Everyone knows that there may be scams in places with funds. Some black platforms have no bottom line. Huiyou will feedback such a platform as a fraud platform.Below I understand Brother, I will summarize some of these platforms to help everyone to avoid lightning!

1. DBGMARKETS Shield Bo

DBGMARKETS (DBGMARKETSLIMITED) was established in 2007. It is the world's leading online trading broker. It is headquartered in London and Sydney, Australia. It also has offices in Asia Pacific, Europe, South America, Middle East, and North Africa.DBGMARKETS provides customers with a variety of trading markets, including foreign exchange, stock, difference contracts, commodities, indexes and futures.

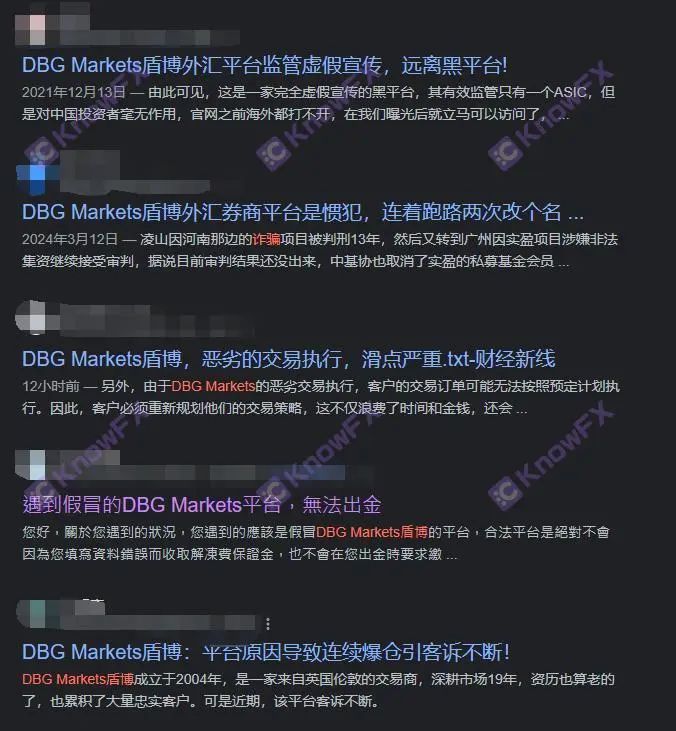

DBGMARKETS Shun Boming's scores on major platforms are high, but on the Internet, but on the Internet, it is very poor?

Because in 2021, it was found out that it was the Chinese platform as soon as it was launched. Some investors said that after investing in Ideal International and COZFX, which cooperated with the single community in TRADELINK, from October last year, 9 months, 30 30 months, 30 30 months, 30 months, 30 years, 30 months, 30 months, 30 months, 30 months, 30 months, 30, 30, 30The funds of 10,000 US dollars (about nearly 2 million yuan) have not been funded, and all the staff lost contact. The original class has founded the new platform DBGMARKETS shield.

