There are always many means and traps in the problem platform. Now let's take a look at these seemingly good platforms and delve into its problems!

Vtmarkets

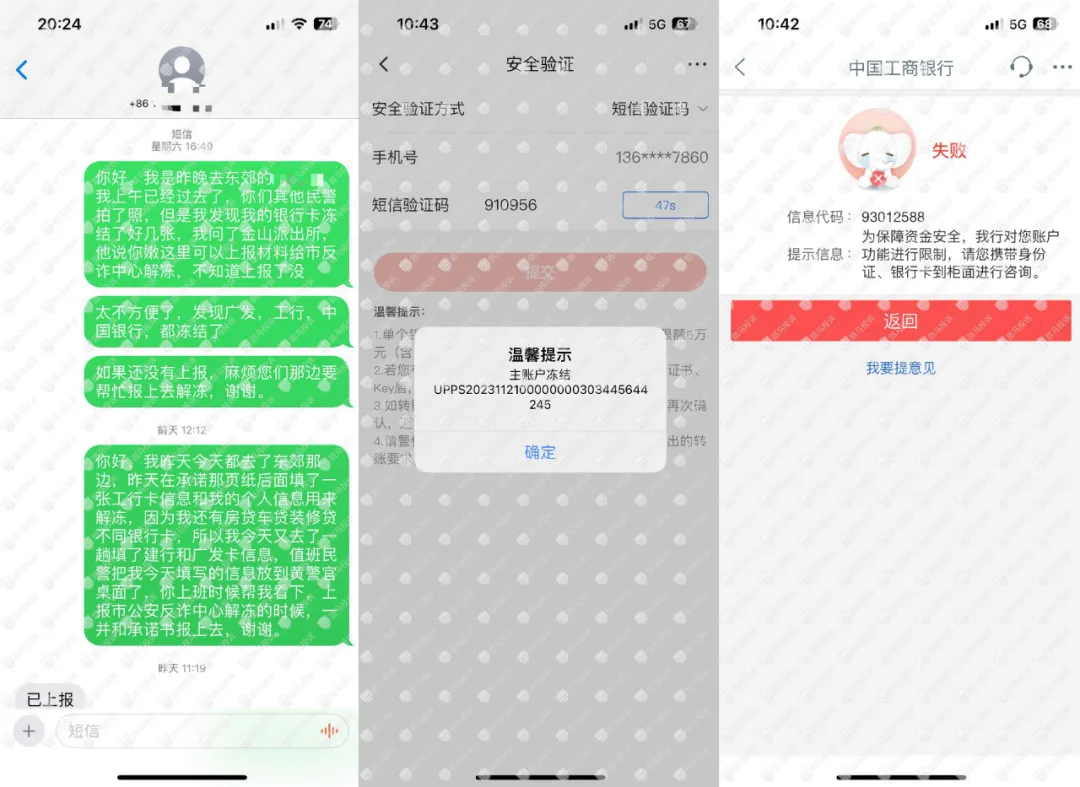

In recent years, the "frozen card storm" of the foreign exchange market has intensified, as if investors have been involved in a "test of ice and fire".The gold out of the gold has become a "stepping on the thunderous area". If you are not careful, you may have an intimate contact with the "big pit" such as the money involved or money laundering, and then froze by ruthlessly.!!

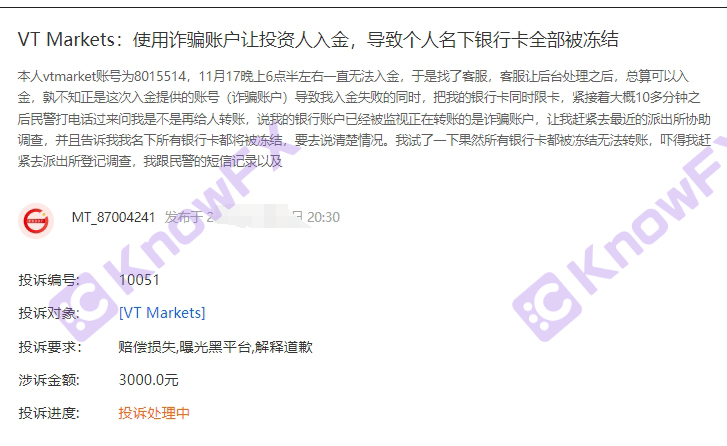

Next, let's take a look at the exposure of the above investors: "It has been unable to enter the gold, let the background process through the customer service, and then you can enter the gold, but the account number provided by the gold will cause the gold to fail. Then his bank card is limited to the card and frozen."

