PrimeTimeglobal is also called PGM. It is a broker claiming to be established in Melbourne, Australia in Melbourne, Australia. It has been a broker providing liquidity institutions in 2016. In 2023, it has expanded the service and business scope and provided trading services to retail customers!

According to it, although it has been operating in the industry for many years, it did not begin to provide "retail customers" trading services until last year!

What makes the detective alert is that, as an Australian broker in Melbourne, Australia, its only official website propaganda material promotional picture actually uses Chinese!You must know that in order to cope with international regional restrictions, Australia has a series of restrictions on my customers.

Therefore, companies that are currently regulated by Australia generally do not list Chinese customers as their main customers!So does this mean that PGM is not an Australian ASIC regulatory broker!??

However, the facts are always unexpected but unexpected.

Unexpectedly, PGM's entity PrimeTimeglobalmarketSptyltd in Australia is indeed supervised by Australian ASIC!

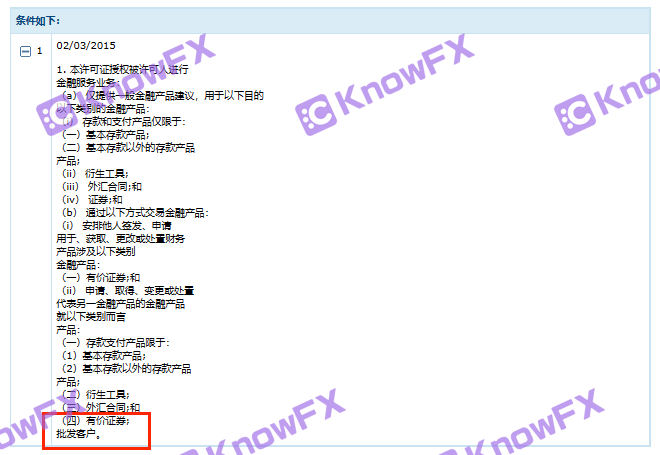

It is expected that the license held by PGM really has problems.Because the service target of the PGM -granting PGM is only "wholesale customers", that is, the entity does not have the qualifications to serve "retail customers".

So PGM has always used this physical over -limit operation to provide "retail customers" to provide services?Obviously not!

