Richsmart's Australian license is "self -hi", no supervisory transaction shady exposure is exposed!Intersection

Recently, an investor has a private letter from the truth, hoping to help inquire about the regulatory compliance of the Richsmart foreign exchange platform. Thank you for your trust. Today, the truth brother will evaluate this platform in detail ~

Before the test, we need to be clear that any foreign exchange trading platform should be supervised by the corresponding regulatory agency to ensure the legality and compliance of its operation.

So, does the Richsmart foreign exchange platform meet this requirement?

The domain name of Richsmart's website name is richsmartfx.com (domain name 1) and Richsmartfx.net (domain name 2). The domain name 1 was registered in December 2023 and the domain name 2 was registered in January 2024.

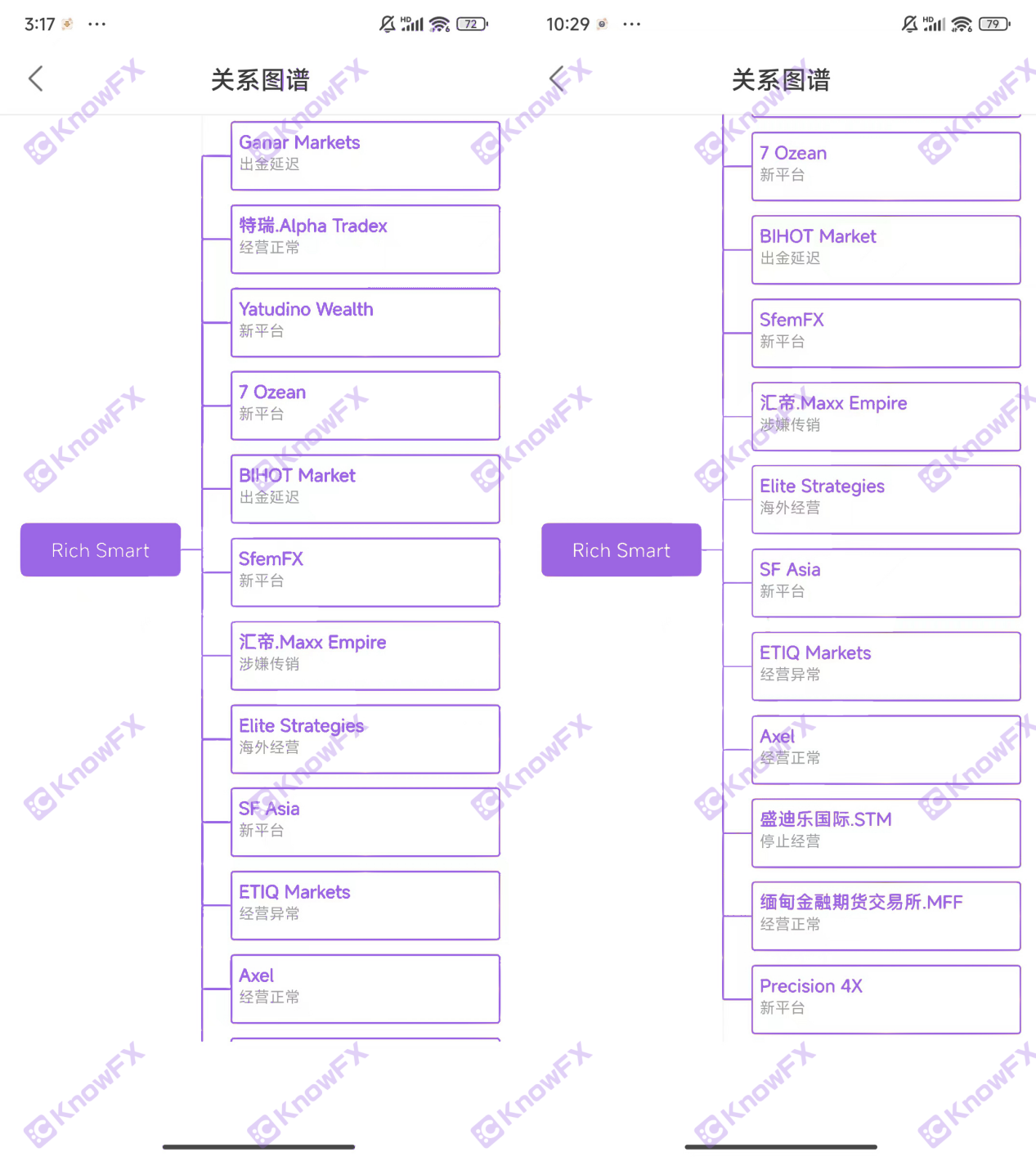

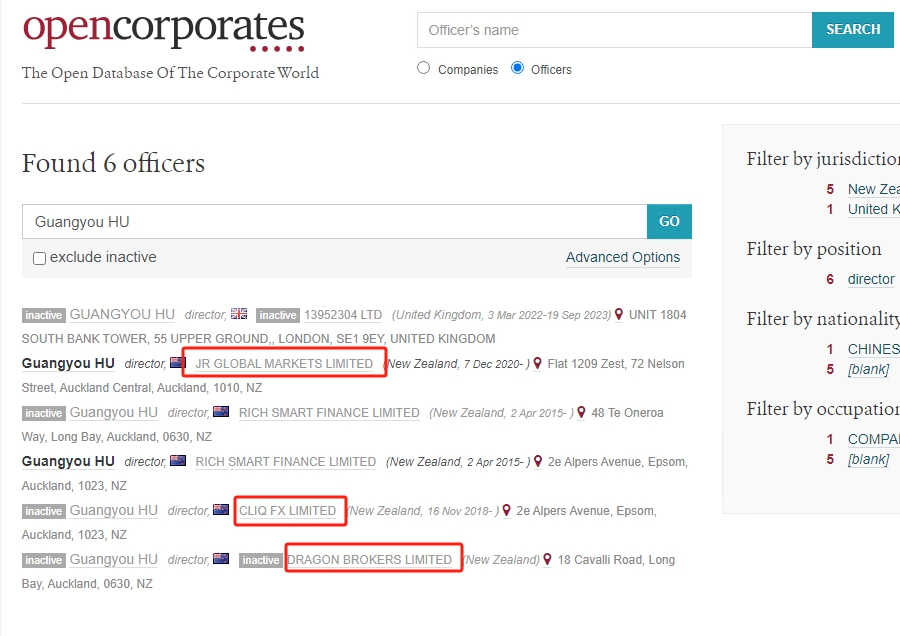

Subsequently, the truth brother found that many brokerage platforms associated with Richsmart were not in many problems. As shown in the figure above, many brokers did not have a new platform, suspected of pyramid schemes, abnormal operations, or stopped operations!Intersection

The Richsmart was established in 2015. The registration time for the domain name of the platform website has not been in the area of the domain name.

Many brokerage companies related to it have many problems, which evoked the truth of the truth about the compliance of the Richsmart platform!Intersection

Next, let's check how the Richsmart platform supervision is?