When investors stood up to complain and expose the VTMARKETS platform, the platform chose to be a "stuffy gourd" and never stood up on the front to give you a reasonable explanation. This attitude undoubtedly made investors more disappointed and angry., Also for investors' trust in the platform!

So what kind of medicine does the Vtmarkets platform sell in the gourd?Intersection

Speaking of this, I have to talk about the problem with the existence of the Vtmarkets platform!Intersection

At present, the public account of the platform has not obtained a statutory license or license or license. It has been stopped using, dissemination, or engaged in related business activities!Intersection

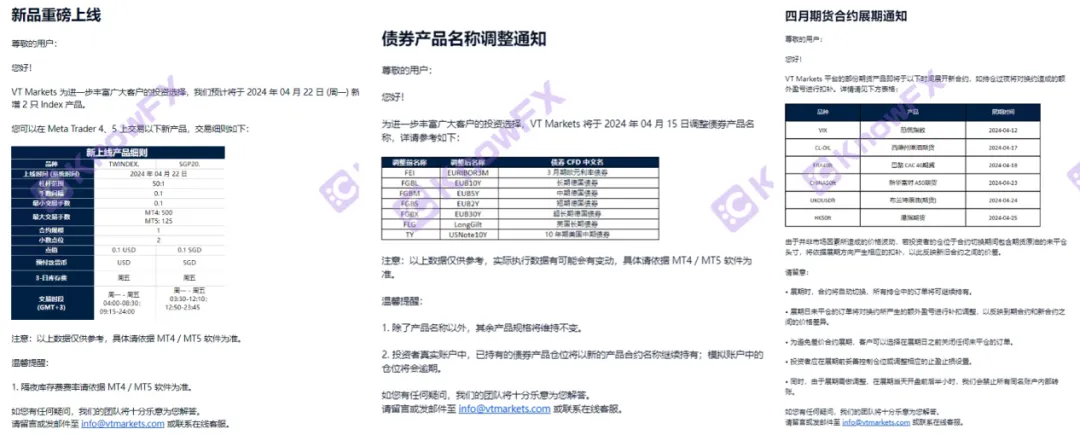

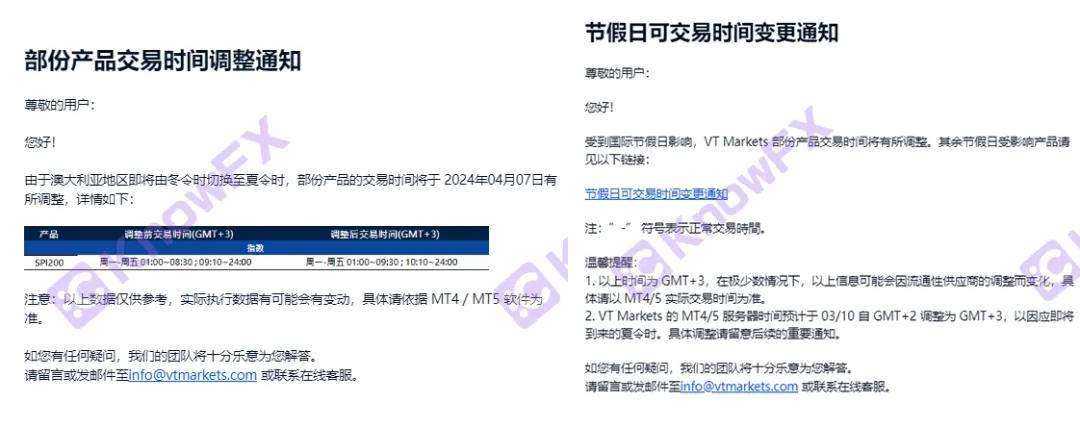

Open the official website of the VTMARKETS platform, and it is a notification statement of the VTMarkets platform. In this statement notification, there is no explanation notice on the platform exposed by the platform!Intersection

Instead, a large number of two INDEX products were promoted on April 22, 2024 (Monday). The notice of bond product name adjustment/bond product name/some product transaction time adjustment ...

