Queensland Bank Co., Ltd. (now BOQ) was founded in 1874. It was the first permanent building mutual assistance meeting in Queensland. Brisbane Permanent Welfare Building and Investment Mutual Assistance Association.Today, it has enjoys a prevalence of reputation across the country.

Its milestone included a trade banking license in 1942, renamed Queensland Bank Co., Ltd. in 1970, and listed on the Australian Stock Exchange in 1971.It is one of the top 100 Australian companies in the Australian Stock Exchange, and is regulated by the Australian Career Supervision Agency as authorized deposit institutions.

In its long history, BOQ has successfully spent the economic adversity, including the Australian banking crisis that many banks closed in 1893, survived in the crisis of the Australian banking industry, remained profitable during two World War and successfully spent the depression of 1931And the global financial crisis.

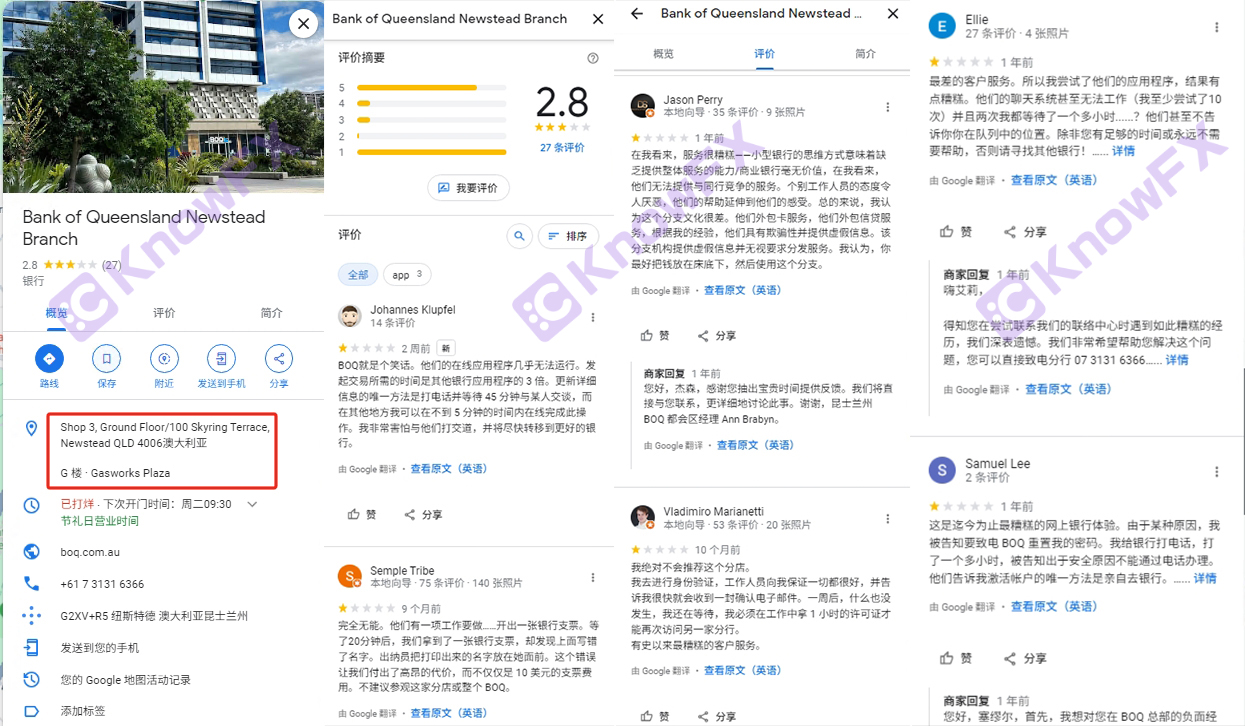

Even though BOQ has such a deep background history, the reputation is good or bad. It used to be before, now it is now.

