● JDR

JDR is an Australian broker who entered the country in 2021 and claimed to be a diversified international financial service group. The scope of corporate services includes (but not limited to) online security gold foreign exchange transactions and derivative transactions.

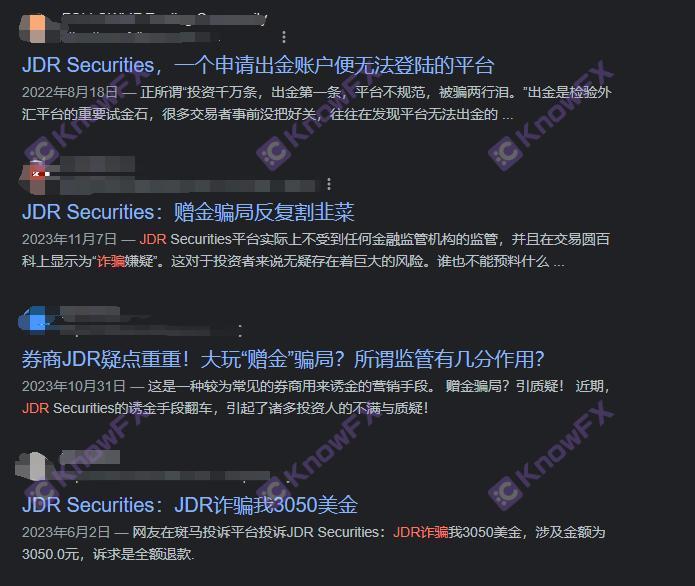

The platform once used "Gifts" to seduce investors into money. After the event, maliciously deducted the recovery of "Gift Gift" and the customer's funds were not allowed to be allowed. The bad behavior was continuously exposed by major platforms and the media.

So how do JDRs recently converge due to the exposure of a large number of guests, or have new trading strategies?

Official website: https://jdrsecurities.cn/

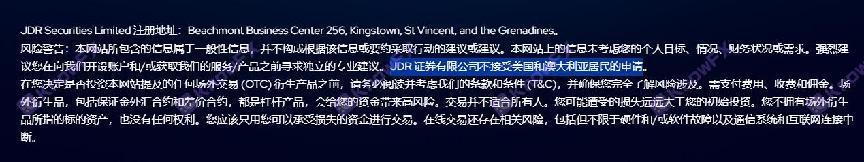

I know that Brother has logged in to the official website of JDR. The language bar has simplified Chinese options. Each navigation and pages have detailed simplified Chinese. At the same time, the webpage disclosure states that "JDR Securities Co., Ltd. does not accept applications from American and Australian residents."

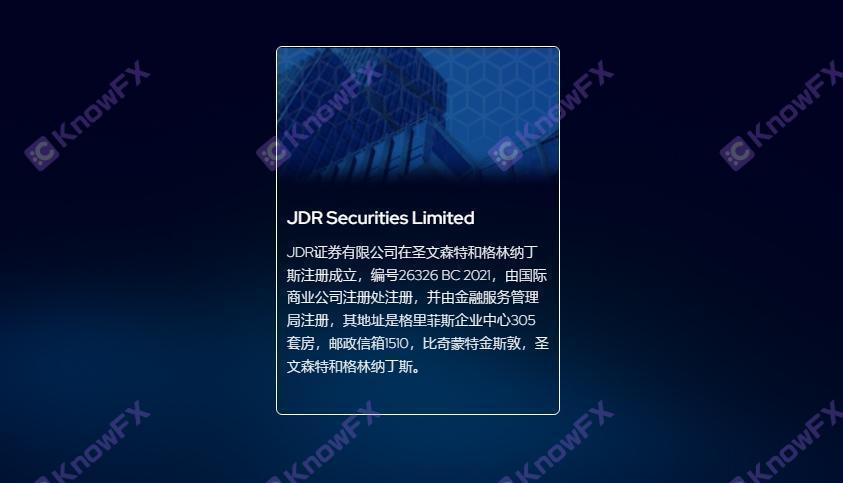

Knowing all the information displayed on the official website, JDR claims that there are two offices, which are located in St. Vincent and Australia. At the same time, the establishment of the company's [JDRSECURITIESLIED]. Although JDR claims to be regulated or displayedIt is also suspicious that the application of residents of the United States and Australia is also very suspicious.

