Recently, it was reported that Mitrade, a dealer with a license holding a well -known regulatory agency license, was suspected of improper operation of Taiwanese users. This incident reminded us that investors cannot rely on regulatory licenses simply when making choices.

Although the regulatory license is regarded as a key reference factor when choosing foreign exchange, futures, and US stock agents, because it represents the constraint and review of the authoritative regulatory agency, this does not meanrisk.

Coincidentally, poisonous tonguejun also saw a lot of voices about Mitrade. Let's see what are the problems!

Judging from the customer's complaint, this broker has exaggerated differences and overnight fees. The slippery point is also very serious, and it will often be forced to close the position.

The difference between the point difference is the difference between the buying price and the selling price. The larger the point difference, the higher the transaction cost of investors to pay.Similarly, a high overnight fee will also make investors bear greater costs when holding overnight.

Slipping points can cause transaction prices to exceed the expected price, thereby increasing transaction costs.

When the market conditions are not conducive to investors, the trading platform forced to close the position without the consent of investors, which will cause investors to lose part or all principal.

These three points have a lot of adverse effects on investors' investment, and they will add many transaction costs.

Regarding Mitrade is a fintech company authorized by authoritative institutions, focusing on providing investors with a simple and convenient trading experience.The innovative Mitrade diversified trading platform has repeatedly won the best mobile trading platform and the most innovative brokerage firms.

Mitrade is supervised by the three regulators, namely:

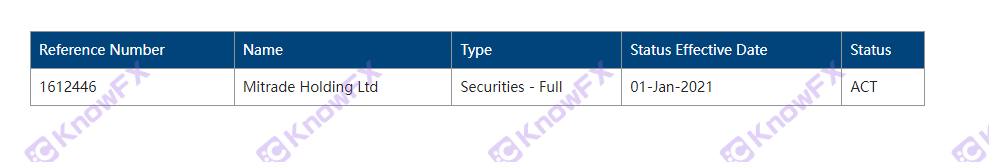

MitraDeholding was authorized and regulated by the CIMA Financial Administration (CIMA). The SIB license number was 1612446.

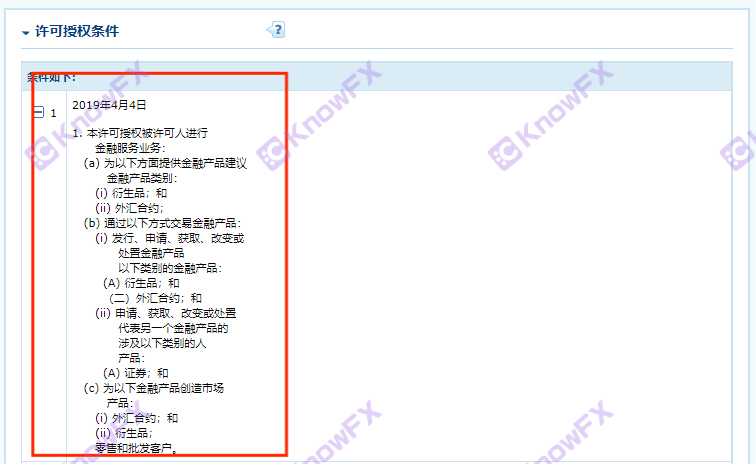

MitraDeglobal holds the Australian Certificate of Investment Council (AFSL398528) authorized by the Investment Council (ASIC).