Recently, the truth brother noticed that on the supervision of the exchange dealer's supervision and query app, BOQ has added more voices, so the truth brother picked one of the guests to start a complaint ~

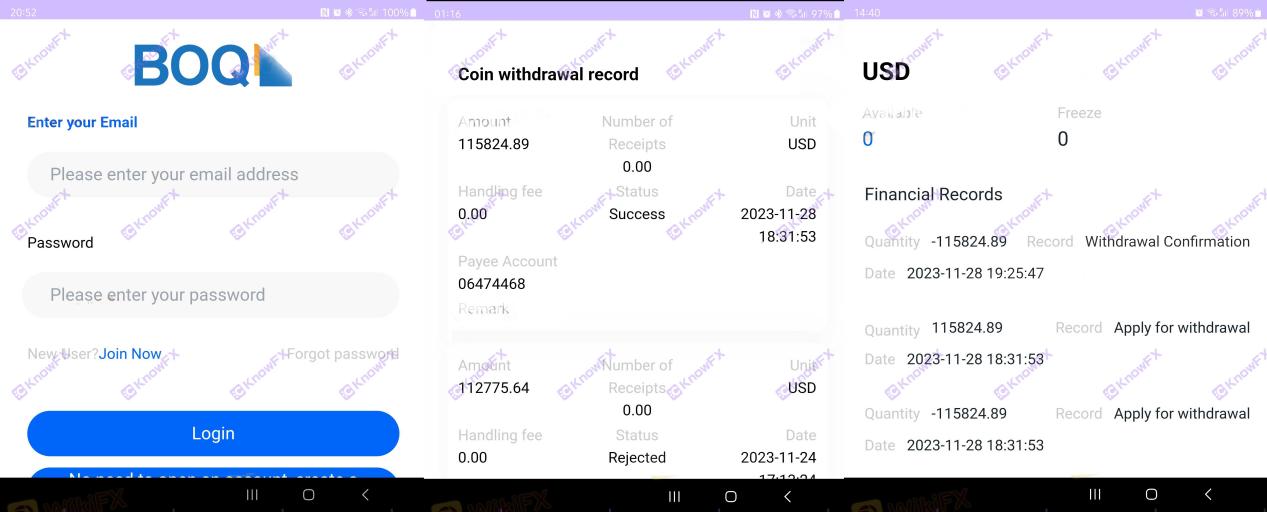

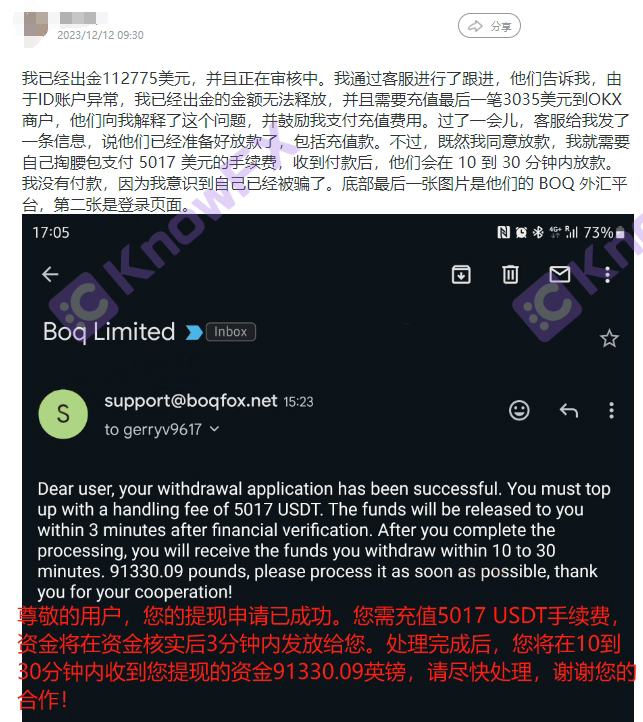

▶ The amount of the gold cannot be released, and the last 3035 US dollars to the OKX merchant need to be recharged

