The situation and policies of various countries are constantly changing, and the situation of the exchange circle is also changing. Investors need to pay more attention to avoid the loss caused by changes to themselves.

Many Hui friends do not know that in 2019, Australia ASIC requires that its regulatory brokers cannot provide services to mainland investors, otherwise they will be punished.For publicity, you can directly determine that it is false propaganda and fraudulent friends!Intersection

1. Mitrade

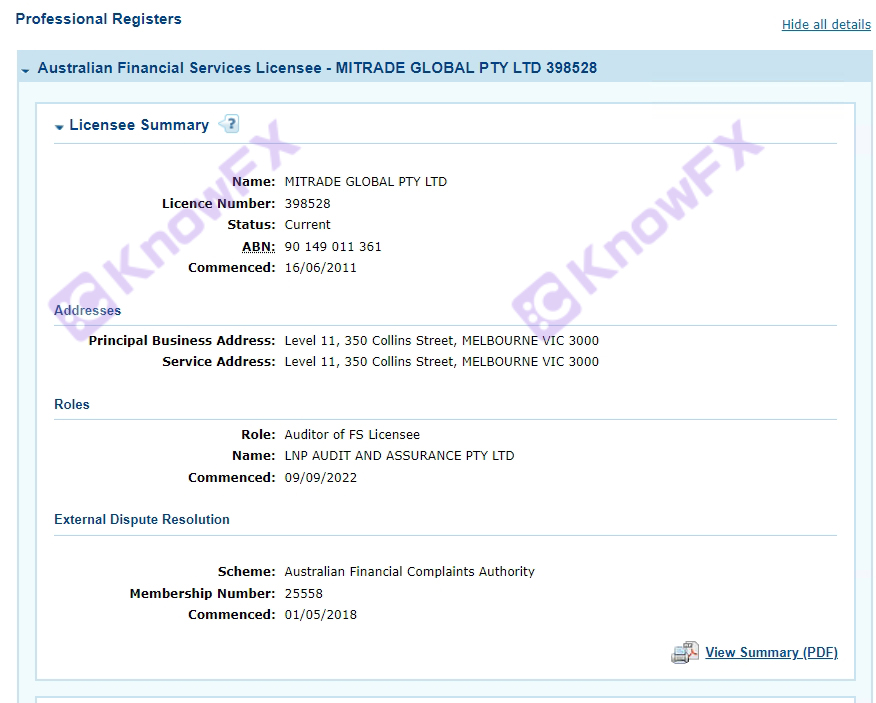

After investigation, the company named Mitradeglobalptyltd is currently regulated on the official website of Australia (ASIC), and its company can also provide retail customers with financial products and services.

In June of this year, news reports that Mitrade issued a temporary ban on it for violation of design and distribution obligations (DDO), Australian Securities and Investment Council (ASIC).

However, after Mitrade rectified in July, ASIC has revoked the temporary stop loss order for the difference between a contract broker Mitrade.

The most important point is that ASIC no longer regulates investors in mainland China.

