Our protagonist BCR Baihui has always claimed to have these 15 years of richness and reputation in the field of online foreign exchange and difference in CFD trading services.However, there have been complaints that it is a black platform, and as long as the user account is profitable, it is banned.

So the detective paid a lot of attention to it!Recently, the Detective received a new and extremely special prosecution, and the complainant was the former agent of BCR Baihui.You did not hear the right proxy to take the lead in launching a strong complaint on BCR Baihui!

It is necessary to know that the relationship between agents and economists is a mutually beneficial and win -win cooperative relationship.Economists can obtain more business opportunities and customer resources through agents, while agents can gain benefits and improve their business level through cooperation with economic vendors.

But the agent was blocked by BCR Baihui account and was limited to gold!IntersectionThis kind of plot is really rare!

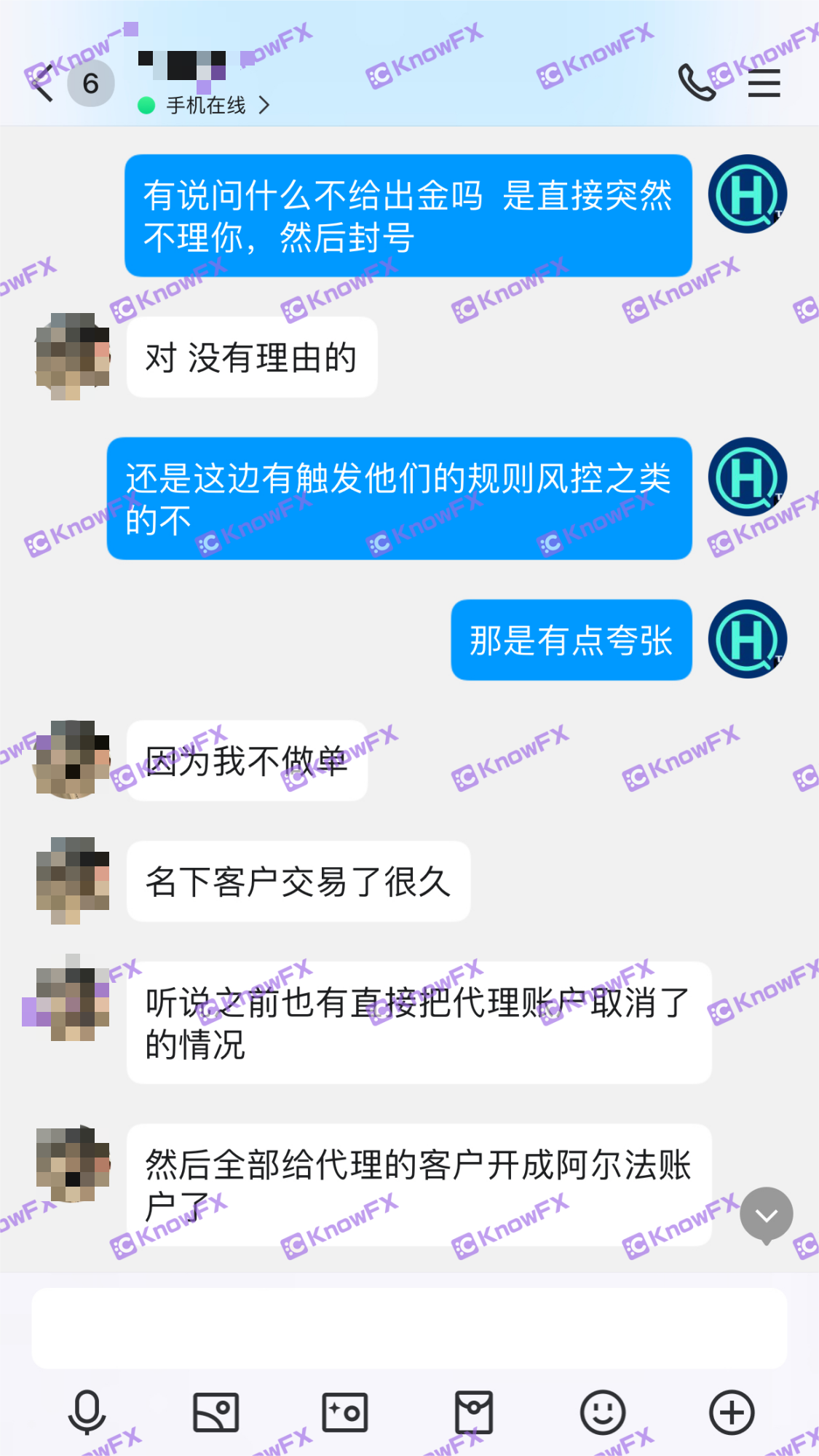

According to the information provided by the agent, it can be seen that its account account has always been normal.Until October last year, it was suddenly unable to log in, and according to the screenshot information, the agent still had at least 4,500 US dollars was swallowed by the platform, equivalent to nearly 3W of RMB.

At the same time, the agent stated that he later discovered that the original proxy ledger was canceled, and under the original account name

The customer's account has become an "Alpha" account! This is obvious. BCR Baihui plays the drama of "killing chickens and getting eggs, royal killing donkeys"!