According to investor feedback, "I have already contributed $ 112,775, and they are under review. Later, I received a customer service notification that their ID account was abnormal, which caused the unable to issue gold. LaterOKX merchants and encourage me to pay the recharge fee. "

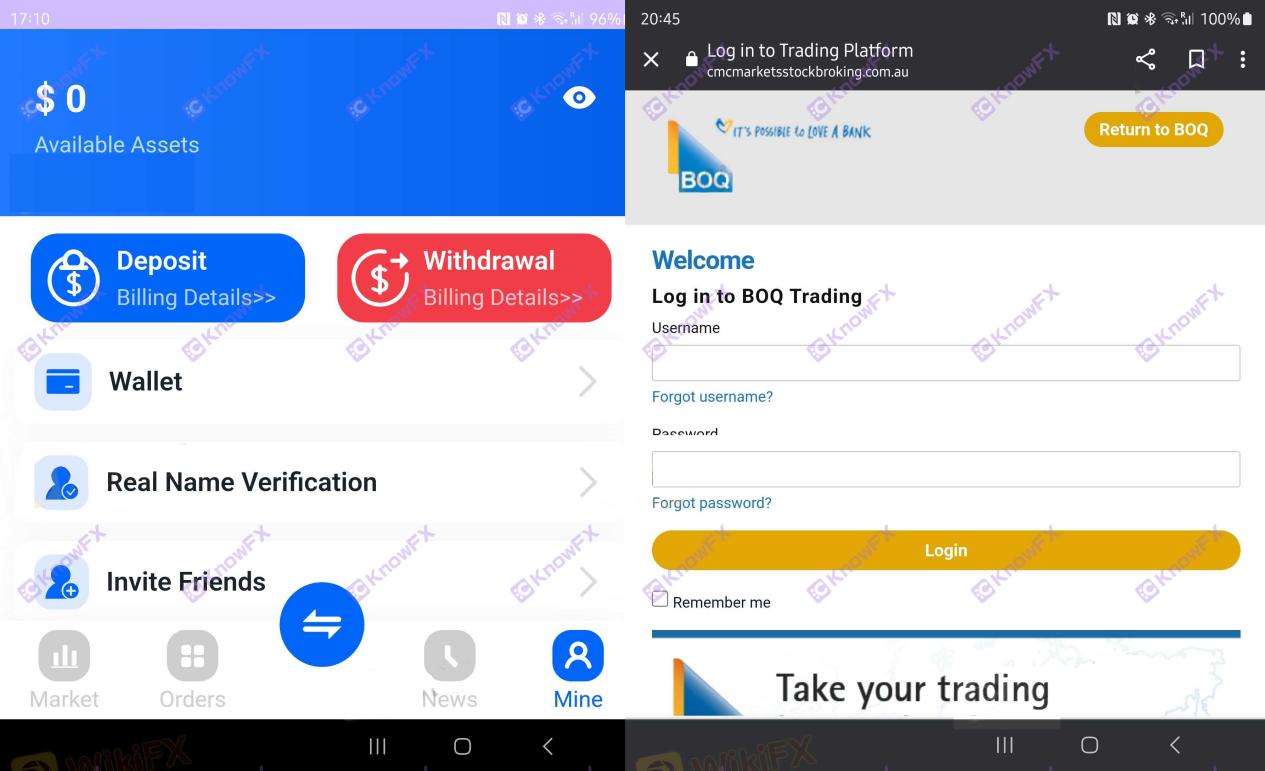

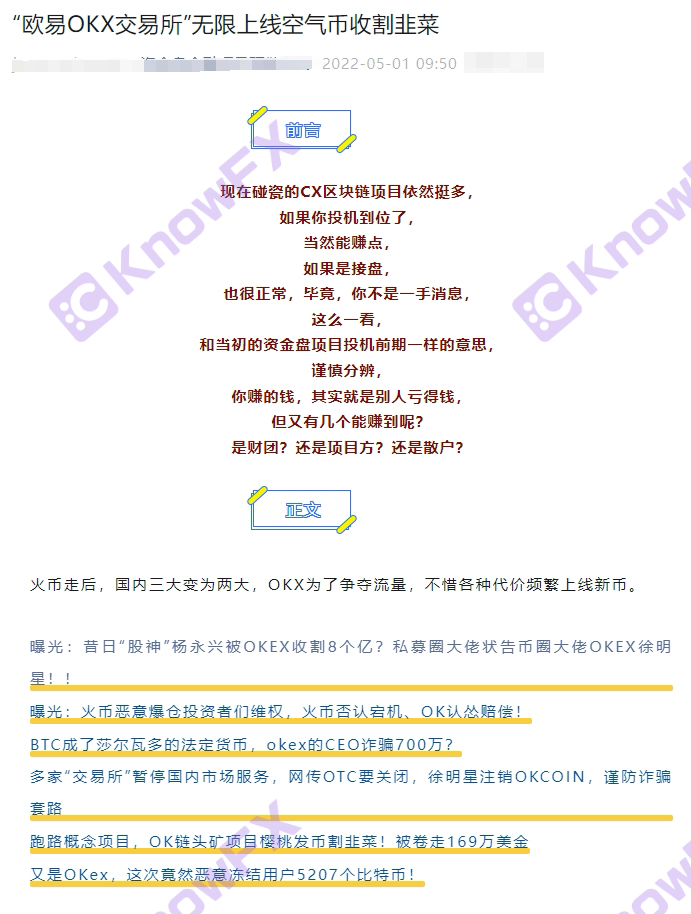

When it comes to OKX merchants, some Hui friends may be in a circle. OKX (once used OKEX) is one of the digital asset trading