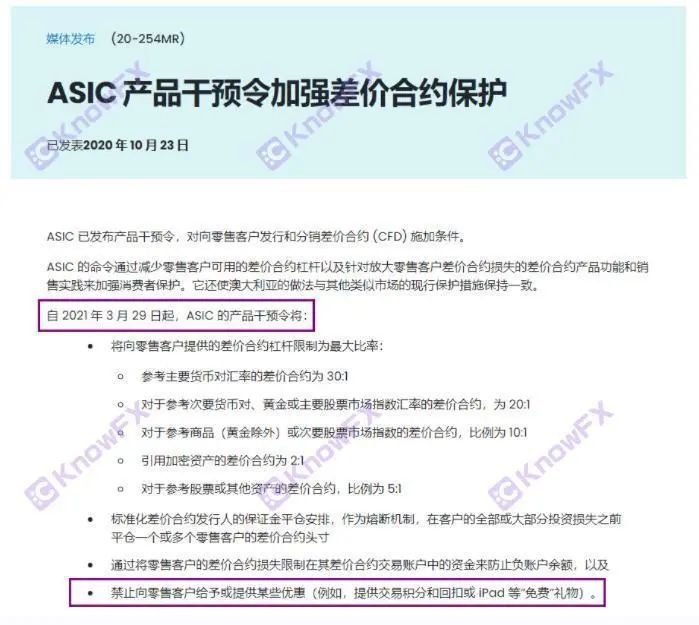

As soon as Brother opened the official website link, the first thing that popped up was the promotional activity, which included recharge, lottery, donation, and so on.Knowing that Brother has remembered the wrong DBGMARKETS Shun Bo, a broker headquartered in Sydney, Australia, holding the Australian ASIC license license. Australian ASIC has a strict control of brokers. It issued a product intervention order as early as 20 years.

Australia ASIC issued an announcement in 20 years: It is strictly forbidden to give or provide certain preferential activities to retail customers.For example, provide transaction points or "free" gifts.So why do DBGMARKETS Shunbo still choose to use gifts and discounts to attract retail when they know that they are prohibited?

The first possibility is that DBGMARKETS Shield ignores ASIC's supervision and is super limited.

Another possibility, DBGMARKETS Shun Bo classified investors and placed advertisements for gifted by investors who were not regulated by ASIC.

If it is the second type, it means that the website of DBGMarkets shields has a bad guidance to the Chinese people, and it also means that the official website has entered, and investors who have traded will not be supervised by Australia ASIC.

Regardless of whether it is, in view of DBGMARKETS Shunbo's own online prosecution, there is only a previous subject that has been returned to the backbone platform, and I know that my brother is advised to stay away!

FPG Caisheng International

FortunePrimeglobal is a subsidiary of the FPG Group. The headquarters is located in Melbourne, Australia's Financial Center. It claims to be an ECN broker who has expanded and provided first -class liquid visits to traders. Since 2011, it has been regulated by Australia Securities and Investment Council (ASIC).Have more than 12 years of experience.

But even the veteran brokerage with more than ten years of experience is a guest complaint!Intersection

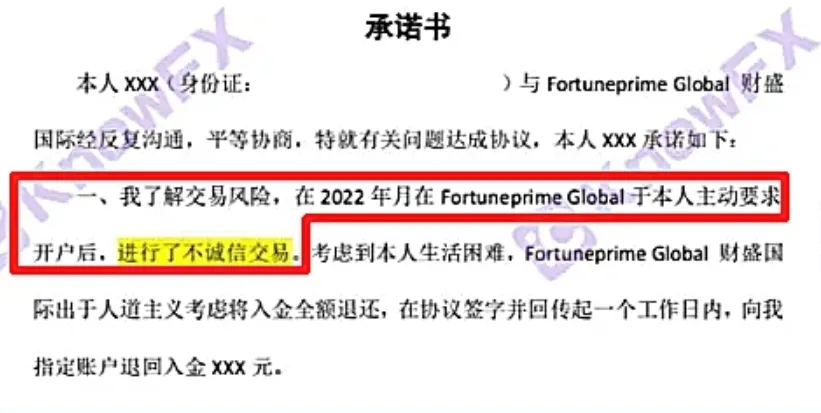

Summarizing the deeds of its platform is: FPG Caisheng International threatened users (threatened investors with principal), signed the overlord agreement, and the principal was issued with withdrawal!Intersection

The detailed promise content can go through the article before the truth brother ~

FPG Caisheng International can't afford to play!Eliminate customer profits, do not withdraw the lawsuit and give gold, and be extremely arrogant!Intersection

The Huiyou Baiyi, who had previously exposed the FPG platform, was puzzled. He claimed that he said: "The trading positions are more than half an hour.