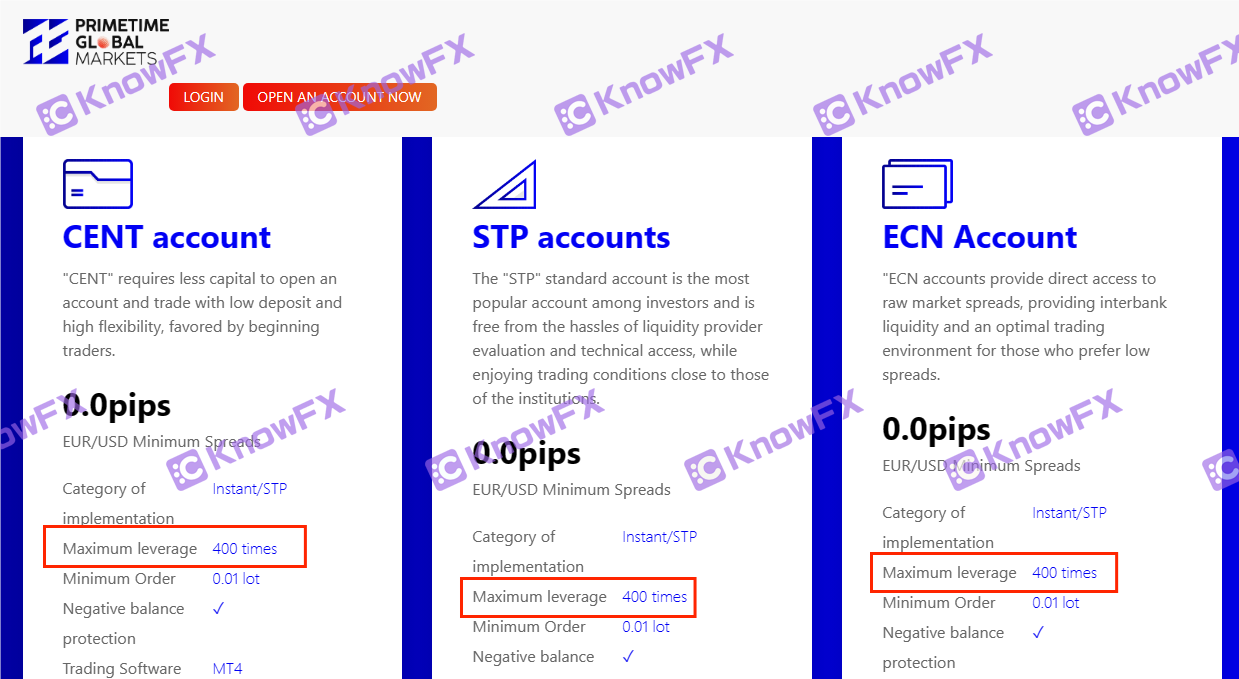

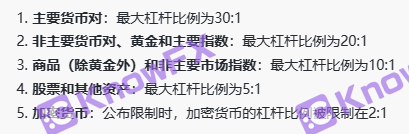

In order to strengthen investor protection measures and reduce the risk of customers' losses, Australia ASIC was first introduced in 2020 -retail customers using financial products (especially differences contracts, CFDS) leveraged ratio restrictions.

And indicate the maximum leverage ratio of different asset categories:

That is to say, PGM must not be traded with entities regulated by Australia!The platform used for transactions has once again confirmed this view!