platforms. It mainly provides global users with currency and derivatives of digital assets such as Bitcoin, Litecoin, Ethereum and other digital assets.Product transaction services are widely recognized as one of the best exchanges in mainland China.

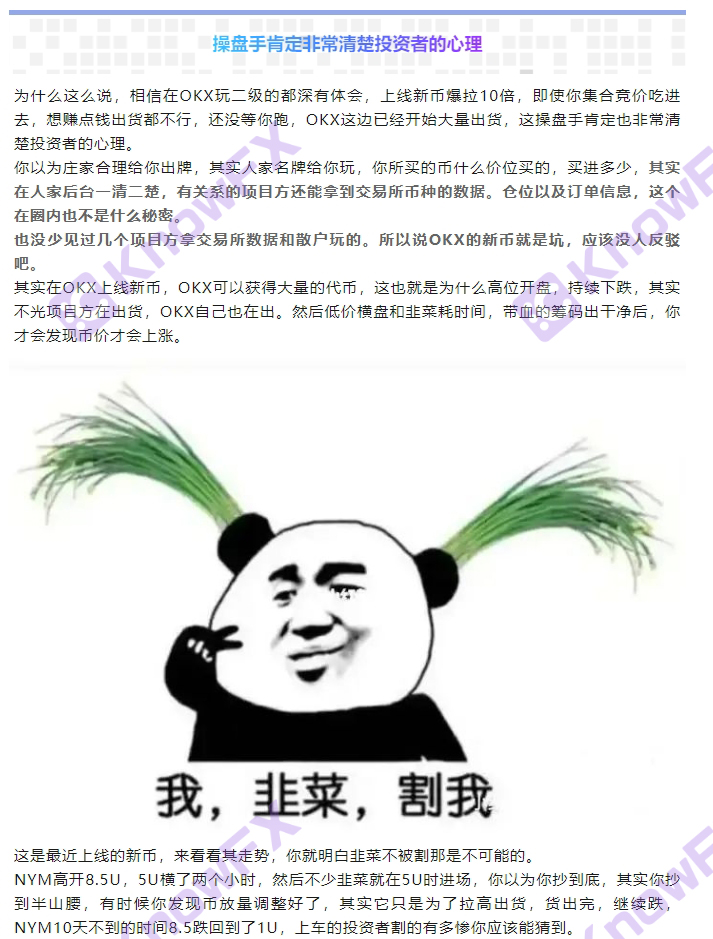

Although it is said that OKX is still the most convenient exchange in mainland China, in recent years, OKX has also frequently exposed melon, and it can't be eaten at all.You can glance at the above graphics ~