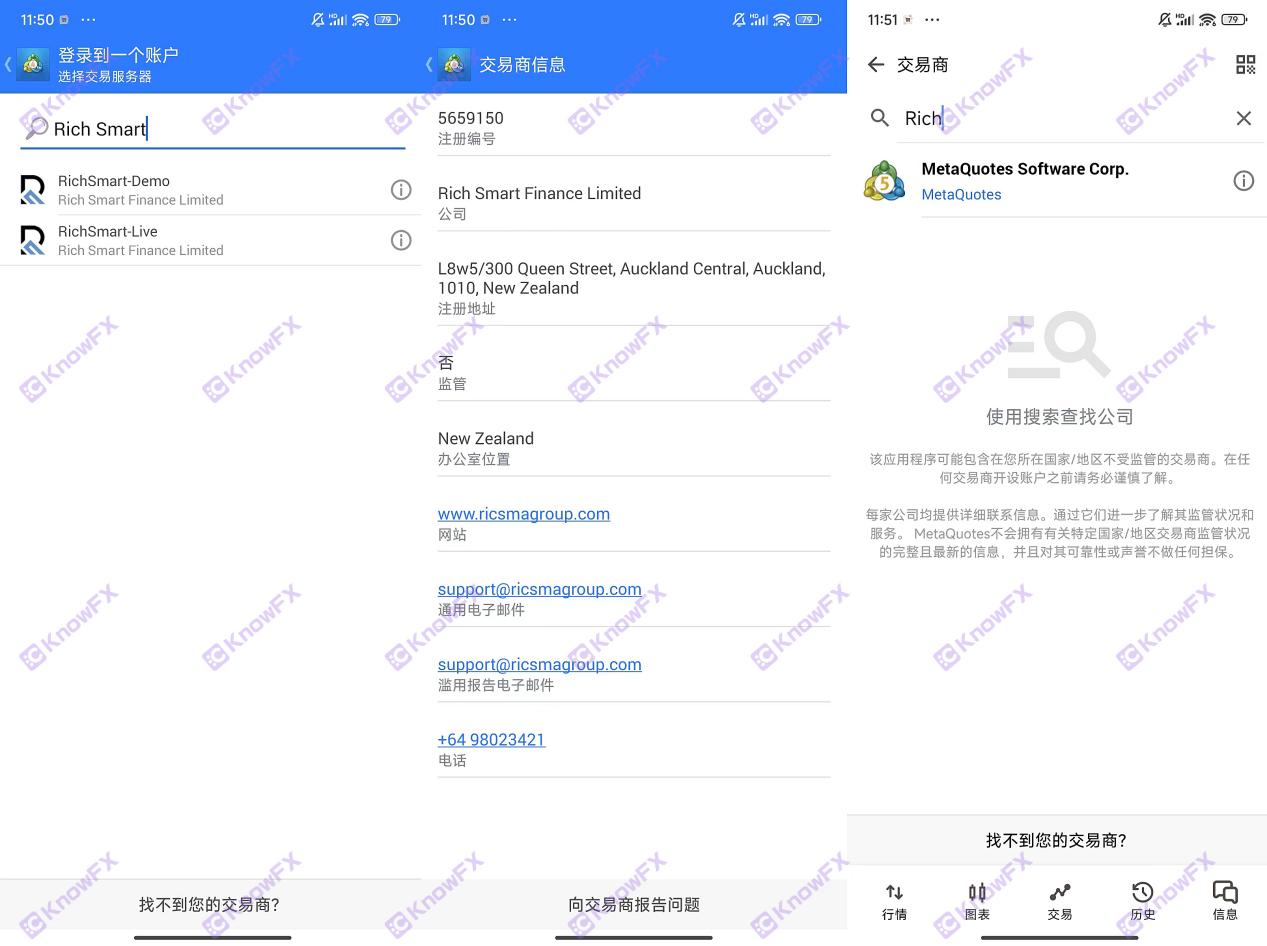

In the information at the end of the Richsmart's official website, Richsmart mentioned that Richsmartfinancelimited's business name, logo, trademark, and www.richsmartfx.net website was owned by RichsmartFinancelimited. 50).