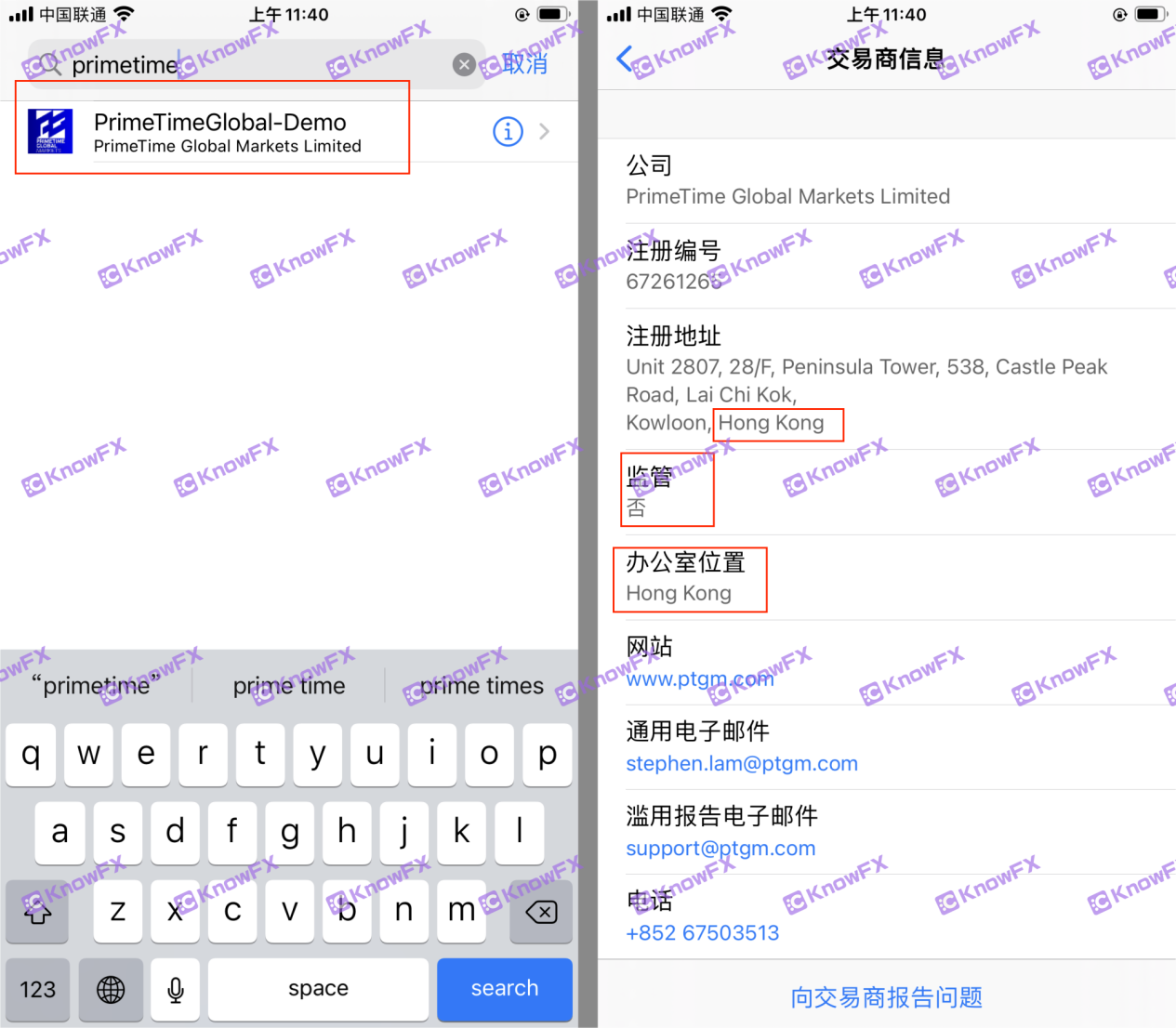

Through the MT4 platform provided by PGM, we can find that there is only one company entity called PrimetimeglobalMarmarketslimited!And the company has no regulatory license by the Hong Kong Securities Regulatory Commission SFC!

Obviously this Hong Kong company used by PGM for transactions has not been regulated by the deserved!It also means that the transactions that have been conducted are actually "naked" without supervision.And the company's entity far away from Hong Kong also confirms the speculation of detectives -PGM is a "danger" agent who is wearing the Australian shell against the Chinese people.

In addition, PGM obviously provided MT4 and MT5 platforms on the official website for transactions!But the adverse's use of MT5 cannot find the server provided by PGM at all!

It's even more outrageous!PGM actually has a face -to -face trick on the customer protocol, and uses PrimeTimeglobalmarketSptyltd, a Australian company that does not accept "retail customers" with customers, signed an agreement with customers!

Don't forget!It only provides PrimeTimeglobalMarketslimited Hong Kong, a completely unmarried -up company, and has directly dumped the responsibilities they should bear!True Qin Shihuang eats spicy and hot -win Mara!Intersection

When analyzing the actual situation of PGM, we revealed a series of concerns.Although PGM claims to be supervised by Australia ASIC, in fact, the services it provides retail customers has no corresponding license support, but instead operates through an unforgettable Hong Kong company.In addition, it has questions in the use of customer protocols and trading platforms, showing possible fraud and supervision loopholes.

Putting this case in a broader background is not only a single warning story, but a microcosm of regulatory importance in the global financial market.Transparency, compliance, and supervision are not only the cornerstone of market order, but also a barrier to protect the interests of investors.With the increasing internationalization and complexity of the financial market, choosing a reliable and strict supervision institution is particularly critical.Investors should actively learn from them to improve their awareness of self -protection to ensure that while pursuing financial income, they will not become victims of regulating gray areas.

If you need to check the platform, disclose clues, complain

Please scan the code to add a detective QQ!

You need business cooperation, please scan the code and leave the aircraft number to cooperate!

Query platforms, complaints, more information, please download the Hui APP

Detective 1: 3464399446 Detective 2: 3147677259

Detective 3: 2124228721 Detective 4: 2389671330

导言:在当今的投资领域里,我们时刻都需要保持警惕,因为投资市场的复杂...

海汇国际诈骗案深度解析:资金盘DRCFX复出传闻背后的真相导言:近年...

据“富途”官方消息:富途拟于2023年5月19日起在中国境内线上应用...

海汇国际资金盘风云再起?DRCFX即将复出,8亿惊天大案细节大揭秘!...

提问:Moomoo资金盘割韭菜:提现不到账,危机初现要懂汇温馨提示:...