2.otfx

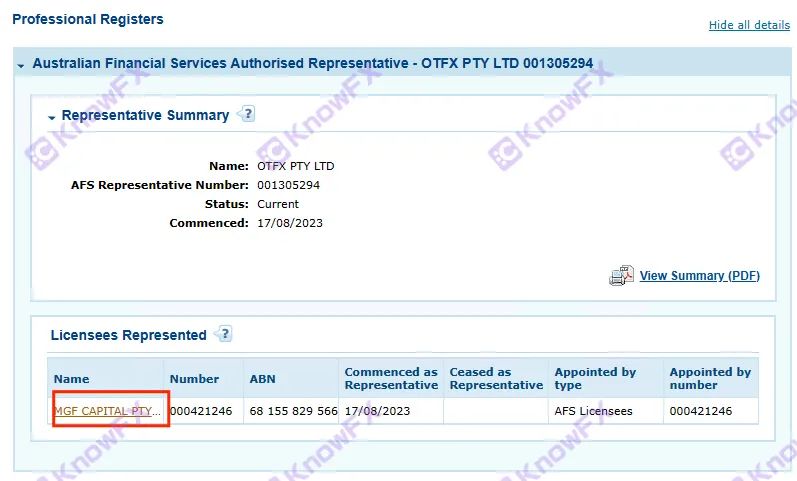

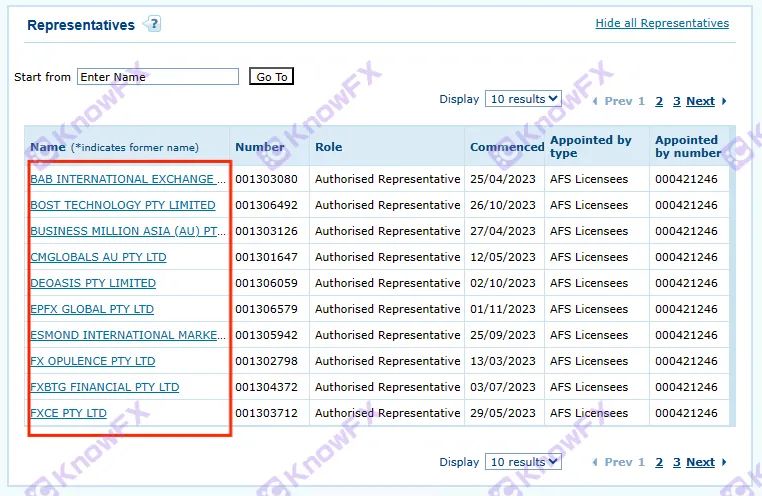

The OTFXPTYLTD found that OTFXPTYLTD is found to be AR -licensed by Australia. ASIC's AR licenses refer to companies or individuals authorized by ASIC regulatory companies (here we call the main body of the commission), so OTFXPTYLTD is notDirectly being supervised by ASIC.

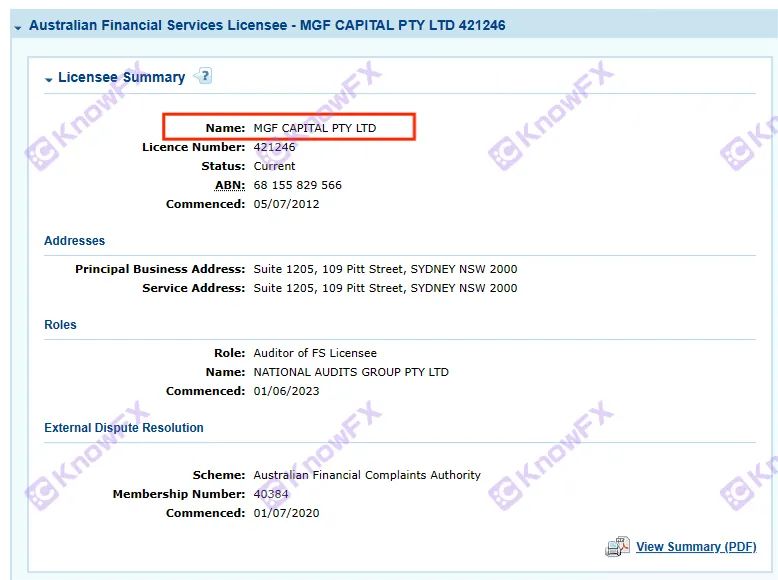

The company authorized by OTFXPTYLTD from the figure is MGFCAPITALPTYLTD, the authorization time is August 17 this year.

At the same time, MGFCAPITALPTYLTD, the main business of the company, is specially issued to securities firms to authorize AR licenses. At present, there are already more than two or 30 companies issued. Among them, there are inevitably some fraud companies. ThereforeIt belongs to the same conspiracy.

For 10,000 steps, even if it is not an AR license, now ASIC has no effect on supervising the Chinese people!Intersection