This approach of the VTMARKETS platform seems to be transferred to investors' attention to the intention to avoid directly facing problems and doubts.Spend.

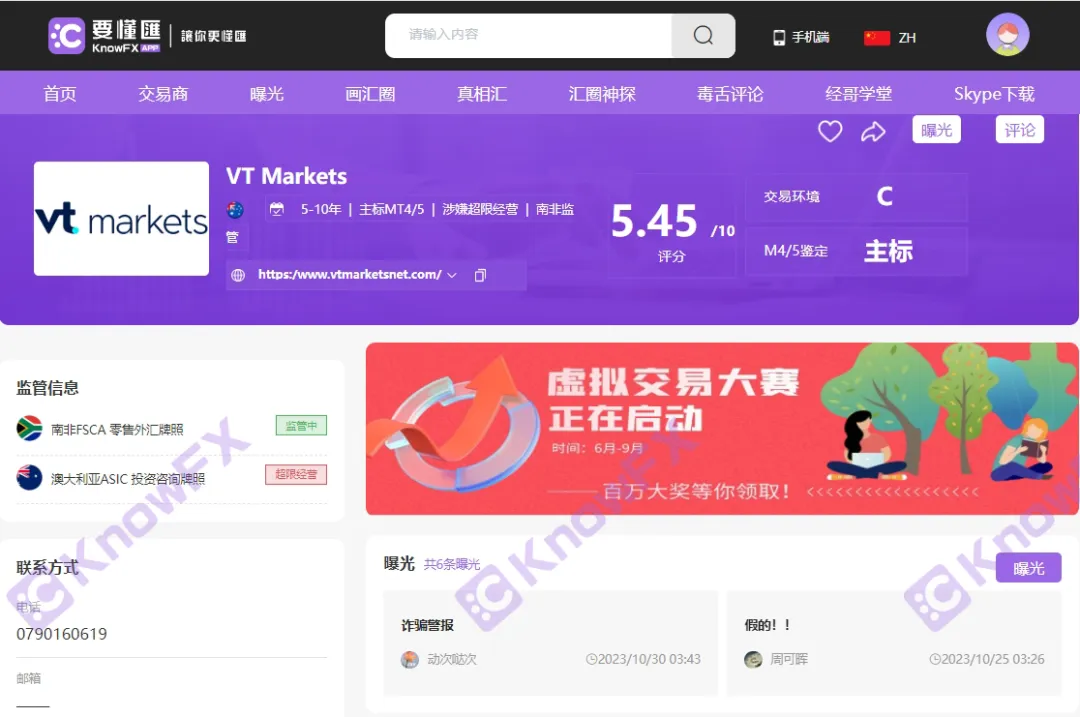

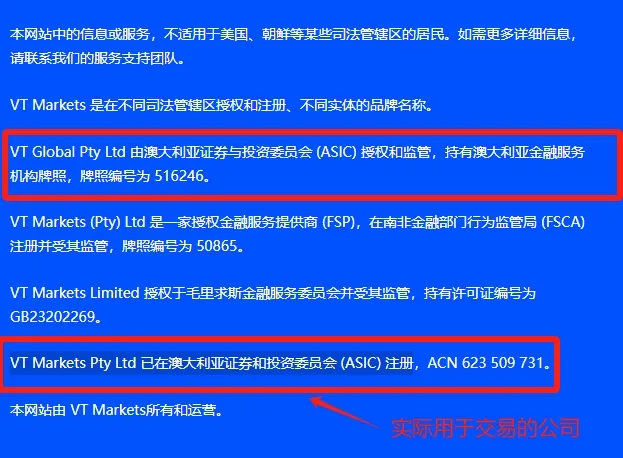

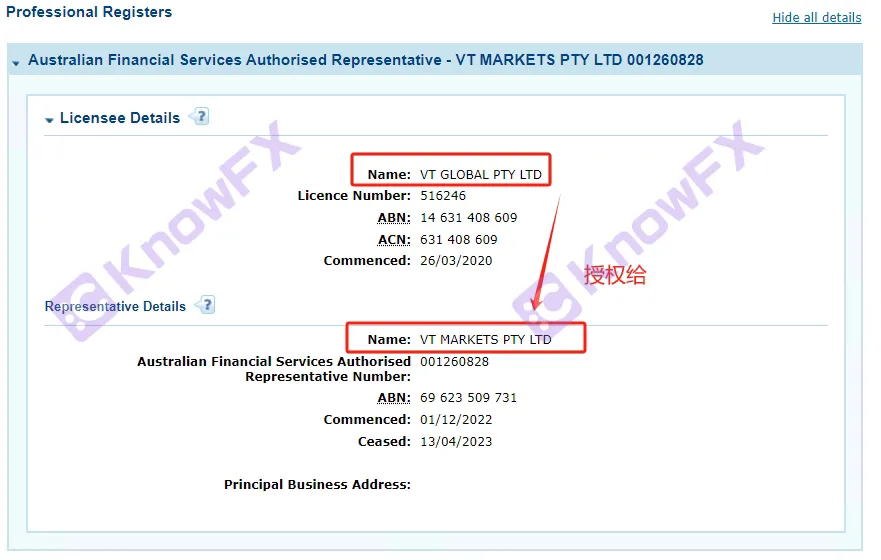

On the official website of the remittance supervision inquiry, VTMarkets' licensed information is South Africa (FSCA) licenses and Australian (ASIC) licenses are currently in a state of over -limit operation.