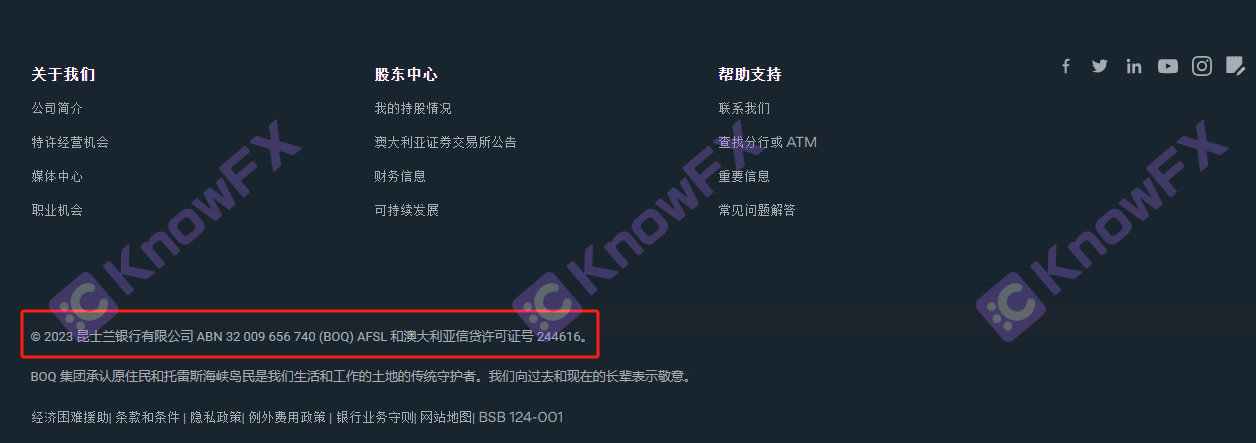

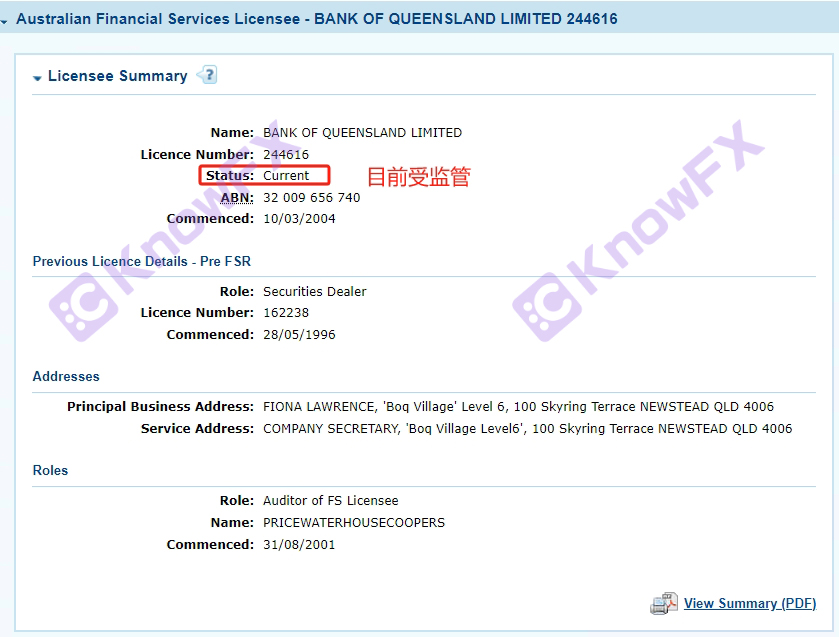

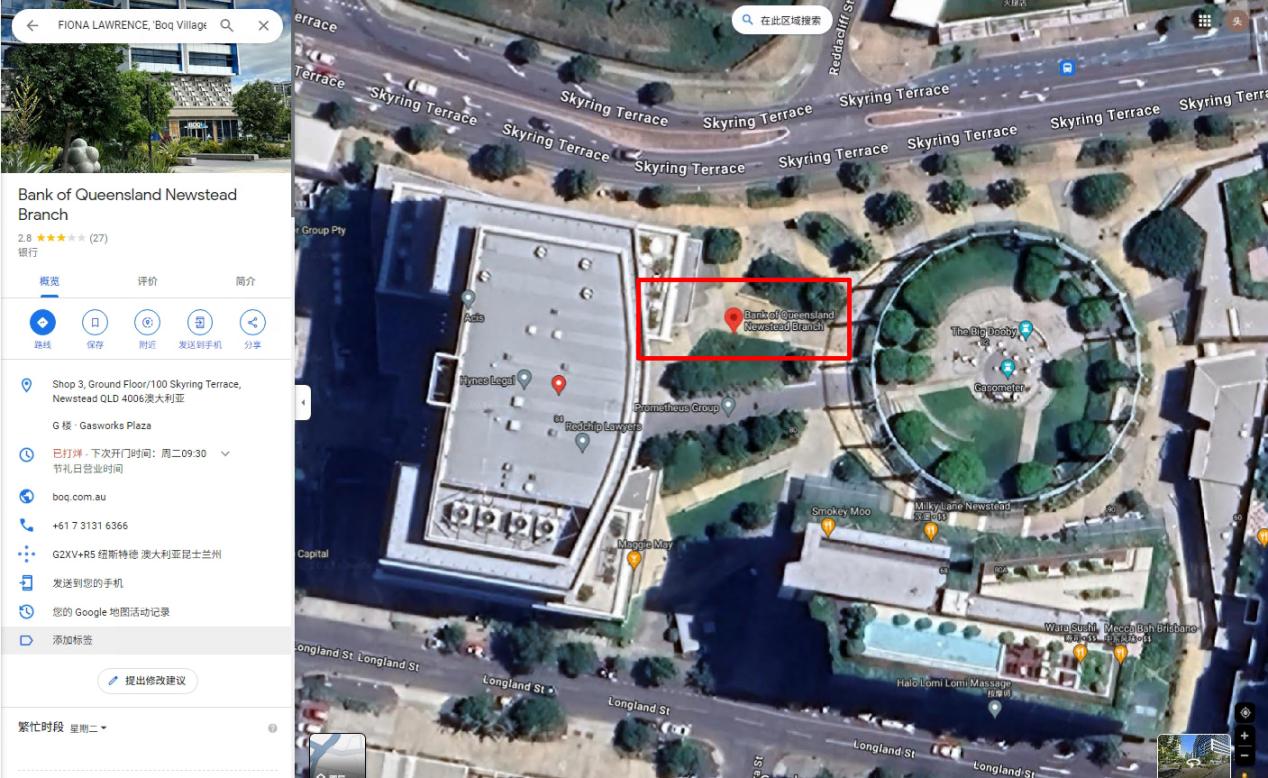

Return to the topic, let's take a look at BOQ's supervision information. Queensland Bank Co., Ltd. ABN32009656740 (BOQ) AFSL and Australian Credit License No. 244616.

Through the information found by the Australian Securities and Investment Council (ASIC) official website, the licenses held by BOQ are the main licenses of Australia (ASIC), and their licensed company name is BankofqueenslandLimited.