After several complaints to the platform, the FPG finally agreed to pay, but there were two prerequisites: one was to cancel the content of the complaint first;After opening an account, a dishonent transaction is required. "

In the currency -against transactions, the commission and point of making compliance with the traders are righteous. Investors use funds to collect income, withdrawing their own profits and principal are also righteous. Any platform or broker should not stop or set up obstacles for no reason.

Quantlab

Quantlab claims that he was co -founded by the academic, technology companies, and hardware suppliers and mixed in the industry for more than 20 years. He regards himself as an innovator and is committed to seeking new breakthroughs and progress in the financial field.And independent as "proof and leader of scientific and technological forces in the financial market".

However, such one, known as focusing on quantitative investment, has many mainstream trading product asset management experience, and has rich market value management experience and listing incubation experience company's official website!

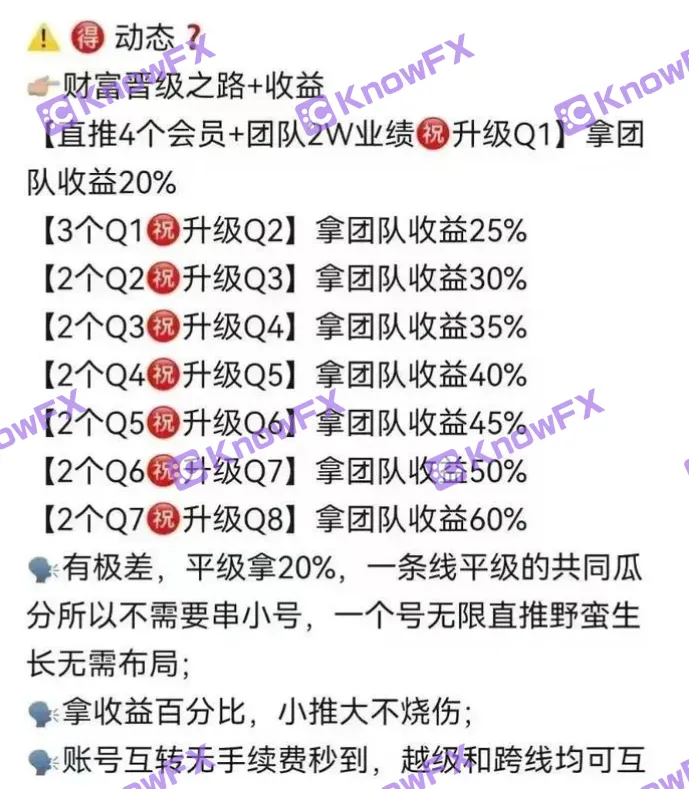

But extremely rude!The entire official website is empty self -introduction, and constantly emphasizes their so -called "professional" and "profitable" capabilities!However, it does not provide its own profit cases at all, and even has not even mentioned the platform and products provided by a financial trading company!Quantlab also made a set of so -called "step team income" saying that it is good to be a multi -level marketing (MLM) or team sales incentive structure.It is a kind of "Ponzi scam" in the field of sales and marketing in the field of sales and marketing!The biggest feature is that it is easy to get out of control, and the Quantlab model is obviously an unsustainable business model!

Quantlab claims to be a financial company on Wall Street. Presumably it must hold the US NFA license!But I can only think about it. Although it is recorded by the US NFA, it is not regulated at all!At this point, a little cognitive person knows that this is not clear about the quantitative slogan, is it the pledge fund disk? The essence is unchanged.

导言:在当今的投资领域里,我们时刻都需要保持警惕,因为投资市场的复杂...

海汇国际诈骗案深度解析:资金盘DRCFX复出传闻背后的真相导言:近年...

据“富途”官方消息:富途拟于2023年5月19日起在中国境内线上应用...

海汇国际资金盘风云再起?DRCFX即将复出,8亿惊天大案细节大揭秘!...

提问:Moomoo资金盘割韭菜:提现不到账,危机初现要懂汇温馨提示:...