Investors definitely hope that the smaller the point difference of the platform, but for the problem platform, this is a good opportunity for them to search for profits. Today, I will give you a look at some large -scale platforms. Some of them still claim to be different!IntersectionBe sure to look down!Intersection

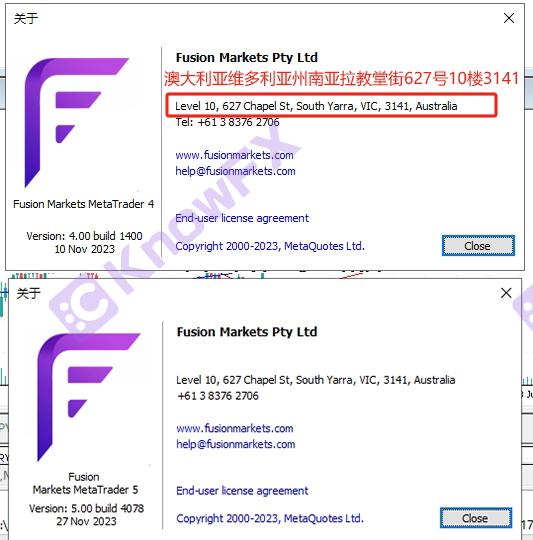

1.FusionMarkets

The brokerage FusionMarkets has a score on the remittance as low as 2.15 points. In the comments, several investors mentioned: "Trading it is absolutely unreliable. It is a pure scammer.Large, you also need to pay the commission of a fixed rate. "

FusionMarkets actually used only one official website that did not mention FusionMarketSptyltd, which did not mention the name, which is an Australian company.

Could it be that this company is a company that can't be on the table?IntersectionWhy dare not publicize the company's information on the official website, or is FusionMarkets trying to cover up?

Looking back at why investors call FusionMarkets a very big problem when trading ~

As we all know, the fluctuation of the Australian currency exchange rate is the result of a multi -factor comprehensive role. Economic factors, political factors, foreign exchange market demand and supply, international trade, and foreign central bank policies will affect the exchange rate of Australian currency.

Therefore, the point difference of the Australian department will be relatively high, and the rebate to the agent is also higher. It is also important to remind everyone to invest cautiously, understand these factors and pay close attention to their changes.The securities dealer deceives investors at ultra -low points. In fact, Australia's point difference is relatively high.

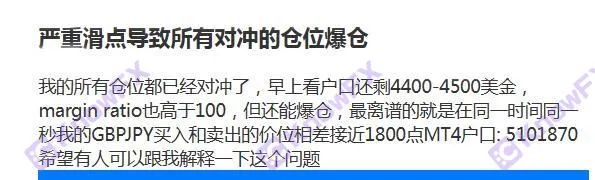

2.sohomarkets

An Hui friend who found a transaction in SOHOMAMARKETS was exposed. All the positions of Huiyou have been hedged, and the difference in the price of the buying and selling price of the pound/yen (GBPJPY) is close to 1,800 points!At that time, the margin ratio had already rushed to 100!The case of slippery point has caused a lot of cases that have been exposed to Burst. Most of them have been exposed to. Most of them are the banner of being strictly supervised by the black securities firm, but secretly controlled the background data ...

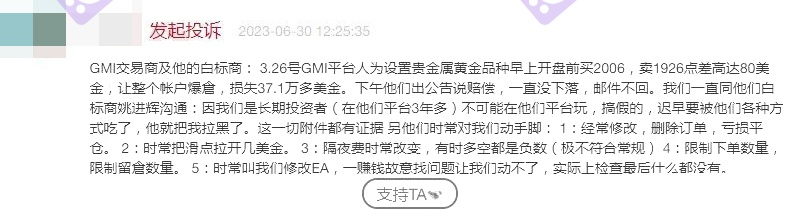

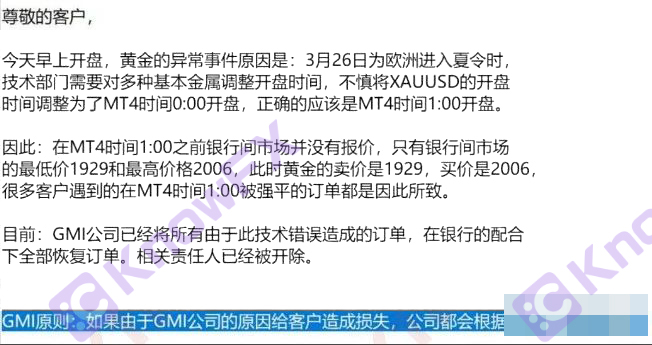

3. GMI

GMI harvested more than two million customers at will, and the blood was unparalleled, and the evidence was conclusive.

In the first two months, some investors said: "Old customers who have been in GMI for more than three years, now they lost more than two million to the platform!

At first, investors felt that the platform's trading environment was okay.However, until March 27 this year's precious metal gold varieties, the price was set by the GMI platform to set the price to 2006, and the 1926 -point difference was as high as 80 US dollars, allowing the entire account to lighten up, losing more than 371,000 US dollars.