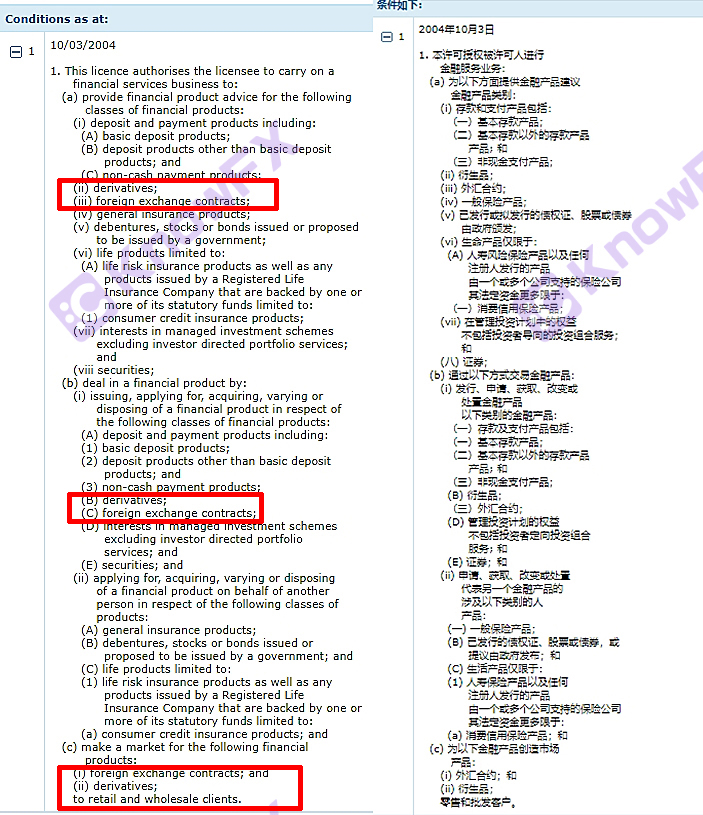

BankofquenslandLimited is currently regulated by Australia (ASIC), and the regulatory business scope includes PROVIDEFINANCIALPRODADVICE (financial product recommendations) and DEALINAFINCIALPRODUCTS (financial product transaction). Contains RetailClients.

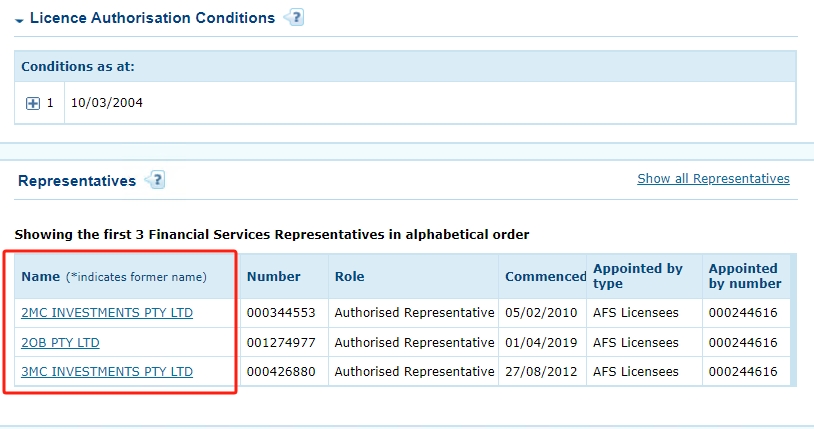

But from the list of personal and companies that have provided financial services on behalf of Australian financial services cardholders, we can see the Bank of Full of AR licenses to multiple companies. Is this based on selling AR licenses?Intersection

Even if BOQ has supervision, it is invalid for domestic customers. As early as a few years, Australia announced that it would not accept domestic customers, so many Australian platforms have withdrawn from China.

