Recently, Poison Tongue Jun found that Nagmarkets added a new customer complaint when he browsed to understand the remittance.This kind of not being reflected in this broker must have some problems. Poison Tongjun will take everyone to see.

Let's take a look at the official website of Nagmarkets that Nagmarkets is the world's leading differential contract broker, providing customers with diversified trading products such as foreign exchange, precious metals, energy and global indexes.The company's strong strength, adherence to customers -oriented, has enhanced our competitiveness in the industry and laid a solid foundation for our development.

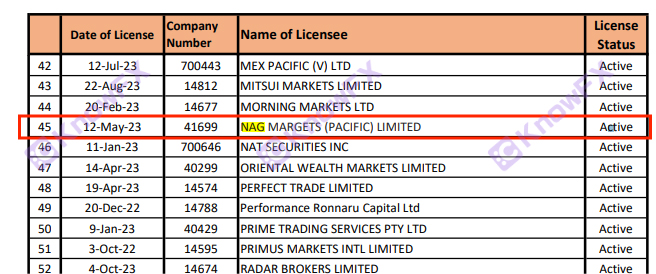

Nagmarkets has a regulatory license of two institutions, namely:

Nagmarkets (Pacific) Limited is regulated by Vanuatu (VFSC), company registration number: 41699.

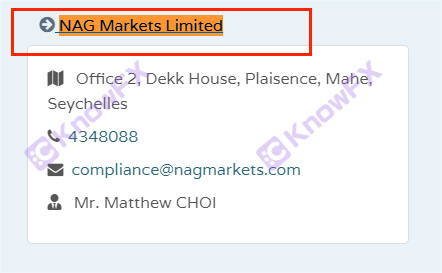

Nagmarketslimited is regulated by Seychelles (FSA), regulatory certificates: SD146.

Poison Tongue found that Nagmarkets (Pacific) Limited was indeed supervised, but there were several disadvantages of the Wanuatu regulatory license.

1. The supervision is weak, and the operating requirements of the licensed institution are relatively loose. It mainly depends on the assistance supervision of practicing lawyers, accountants and other institutions. Some criminals and institutions use supervision vulnerabilities to perform illegal operations to harm the interests of investors.

2. Since Vanuatu's financial regulatory agency does not require licensed companies to store customer funds on a separate bank account. Most of them will choose such licenses with customers who gambling foreign exchange dealers, and it is difficult for customers to be guaranteed.

3. The risk of illegal operations such as manipulating the market. Due to the poor supervision, there may be illegal operations such as manipulating markets and embezzling customer funds.

Therefore, investors need to consider cautiously when choosing a trading platform with Vanuatu's financial regulatory license.

Poison Tongue found on the official website of Seychelles (FSA) that NagmarketsLimited is indeed supervised, but Seychelles belongs to offshore supervision., But at the same time, there are some problems.

First of all, its regulatory agencies have relatively loose supervision of offshore companies, which may lead to illegal activities by criminals using these companies.Secondly, the information disclosure of offshore companies is low, and it is difficult for customers to understand the company's real situation and increase investment risks.In addition, due to the relatively small financial markets of Seychelles, the service quality of some offshore companies may be low, bringing inconvenience and losses to customers.The most important thing is that the credit status of offshore companies is more complicated, and customers may suffer credit risk.

Therefore, investors need to consider carefully when choosing an offshore company, and make decisions after understanding their advantages and disadvantages.

Poison Tongjun found that the actual address of Seychelles was SUITE2, Level3/64Talaverard, Macquarieparknsw2113, which is a place similar to a Park in Australia.Or the address that the brokerage deliberately stayed!Is it the back road to run in the future?

Poison Tongjun, a self -developed trading software, has said many times.

To sum up, the self -developed trading software lacks third -party supervision and review. The software cannot guarantee the fairness and fairness of the transaction. There may be problems such as data fraud and slippery points, resulting in loss of investors.

Secondly, due to the opaque transaction data and rules, it is difficult for investors to obtain accurate and comprehensive information, which is difficult to make correct investment decisions.

In addition, when using the software for transactions, investors need to deposit funds into the account of the platform, but the platform may have fund security issues, such as embezzlement of customer funds and false publicity, resulting in damage to investors' funds.

Finally, the software may not be able to provide timely and effective customer services. When investors encounter problems, they may not be resolved in time, which will affect investors' investment experience.

Detective 1: 3464399446

Detective 2: 3147677259

Detective 3: 2124228721

Detective 4: 2389671330

If you need to check the platform, disclose clues, and complain, please scan the code to add a detective QQ to disclose the news!

You need business cooperation, please scan the code and leave the aircraft number to cooperate!

Query platforms, complaints, more information, please download the Hui APP

导言:在当今的投资领域里,我们时刻都需要保持警惕,因为投资市场的复杂...

海汇国际诈骗案深度解析:资金盘DRCFX复出传闻背后的真相导言:近年...

据“富途”官方消息:富途拟于2023年5月19日起在中国境内线上应用...

海汇国际资金盘风云再起?DRCFX即将复出,8亿惊天大案细节大揭秘!...

提问:Moomoo资金盘割韭菜:提现不到账,危机初现要懂汇温馨提示:...