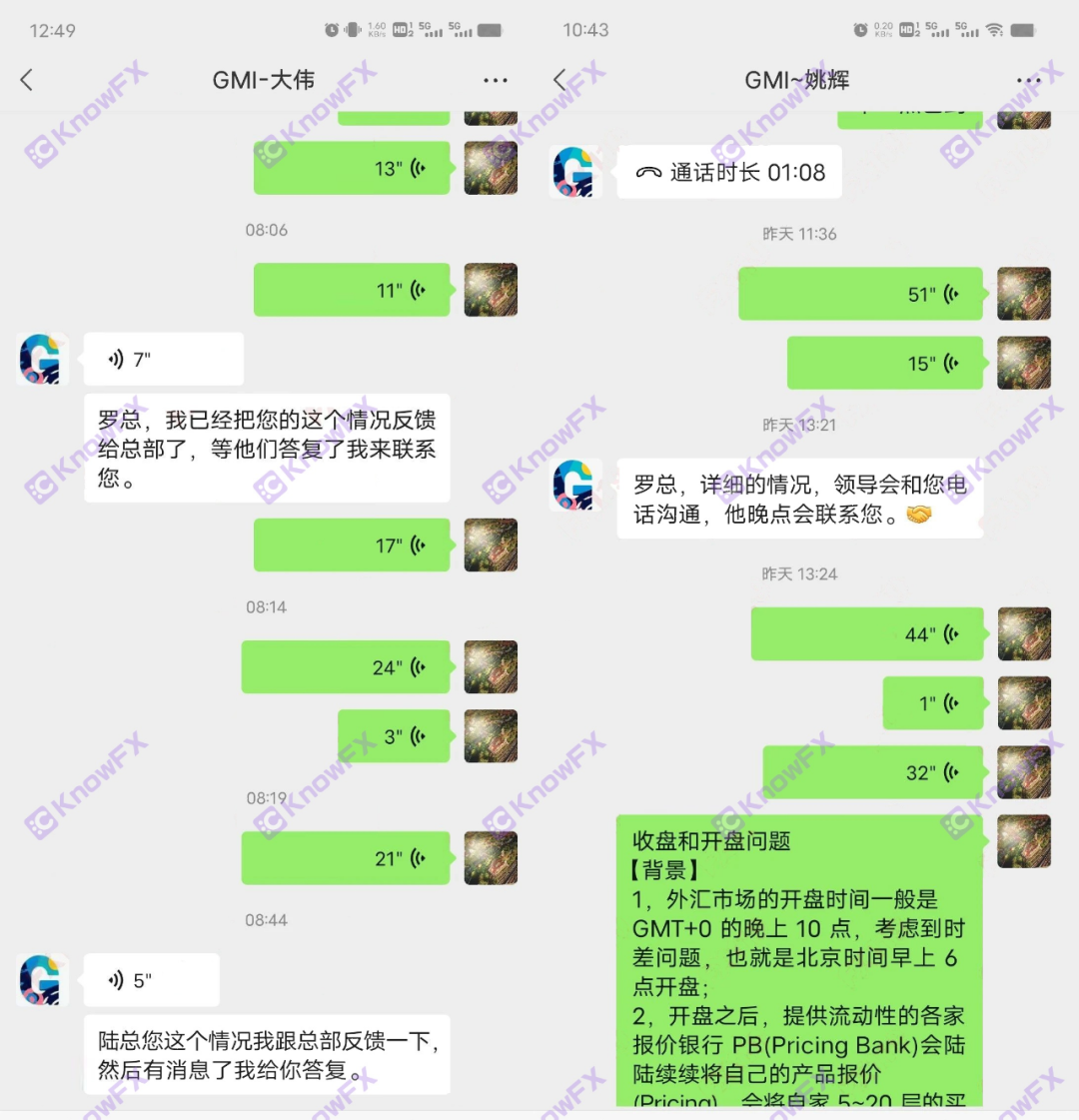

After that, the investors submitted the collection of evidence to the GMI dealers and his white standard, and explained the situation.

In the afternoon, GMI issued a soothing announcement, saying that the platform would compensate investors!

However, after the announcement was released, the platform was silent. Investors have repeatedly via WeChat, and the email communication has no results!Intersection

Therefore, don't trust the so -called low -point difference platform. Most of them are the methods of inducing gold in the problem platform!Intersection

导言:在当今的投资领域里,我们时刻都需要保持警惕,因为投资市场的复杂...

海汇国际诈骗案深度解析:资金盘DRCFX复出传闻背后的真相导言:近年...

据“富途”官方消息:富途拟于2023年5月19日起在中国境内线上应用...

海汇国际资金盘风云再起?DRCFX即将复出,8亿惊天大案细节大揭秘!...

提问:Moomoo资金盘割韭菜:提现不到账,危机初现要懂汇温馨提示:...