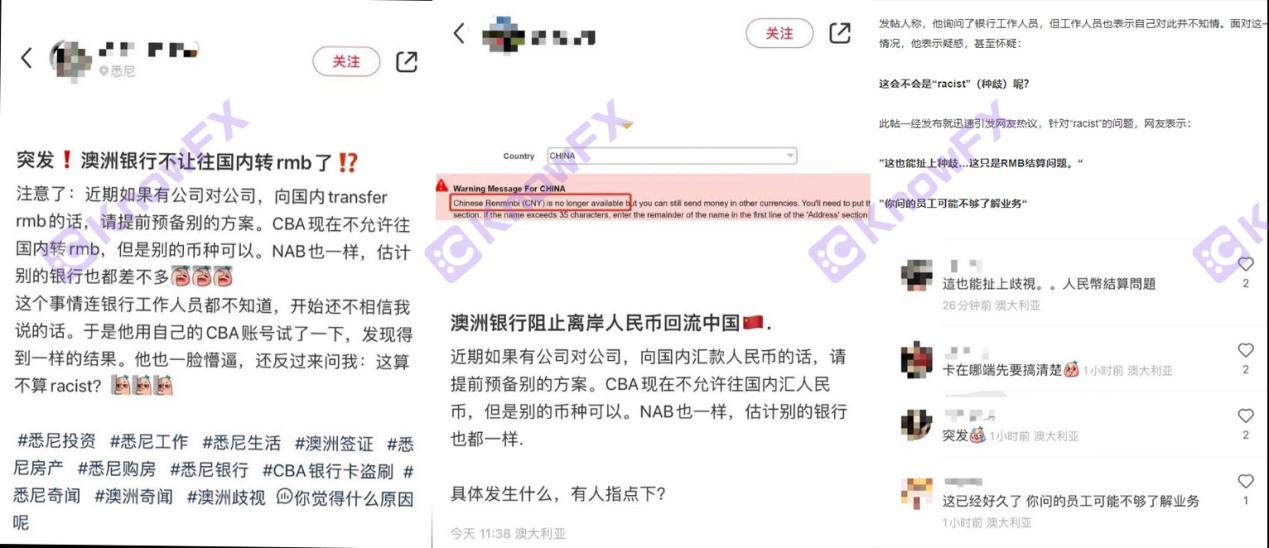

Coupled with recently, "Australia suddenly banned money to China! A large number of Chinese and international students were affected, and the four major banks also had a limit order ... even more strict!"Intersection

Will BOQ be the same in the future?IntersectionEveryone must consider this ~

▶ Last summary

For Chinese customers Australia (ASIC) supervision may become history, can it be suddenly safeguarded by strong supervision Australian licenses to weak regulatory island national licenses?Intersection

The Chinese regulatory authorities have issued a notice to the Australian Securities and Investment Commission (ASIC) demanding that ASIC prohibit licensed brokers from providing transaction services to the Chinese people because the act is suspected of violating Chinese laws and regulations.In the final analysis, policy supervision factors have caused them to leave the Chinese market.So the truth brother remind everyone in the future to consider the Australian securities firms in the future ~

I would like to remind investors that investors need to be cautious, please brighten your eyes!Intersection

You need business cooperation,

Please scan the code and leave the aircraft number to cooperate ~

Query platform, complaint, more information

Please download the app to understand the app ~

If you need to check the platform, disclose clues, complaints,

Please scan the code to add a detective QQ to make the news !!

Welcome everyone to contact us ~

Detective: 3464399446 Truth: 31476777259

Poisonous tongue: 2389671330 Knowing Brother: 2124228721

导言:在当今的投资领域里,我们时刻都需要保持警惕,因为投资市场的复杂...

海汇国际诈骗案深度解析:资金盘DRCFX复出传闻背后的真相导言:近年...

据“富途”官方消息:富途拟于2023年5月19日起在中国境内线上应用...

海汇国际资金盘风云再起?DRCFX即将复出,8亿惊天大案细节大揭秘!...

提问:Moomoo资金盘割韭菜:提现不到账,危机初现要懂汇温馨提示:...