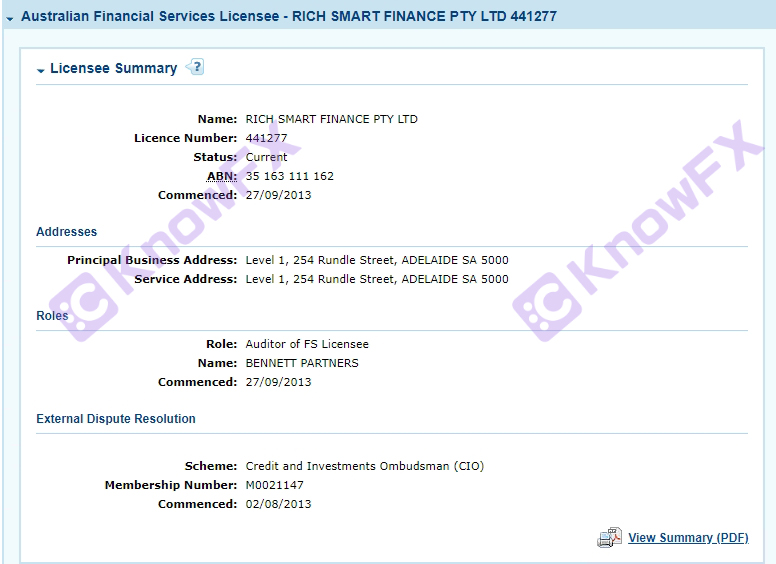

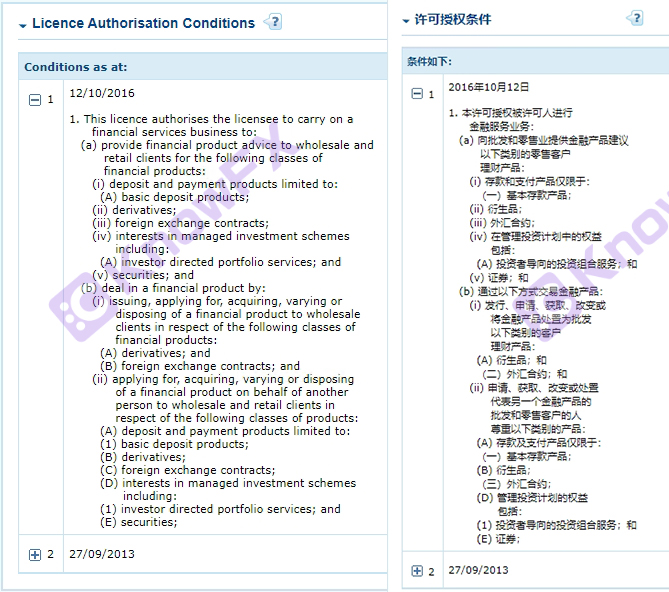

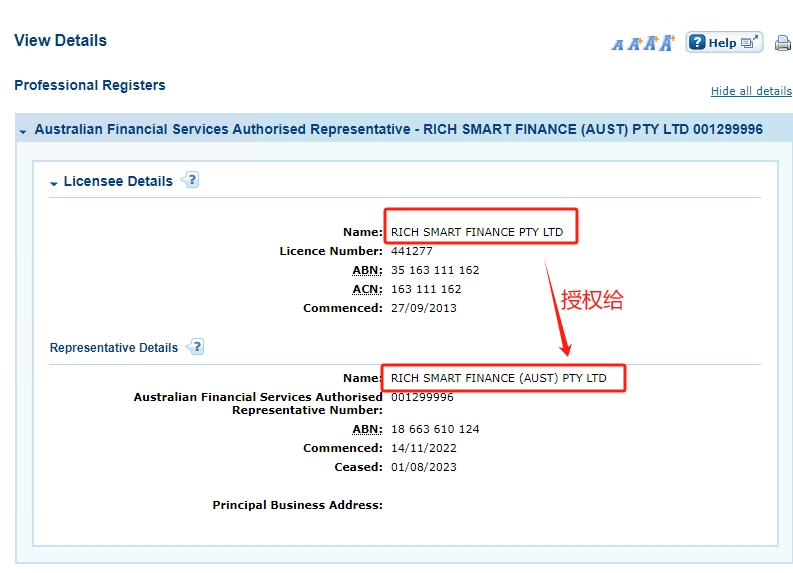

Richsmartfinanceptyltd is authorized and supervised by the Australian Securities and Investment Commission (ASIC) and holds Australian financial service licenses (AFSL441277).

