China's most mysterious capital crocodile "Zhongzhuang Department", with no debt at least 200 billion!

Recently, the Sino -Zei Financial Group has had serious financial problems, and its assets have not been able to cover the debt in full, facing the dilemma of non -debt debts.

Since the sudden death of the actual controller in 2021, many senior executives and core personnel of the group resigned one after another, resulting in internal management facing a state of failure.The operating decisions of Zhongzhi Group and its enterprises are highly dependent on the real -life controller. This highly concentrated decision -making model makes the group facing huge management challenges after the death of Zhizhi.

According to Zhongzhi Group itself, the company's business has continued to deteriorate since the death of Zhizhi in 2021.Let's take a look at the beginning and end of the incident today!

1. The glory of the Chinese planting department

The name "Zhongzhi Department" is no stranger to many investors.As a historic wealth management company, the Chinese plant has created one legendary story after another.With its unique investment philosophy, rigorous risk control and efficient team collaboration, the rapid rise of the China planting department has become the power that cannot be ignored in the domestic and international financial markets.

During the glorious period, the business scope of the China Planting Department covered multiple fields such as private equity investment, asset management, wealth management, and provided a full range of financial services for many high net worth customers.Its outstanding performance and good reputation have attracted a large number of investors, including well -known enterprises and institutions.

However, as people say: "The prosperity will decline." After the glory of the Chinese planting department, some unknown secrets were hidden.These secrets have caught the unprecedented storm.

Second, the reconnaissance of the case

On November 25, after the official report of the Beijing police, the actual controller of China Chi Group Xie Zhizhi and other personnel were confirmed to be suspected of crime and had been taken criminal compulsory measures.This means that the managers and core members of Zhongzhi Group are currently in a state of control.

Now that Zhongzhi Group is defined as criminal crimes, it may involve illegal absorption of public deposits or crimes of illegal fundraising.No matter what kind of qualitative, it is a collective crime of gang, so there are many people involved.

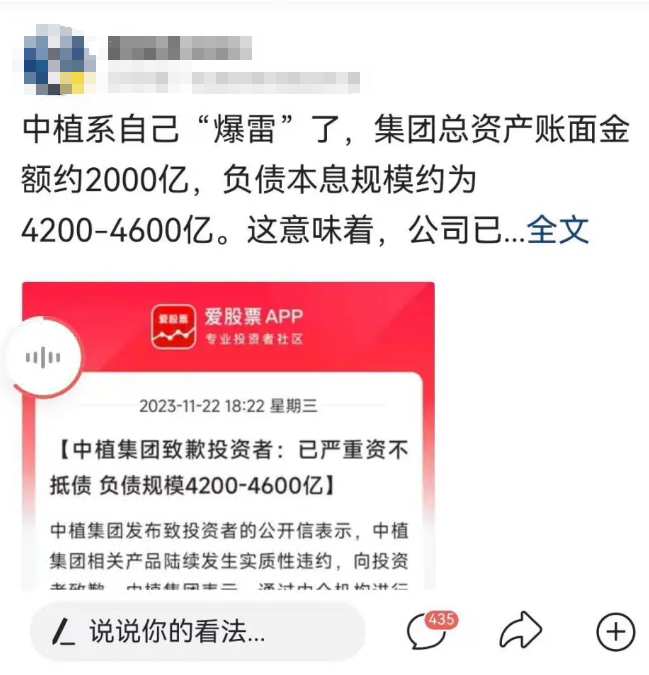

In the public letter to investors issued by Zhongzhi Group, they frankly admitted that they had begun to liquidate through an intermediary simulation.At present, the total assets of Zhongzhi Group are about 200 billion yuan, but due to the huge debt scale, after deducting the deposit, the relevant liability principal and interest rate is about 420-460 billion yuan.This means that the final result may be that the debtor will face a loss of about 260 billion yuan.

This situation is a huge blow for Zhongzhi Group and investors!

At present, the Chinese plant department is actively seeking a solution to the problem of non -debt.Relevant parties said that they will try their best to reduce the impact on the financial market and other related industries.At the same time, the company is also trying to adjust the business structure to improve the operating conditions.However, specific solutions and future development still need to be further observed.

Third, risk awareness and rational choice

The scandal of Zhongzhi Group made us realize that the risks in the financial market are everywhere, so we need to have a certain sense of risk to succeed in the unstable market environment.

First, learn to invest rationally.

Abandon the fantasy of wealthy overnight and establish the concept of long -term investment.Do not follow the trend, do not greedy huge profits.

Secondly, enhance the sense of risk prevention.

When choosing to invest in products, you should fully understand the risk characteristics of the product and ensure that your investment risk tolerance is matched with the product's risk level.At the same time, pay close attention to the dynamics of the market and adjust the investment portfolio in a timely manner to cope with market changes.

Finally, learn to protect rights.

When encountering problems, we should actively report the situation to the regulatory authorities and safeguard their legitimate rights and interests.Only with sufficient awareness of risk and rights protection can we better protect their own interests in the financial market.

Although the illegal acts of Zhongzhi Group have brought some losses to investors, we also see that the regulatory authorities' strict law enforcement and market self -purification capabilities have also been seen.In this process, investors need to continuously improve their awareness of risk and rational choice to ensure that their investment path is more stable and sustainable.

Investment needs to be cautious, please brighten your eyes!

导言:在当今的投资领域里,我们时刻都需要保持警惕,因为投资市场的复杂...

海汇国际诈骗案深度解析:资金盘DRCFX复出传闻背后的真相导言:近年...

据“富途”官方消息:富途拟于2023年5月19日起在中国境内线上应用...

海汇国际资金盘风云再起?DRCFX即将复出,8亿惊天大案细节大揭秘!...

提问:Moomoo资金盘割韭菜:提现不到账,危机初现要懂汇温馨提示:...