Regulatory information

You can directly check the supervision of JDR at the app to understand the exchange. In addition, the two offline physical companies displayed on the official website on the official website are located in St. Vincent and Australia. Let's check whether these companies hold supervision issued by the regulatory agency.license.

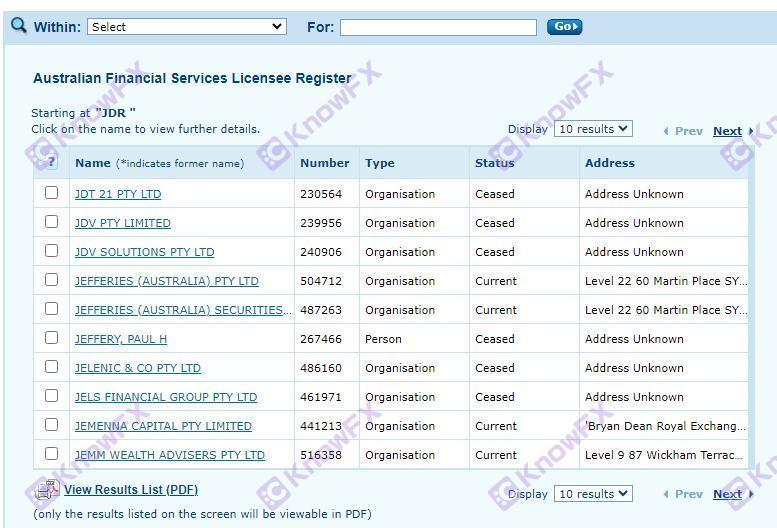

First of all, in the Australian ASIC official website inquiry, in its own AustralianFinanCialServicesLicEnsee (Australian Financial Services card holder) option, JDR's Australian licenses were not found.

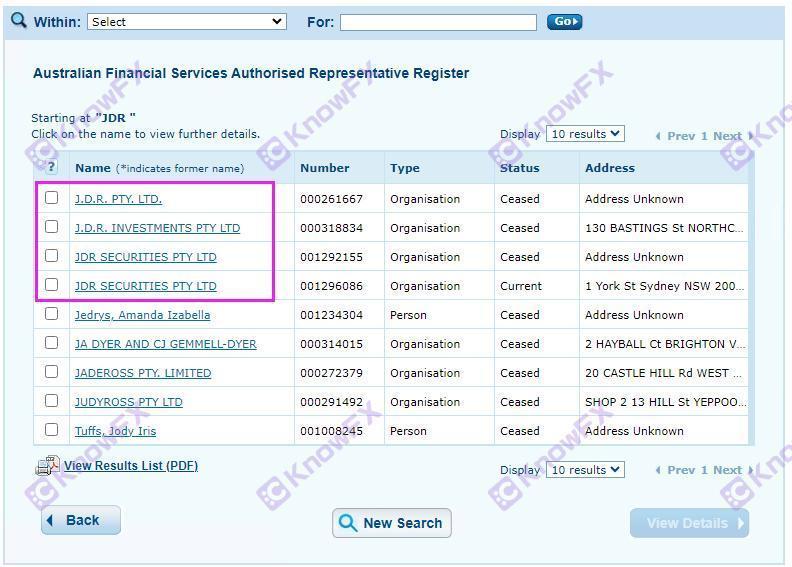

However, after understanding the "financial service authorization representative" (AR), I found that JDR holds multiple relevant licenses, and the licensed license with the regulatory certificate is: 001296086, the name of the licensed company is [JDRSECURITIESPTYLTD]]Essence

This license is an AR license for the Australian ASIC license that JDR claims to hold.The real licensed company of this license is [RoyalfinanCialtrandingptyltd], so Australia ASIC does not directly supervise JDR's Australian entities [JDRSECURITITIESPTYLTD].