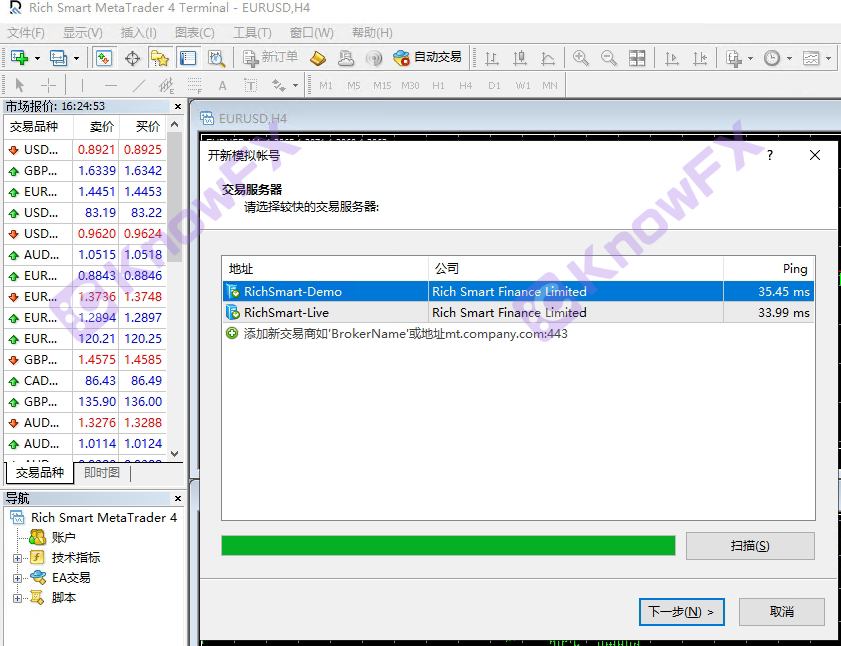

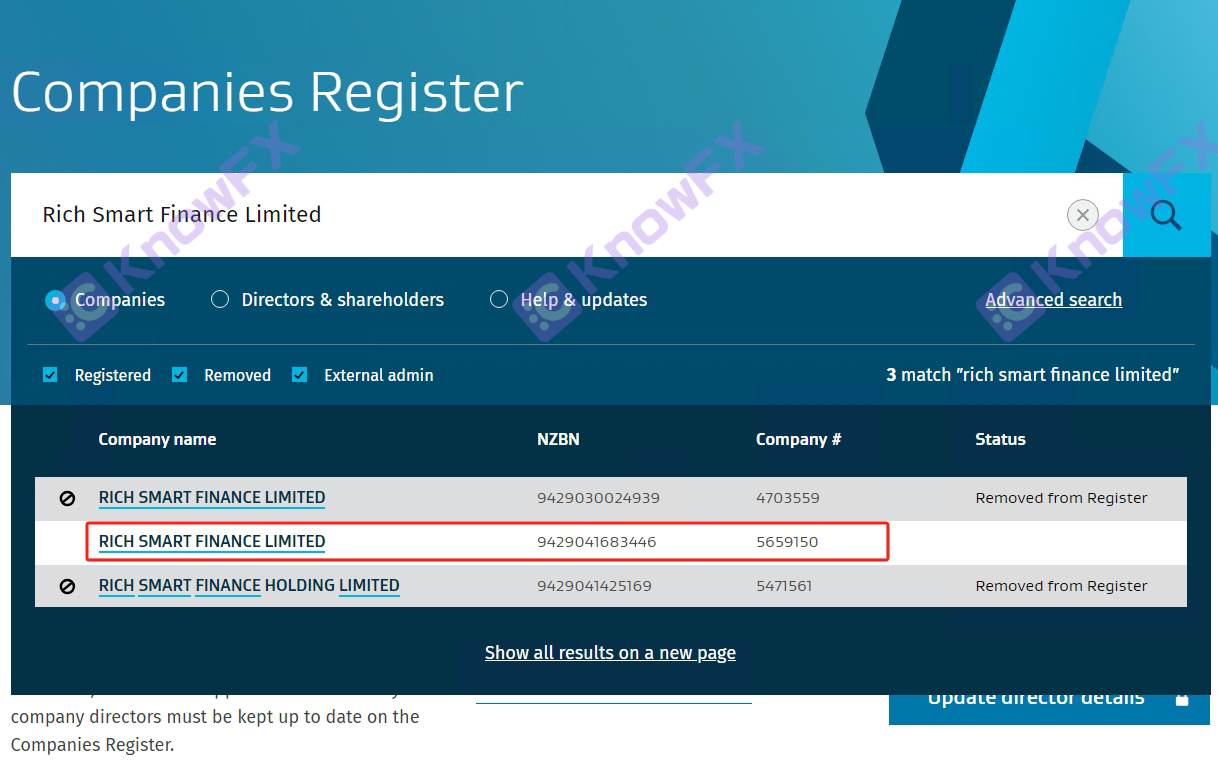

So the truth brother went to check the company that Richsmart actually used in trading. As shown in the figure above, there is only RichsmartFinancelimited this New Zealand company ~

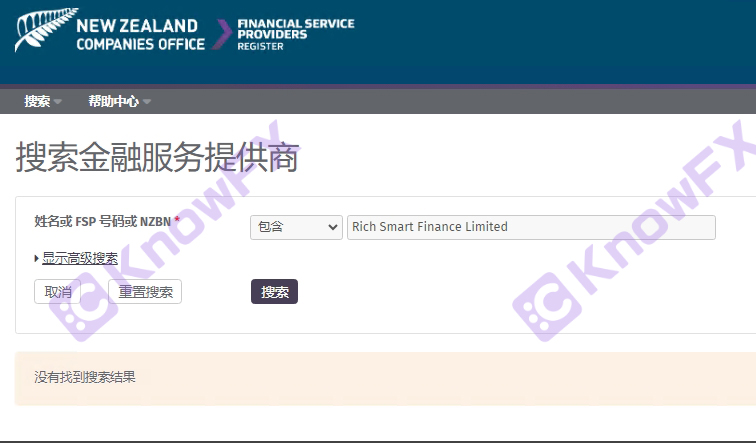

After some exploration investigation, the truth brother found that Richsmartfinancelimited was unable to rank among New Zealand's financial service provider registry (FSP), although in the company's company register in New Zealand.

It's like a liar wearing a gorgeous jacket. The appearance seems to be legal, but it is an unrestrained ordinary registered company. It lacks formal financial supervision. It is like walking in the gray area of supervision.

For such a company, the big money bag of the big guy has to be tight, don't hang it easily!Intersection

Look at the Richsmartfinanceptyltd company holding the Australian (ASIC) regulatory license.

But the truth brother was shocked after digging deeply. RichsmartfinancePtyLtd actually played the "self -producing and self -selling" trick and authorized himself!Isn't this the bottom line of challenging supervision?This is equivalent to giving the company a knife and letting it supervise whether it is a knife, it is really a big glue!Intersection

This self -authorized absurd behavior is simply blatant contempt for the regulatory mechanism. It opens the door of conflict between interests and improper behaviors, allowing RichsmartFinanceptyltd to manipulate everything behind the scenes, but the external regulatory agency is like a decoration.

Furthermore, it communicates with its official website customer service, and its customer service calls RichsmartGroup.

Such a lack of transparency is like playing a football game without a referee.

Fortunately, ASIC has requested that the brokers who have been regulated in April 2019 will no longer provide services to mainland investors, otherwise they will be punished, so this license has no regulatory effect on Chinese customers.