And, according to the detective, this is not an example!This can not help let the detectives weigh the methods and reputation of BCR Baihui. After all, it is rare to have a bottomless line for the benefit of the agent!This is also the first time that the detective reminds that the "agent" agents are risky, and they should stay away from

BCR Baihui platform!

In addition, investors who suddenly leave the "agent" are particularly reminded!

You originally signed by agents and platforms such as the agreement and other related provisions of the agency and the platform are very likely to fail!This is a very serious legal risk. Detective reminding the platform to contact the platform to request re -signing related contracts and agreements!And pay special attention to the channels for in -deposit funds to avoid the risk of capital transfer!

In addition, BCR Baihui itself has regulatory risks!It claims to hold a financial service license in multiple jurisdictions and can ensure the interests of our customers and the security of funds.

But when the detective retrieval information is found!BCR Baihui does not seem to be propagated as a number of supervisors. In fact, only Australia ASIC and the Virgin Islands FSC license is actually recorded.

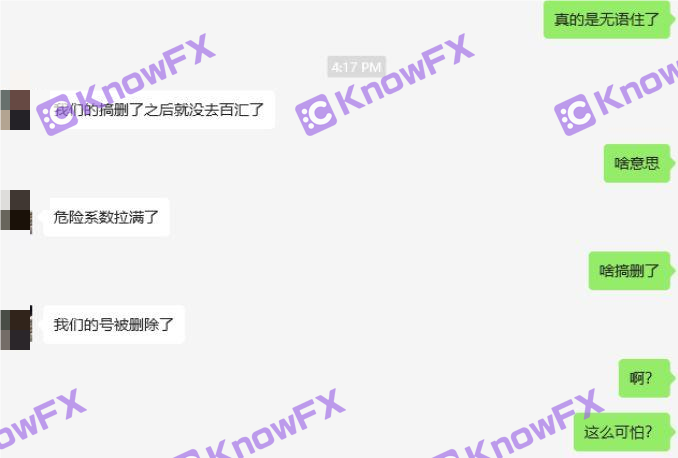

What makes the detective more strange is that the information about its official website can find the information about supervision. Only in the "jurisdiction exemption" clause!But in terms of the terms, it only emphasizes the relevant information of the Virjing Islands FSC!

You must know that when BCR Baihui publicized, it is clearly always used Australian ASIC licenses as gimmicks.