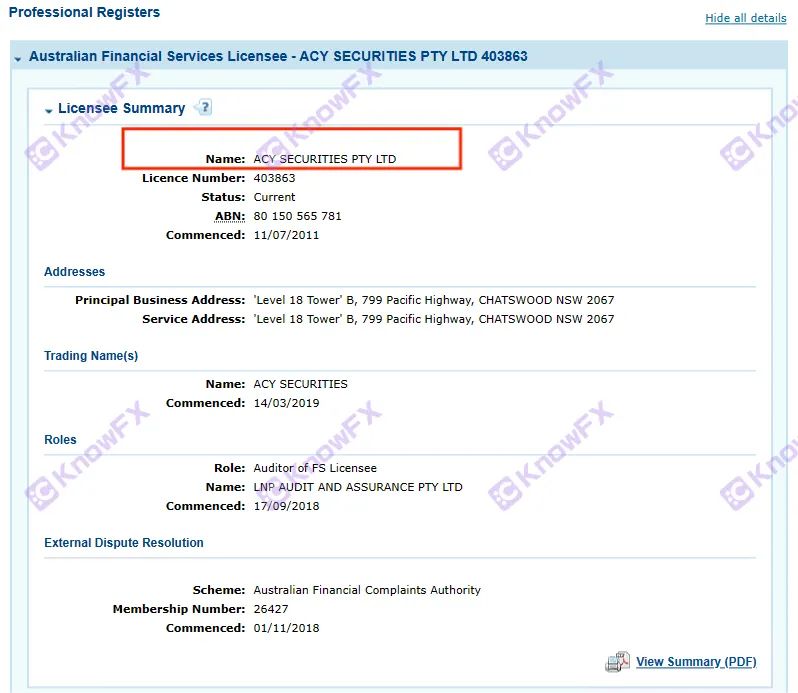

3.Acy

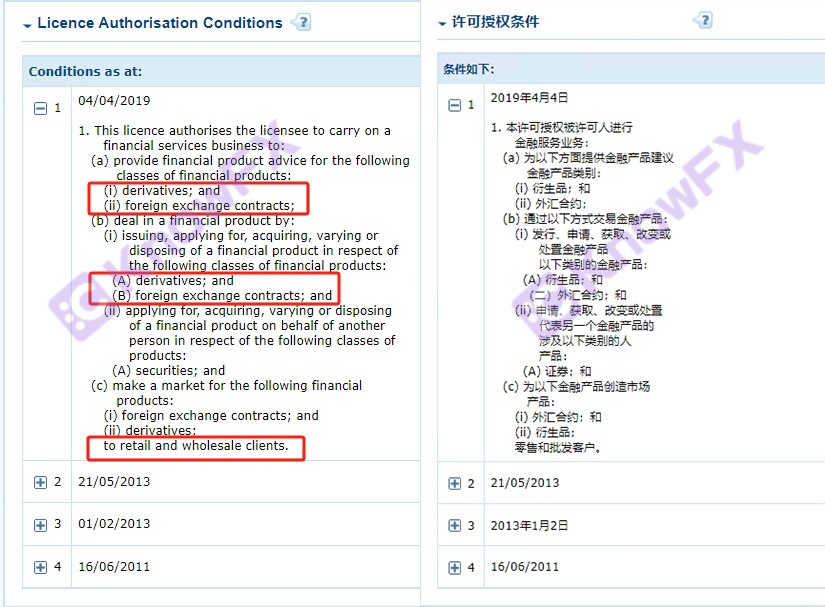

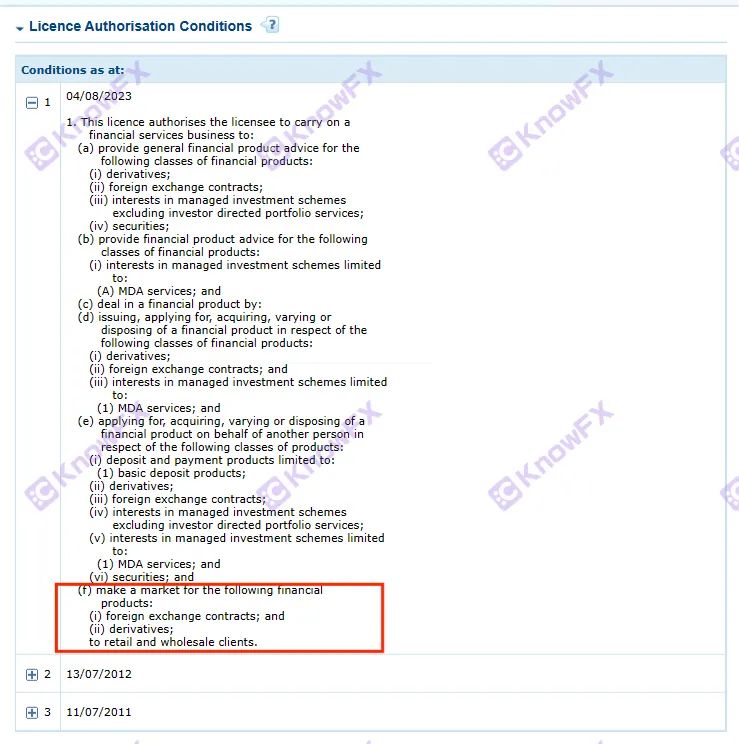

The ACYSECURITIESPTYLTD is indeed supervised on the Australian official website, and the financial services content that the license can provide should include Derivatives (financial derivatives) and ForeignexchangeContracts, and it can also be provided to retail customers (TORETAIs L)Retail investors, so this license is Australia's full license.

ACY Securities official website sees a message that only Australian residents can open accounts under the Australian (ASIC) license supervision, and not Australian residents can only open under non -foreign exchange supervision accounts such as SVGFSA.

Therefore, as long as it is not the funds of Australian residents, it will not be supervised and there is no guarantee at all. It will use Australian licenses to attract customers, and then open funds to harvest funds.

The above is the problem platform that I know about the use of Australian licenses to publicize the publicity of the Chinese people. Everyone must be careful!Intersection

导言:在当今的投资领域里,我们时刻都需要保持警惕,因为投资市场的复杂...

海汇国际诈骗案深度解析:资金盘DRCFX复出传闻背后的真相导言:近年...

据“富途”官方消息:富途拟于2023年5月19日起在中国境内线上应用...

海汇国际资金盘风云再起?DRCFX即将复出,8亿惊天大案细节大揭秘!...

提问:Moomoo资金盘割韭菜:提现不到账,危机初现要懂汇温馨提示:...