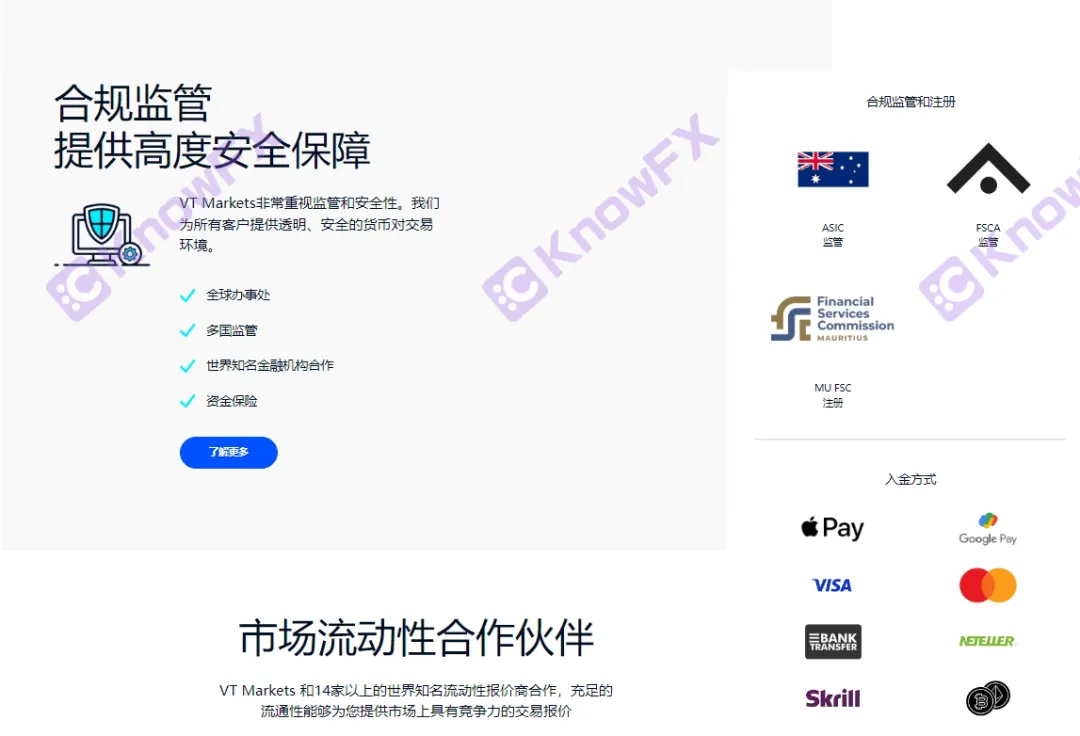

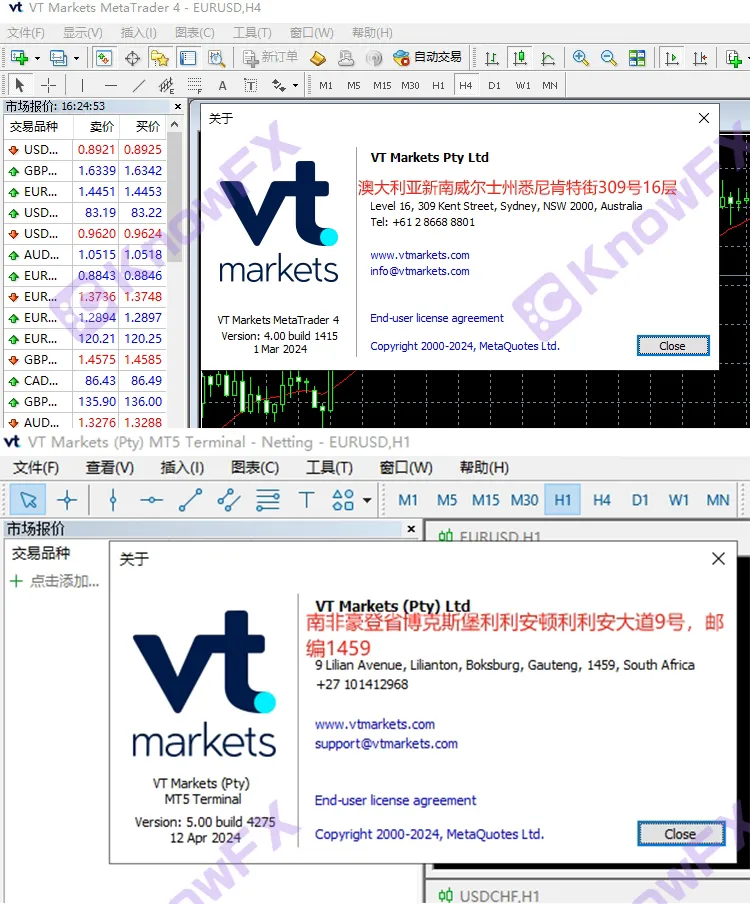

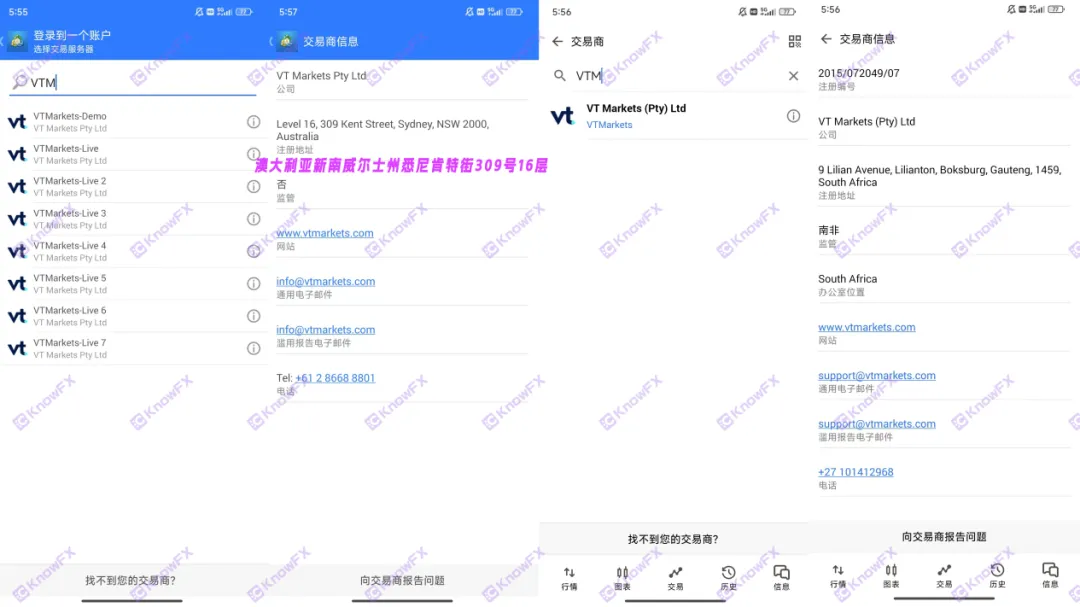

Look at the regulatory information published on the official website of VTMARKETS:

