectionIntersectionThey really make money do not depend on foreign exchange transactions!Investment needs to be cautious!IntersectionIntersectionI hope everyone can polish their eyes!IntersectionIntersection

导言:在当今的投资领域里,我们时刻都需要保持警惕,因为投资市场的复杂...

海汇国际诈骗案深度解析:资金盘DRCFX复出传闻背后的真相导言:近年...

据“富途”官方消息:富途拟于2023年5月19日起在中国境内线上应用...

海汇国际资金盘风云再起?DRCFX即将复出,8亿惊天大案细节大揭秘!...

提问:Moomoo资金盘割韭菜:提现不到账,危机初现要懂汇温馨提示:...