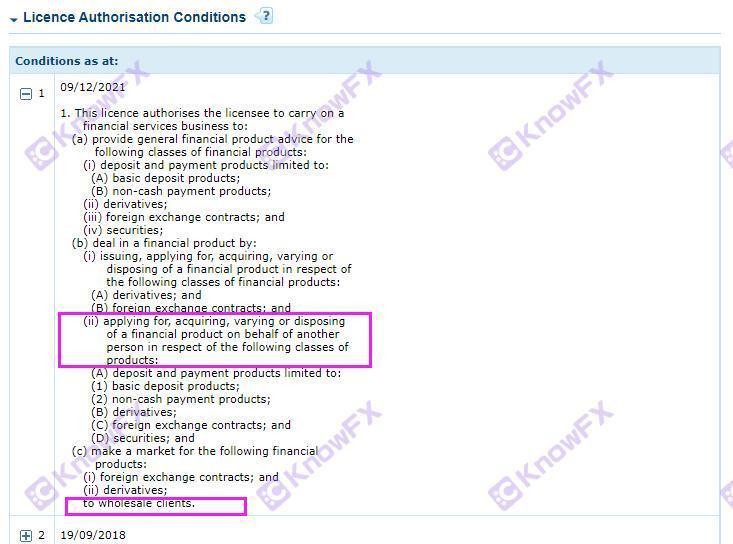

Moreover, this license only provides general financial product suggestions.Application, acquisition, change or disposal represent another financial product, and can only wholesale customers and cannot serve customers on ordinary retail.

To put it simply, this license is AR license, which is not regulated by regulatory agencies Australia ASIC, and does not have a comprehensive regulatory agency's authorization of foreign exchange transactions. It is invalid supervision.

On the official website JDR also showed the entity [JDRSECURITIESLIMITED] located in Saint Vincent. Unfortunately, it is unfortunately who knows that Brother has not checked the regulatory license of SVGFSA.

In addition, I know that Brother New Zealand also finds a company of the same name company [JDRSECURITIESLIMITED], but the official license plate of JDR New Zealand [JDRSECURITIESLITED] in New Zealand FMA officials.Therefore, this license cannot be used for transactions with investors, and it is cautious to operate!

Trading platform

At present, we have not checked JDR to hold effective supervision. You can see the mainstream platform of MT4 on the JDR trading platform. Do MT4 use entities holding effective supervision and investor transactions?

JDR registered and realized a real trading company on the MT4 platform. It is St. Vincent [JDRSECURITIESLIMITED]. We have queried above. JDR's St. Vinson [JDRSECURITITIESLIMITED] is unsuccessful.

The two servers of the two -unappeared accounts opened by MT4 are also in China. In addition, the official website also defaults to the transaction description of simplified Chinese. Are these two large pits without regulatory accounts preparing to let Chinese investors jump inside?

Summarize

There is no supervision of JDR's current accounts that have traded transactions, and there are suspicion of deceiving Chinese investors. The Australian ASIC (AR) license displayed by the display not only does not have a complete foreign exchange transaction authority, but cannot play a role in regulatory transactions.There is no supervision of physical companies!The mainstream MT4 platform uses a non -regulatory account transaction, and the risk is extremely high. Knowing that Brother recommends staying away!

The above content is a transaction environment that understands the brother -in -law based on paper information. In order to avoid illegal traders' use of self -developed trading platforms, the trading environment caused absolute control.The verification content is only for reference for Hui Friends. Please check carefully before the transaction!

Detective (1): 3464399446

Detective (2): 3147677259

Detective (3): 2124228721

Detective (4): 2389671330

If you need to check the platform and disclose clues, please scan the code to add a detective QQ to disclose the news!

You need business cooperation, please scan the code and leave the aircraft number to cooperate!

Inquiry platforms, complaints, more information, please understand the Hui app.

导言:在当今的投资领域里,我们时刻都需要保持警惕,因为投资市场的复杂...

海汇国际诈骗案深度解析:资金盘DRCFX复出传闻背后的真相导言:近年...

据“富途”官方消息:富途拟于2023年5月19日起在中国境内线上应用...

海汇国际资金盘风云再起?DRCFX即将复出,8亿惊天大案细节大揭秘!...

提问:Moomoo资金盘割韭菜:提现不到账,危机初现要懂汇温馨提示:...