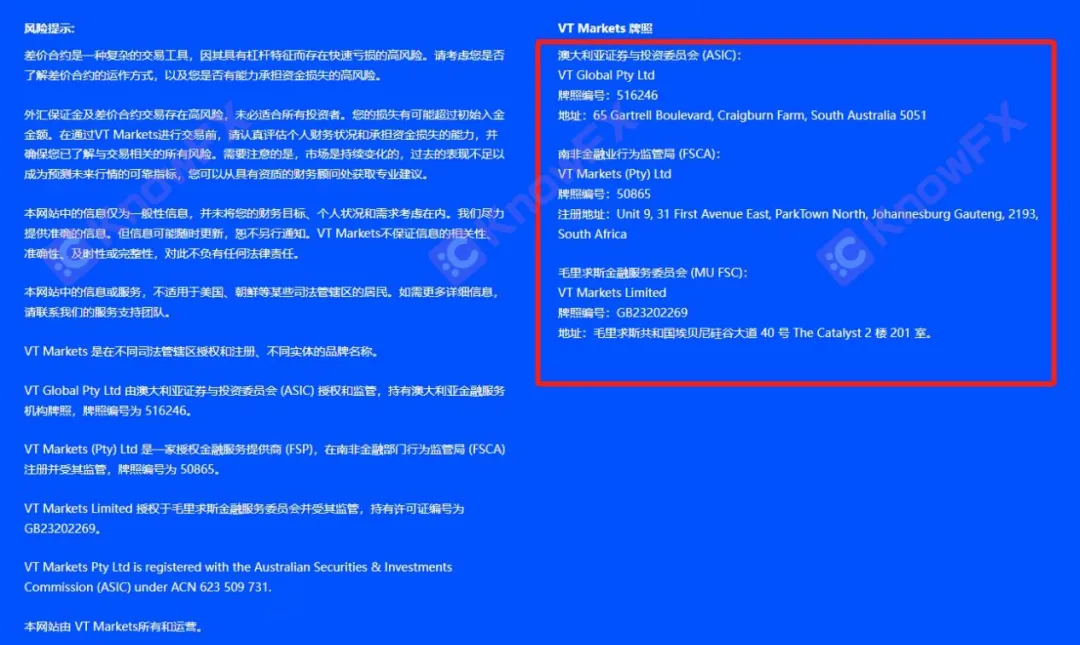

VTGLOBALPTYLTD is supervised by the Australian Securities and Investment Council (ASIC), with license number 516246.

VTMARKETS (PTY) LTD is supervised by the South African Financial Industry Behavior Regulatory Bureau (FSCA), license number 50865.

VTMARKETSLIMITED, MUFSC, license number GB23202269.

The actual companies used for transactions include VTMARKETSPTYLTD (Australia) and VTMarkets (PTY) LTD (South African Corporation).

Through the official website of the Australian Securities and Investment Council (ASIC), the truth brother has verified the AR license of the Australian (ASIC) AR license to VTMarketSPTYLTD. Is it the company authorized by him or VTMarkets's own company?Intersection