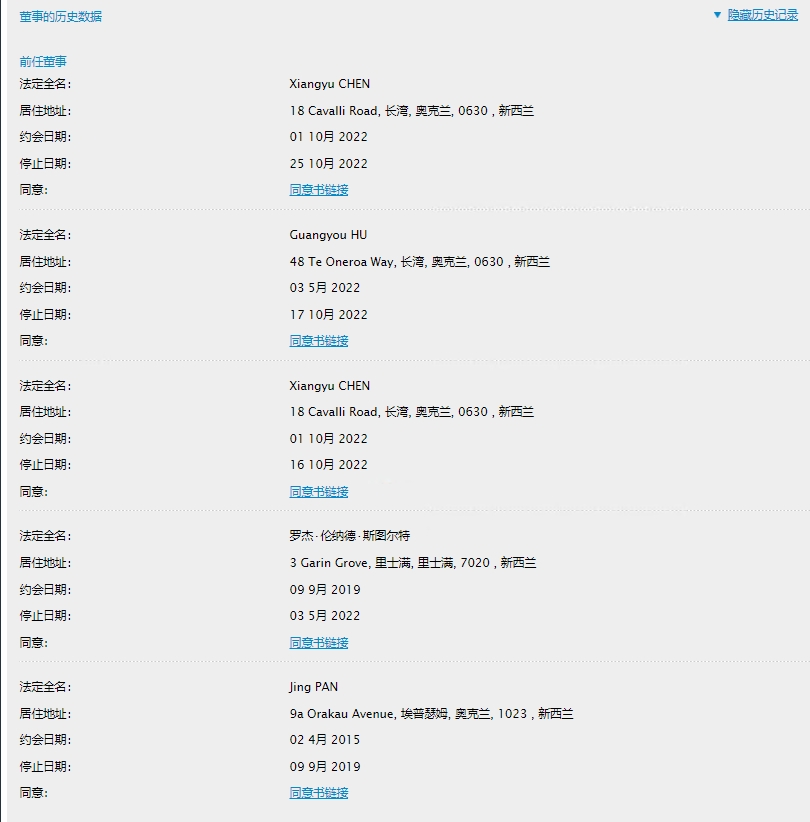

Richsmartfinancelimited, the company has experienced five directors in just seven years, showing the unstable company's governance structure.His current directors are also directors and many companies, including some platforms that have no supervision, which undoubtedly increases investment risks.

What's even more shocking is that Richsmartfinancelimited is just a registered company, but is used by Richsmart as actual transactions. Richsmart uses this company to conduct financial transactions without obtaining appropriate supervision and review. This behavior is not to investors.Responsible performance does not meet the rules and moral standards of the financial market.

In short, investment is a risk behavior that needs to be treated with caution.Before making any investment decisions, be sure to conduct adequate investigations and evaluations.

I would like to remind investors that investors need to be cautious,

Please brighten your eyes!Intersection

You need business cooperation,

Please scan the code and leave the aircraft number to cooperate ~

Query platform, complaint,

For more information, please download the exchange app ~

If you need to check the platform, disclose clues, complaints,

Please scan the code to add a detective QQ to make the news !!

Welcome everyone to contact us ~

Detective: 3464399446 Truth: 31476777259

Poisonous tongue: 2389671330 Knowing Brother: 2124228721

导言:在当今的投资领域里,我们时刻都需要保持警惕,因为投资市场的复杂...

海汇国际诈骗案深度解析:资金盘DRCFX复出传闻背后的真相导言:近年...

据“富途”官方消息:富途拟于2023年5月19日起在中国境内线上应用...

海汇国际资金盘风云再起?DRCFX即将复出,8亿惊天大案细节大揭秘!...

提问:Moomoo资金盘割韭菜:提现不到账,危机初现要懂汇温馨提示:...