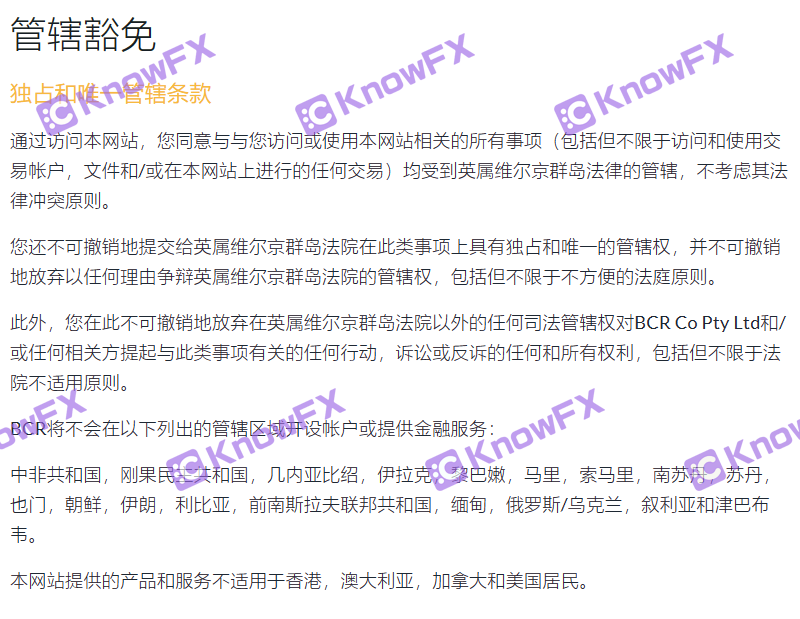

This makes the detective highly vigilant!After all, this year's first cards are fake, false publicity, etc. It is nothing new.So the detective locks the BACERACOPTYLTD, the so -called Australian company!

Surprisingly, the company's entity BaceracopTyltd is indeed regulated by Australia ASIC and has been granted more comprehensive operating permissions.But there is a strange phenomenon that makes the detective cause great doubt.

Note that this "frequent modification" is for many years in a row, changes in personnel, equity, and address of the emergence of one 4 or 5 times a year!This is an extremely rare thing. Detective suspects that this is a means of avoiding the "dividend" through personnel flowing through the personnel flow!

What is more interesting is that its official website states that they support MT4 and MT5 platforms for transactions at the same time, and only provide MT4 channels on the other!IntersectionHowever, the MT4 platform only registered and traded through BCRCOPTYLTD.

The British Virgin Islands FSC is an island financial institution for offshore supervision.There has always been the possibility of risk management and control challenges and regulatory loopholes. At present, it is necessary to continuously improve the regulatory system and strengthen compliance measures to ensure the stable and transparent development of the financial system.

Therefore, even if BCR Baihui holds the British Virgin Islands FSC license, the detective still believes that there is a greater risk at the transaction supervision level!

In short, although BCR Baihui claims to have 15 years of experience, there is a complaint that has a complaint suspected of banning accounts, restricting gold, and transferring agent accounts.Its propaganda supervision information does not match the actual situation. It only holds Australian ASIC and the Virgin Islands FSC license, and the company frequently modify the information and equity structure.Investors and agents should carefully choose the trading platform, re -examine the agreement, pay attention to the security and risks of funds to reduce investment risks.

I would like to remind investors that investors need to be cautious, please brighten your eyes!Intersection

You need business cooperation, please scan the code and leave the aircraft number to cooperate ~

Query platforms, complaints, more information, please understand the Hui app ~

If you need to check the platform, disclose clues, and complain, please scan the code to add the truth QQ to disclose the news !!

Welcome everyone to contact us ~

Detective 1 3464399446 Detective 23147677259

导言:在当今的投资领域里,我们时刻都需要保持警惕,因为投资市场的复杂...

海汇国际诈骗案深度解析:资金盘DRCFX复出传闻背后的真相导言:近年...

据“富途”官方消息:富途拟于2023年5月19日起在中国境内线上应用...

海汇国际资金盘风云再起?DRCFX即将复出,8亿惊天大案细节大揭秘!...

提问:Moomoo资金盘割韭菜:提现不到账,危机初现要懂汇温馨提示:...