2. Brokerage FBS

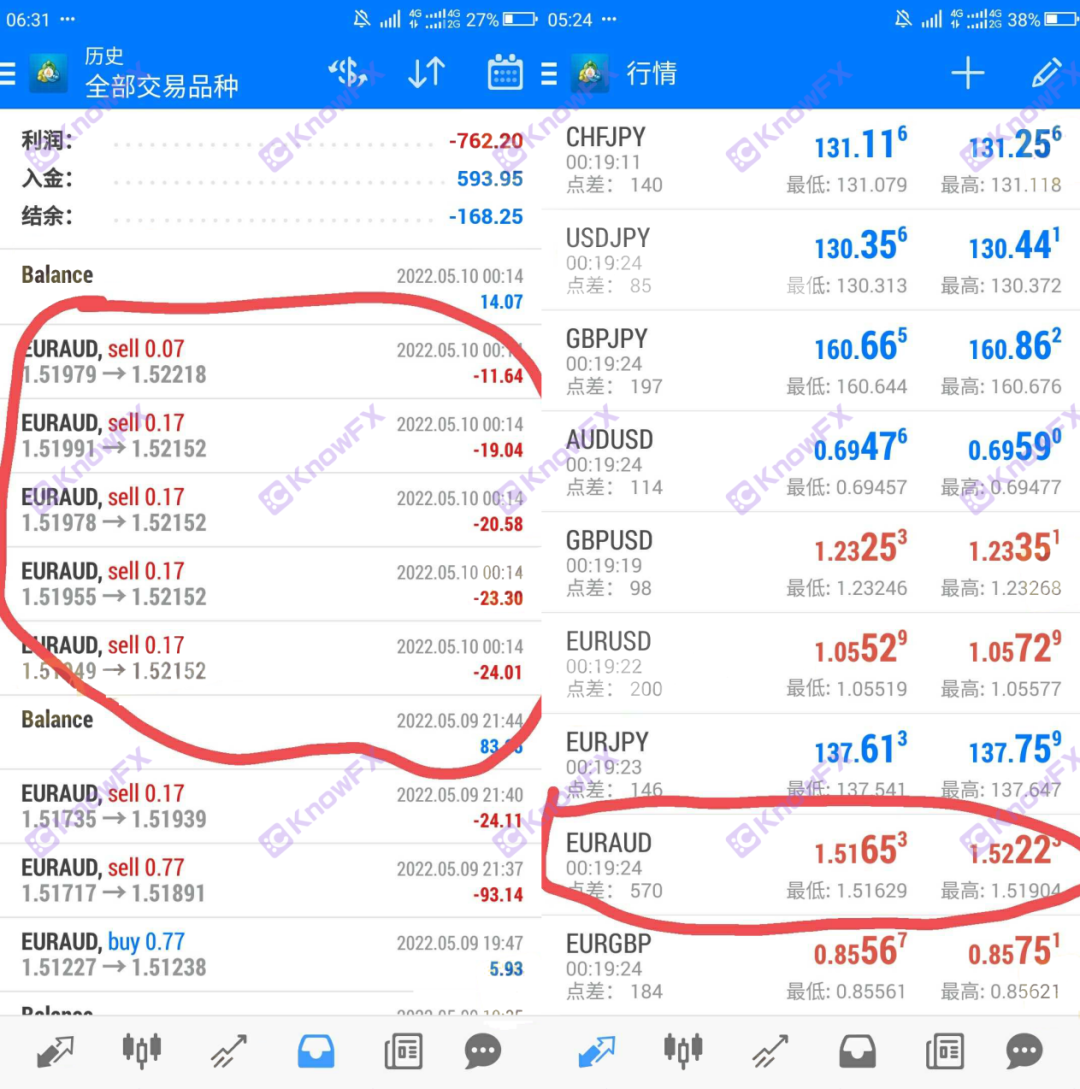

On the major regulatory query websites, everyone's evaluation of their platforms is not very satisfactory. Many investors said: "FBS platform, severe slippery point, poor malicious expansion, and attracting transactions with high leverage, and then all kindsWarehouse, etc.

Open the official website of FBS, we noticed that the leverage ratio of FBS was as high as 1: 3000 on its homepage!Intersection

As for the investors' previous charges of malicious expansion points, the use of high leverage to attract transactions and liquidation of various means, and various means, it is really worrying.

This behavior not only violates the morality and legal norms of the financial market, but also further increases investment risks. Excessive leverage ratio may cause investors to suffer major setbacks under small loss, and may even face unbearable debt burdens.

There is indeed a certain risk of foreign exchange transactions using high leverage transactions. High leverage transactions means that investors only need to pay a small amount of margin to make large -scale transactions.