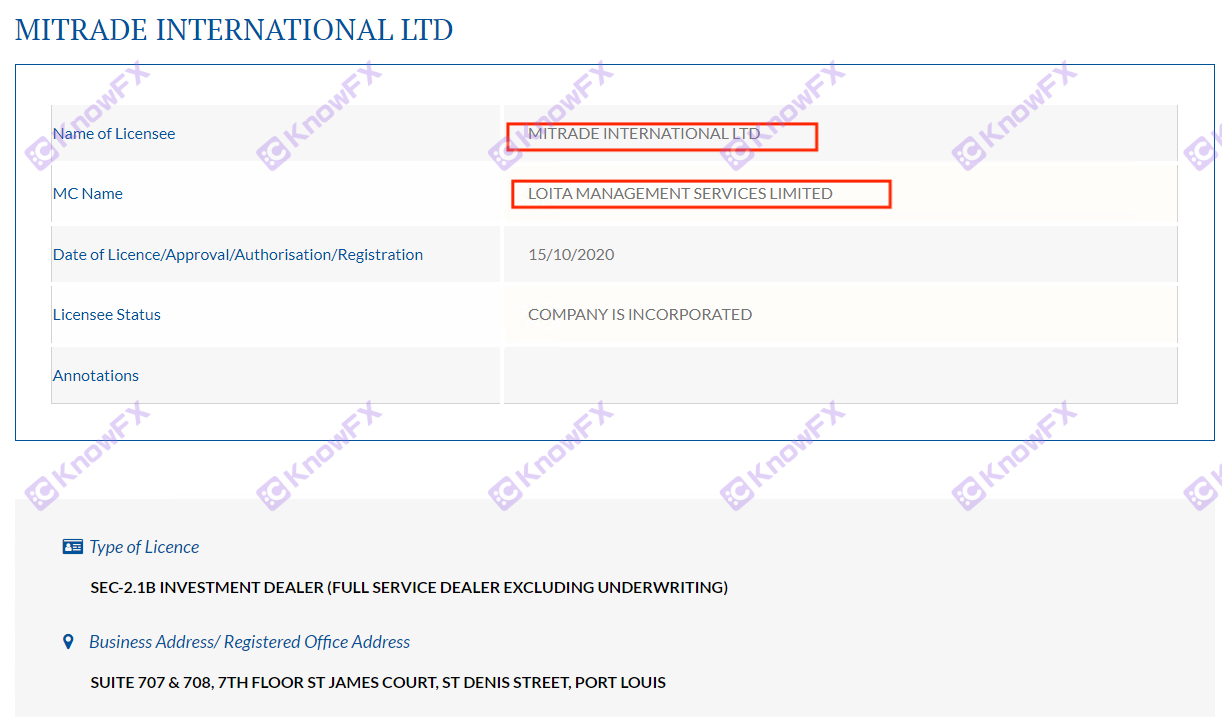

MitraDeinTERNATIONAL was authorized and regulated by the Mauritius Financial Services (FSC). The license number was GB20025791.

The Mitradeholding was indeed supervised on the official website of the Cayman Islands (Cima) official website, but the Cayman Islands license was mainly responsible for supervision banks, financial service companies, trust institutions, insurance companies, company services, investment funds, and securities services.However, this does not include direct supervision of foreign exchange margin transactions.

Therefore, brokers use the Cayman Islands license to promote their supervision. In fact, the license plate of the Cayman Islands does not regulate foreign exchange margin transactions. This behavior may constitute false publicity.The customer account will not be guaranteed under this company's account!

Poison Tongue found that MitraDeglobal was indeed supervised on the official website of ASIC and was able to provide financial services for retail customers.The Manchu Islands and other regulatory places are loose.

Mitrade was temporarily banned by the Australian Securities and Investment Council (ASIC) for violating the design and distribution obligations (DDO) last year.After rectification, ASIC canceled its temporary stop loss list.

However, it should be noted that although Mitrade rectified under Australia's regulatory framework and was recognized by ASIC, ASIC has stopped providing financial services to mainland Chinese customers in 2019.This means that even if Mitrade is regulated in Australia, this does not directly ensure that its business in mainland China is compliant and supervised.

The MitradeInternational was indeed supervised on the official website of Mitrius (FSC), but this license was authorized by LoitamanagementServiceSlimited.This means that MitradeInternationAllTD is not directly regulated by FSC, but is subject to the LOITAMANAGEMERVIRESLIMITED, so investors should be cautious, such licensed regulatory will not guarantee funds.

Mitrade did not use MT4/5 trading software, only self -developed trading software.Due to the lack of wide market verification and third -party supervision, there are potential security hazards and justice issues in self -developed trading software.

Recently, the number of client complaints on the Mitrade platform has increased, and problems such as poor points, serious slide points, and forced liquidation.It should be caused by modifying data in the background. Self -research trading software may become a tool used by some bad platforms. It can harm the interests of investors through back -end control and other means, and even harvest customer funds.

When choosing a trading platform, investors should carefully consider the risk of self -developed trading software.Although self -developed software may have some unique functions or advantages, its potential risks cannot be ignored.In order to ensure the security of funds, investors should choose a platform to be supervised by authoritative regulatory agencies, a platform with a transparent transaction execution process and a good market reputation for transactions.Detective 1: 3464399446

Detective 2: 3147677259

Detective 3: 2124228721

Detective 4: 2389671330

If you need to check the platform, disclose clues, and complain, please scan the code to add a detective QQ to disclose the news!

You need business cooperation, please scan the code and leave the aircraft number to cooperate!

Query platforms, complaints, more information, please download the Hui APP

导言:在当今的投资领域里,我们时刻都需要保持警惕,因为投资市场的复杂...

海汇国际诈骗案深度解析:资金盘DRCFX复出传闻背后的真相导言:近年...

据“富途”官方消息:富途拟于2023年5月19日起在中国境内线上应用...

海汇国际资金盘风云再起?DRCFX即将复出,8亿惊天大案细节大揭秘!...

提问:Moomoo资金盘割韭菜:提现不到账,危机初现要懂汇温馨提示:...