Although this provides investors with a small opportunity, it also enlarges potential risks!Intersection

3.zfx Shanhai Securities

Let ’s take a look at the customer's complaint. Some customers’ picked up platform shows that the deduction has been successfully transferred, but without receiving the money. The second gold was rejected by the platform, and the application account was closed again.There is still no money, and even lock the principal. He also asked to pay the insurance benefit. You ca n’t pay the money without paying the money.

It seems that this broker has been inducing customers to invest money, then rolled the money, and close the account!It's abominable!

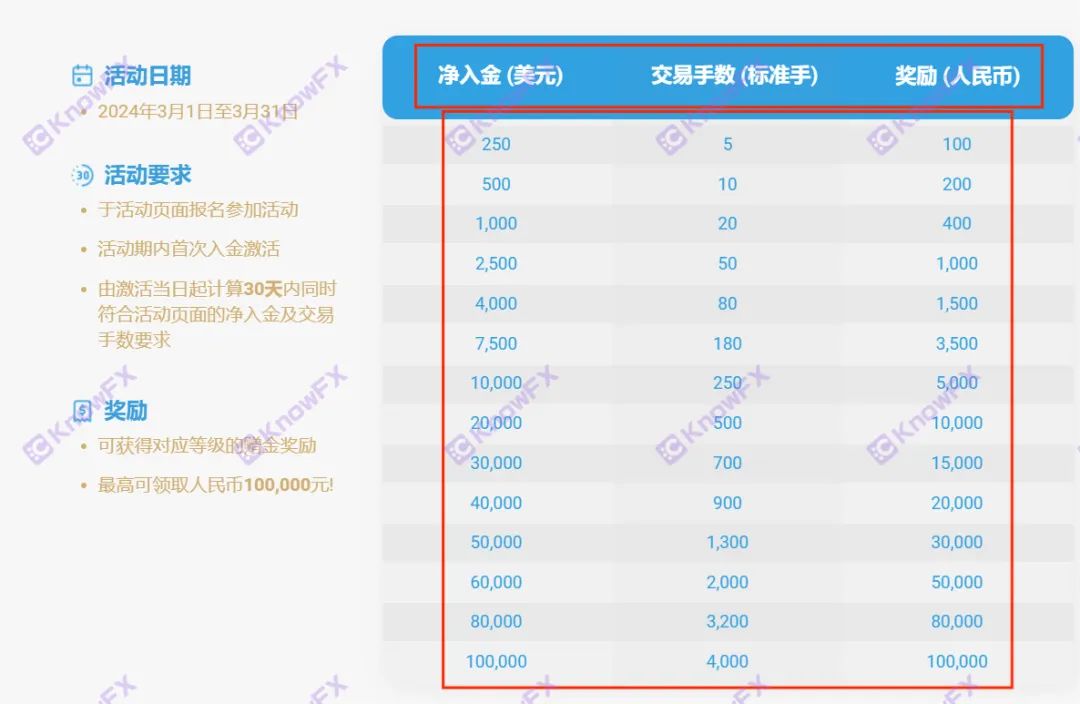

Knowing Brother discovered an event on the official website of ZFX Shanhai Securities, with a bonus of up to 100,000. Whoever watched this is not exciting, but there is no free lunch in the world.And the number of transactions is required, but the reward is RMB.This difference is too big. Not to mention whether you can get this reward. Assuming that you enter the gold 10,000 US dollars, you need 250 trading hands to get 5,000 yuan.Kim, don't say rewards, even the principal can't get back.

Many brokers use this method to attract customers' funds, so the eyes must be clearly seen, don't be confused!

As mentioned above, we can see that there are many platforms on the surface, but the traps behind them are heavy. It is still the problems we mentioned. Don't be greedy. It is attracted by the so -called high returns!

导言:在当今的投资领域里,我们时刻都需要保持警惕,因为投资市场的复杂...

海汇国际诈骗案深度解析:资金盘DRCFX复出传闻背后的真相导言:近年...

据“富途”官方消息:富途拟于2023年5月19日起在中国境内线上应用...

海汇国际资金盘风云再起?DRCFX即将复出,8亿惊天大案细节大揭秘!...

提问:Moomoo资金盘割韭菜:提现不到账,危机初现要懂汇温馨提示:...