Infinox was founded in 2009 and claimed to be a global recognized and under international supervision foreign exchange difference contract trading broker.The company holds a regulatory license issued by the Mauritius Financial Services Committee (FSC) and the Bahama Securities Committee (SCB).

As an old -fashioned broker, Infinox's strength has always been not to be underestimated.However, recent detectives have discovered that many of Infinox's high -levels have changed to the competitor platform, which is undoubtedly a major disaster for Infinox.

1. Infinox high -level high -level hop

Tiagodacostacardoso, who has been an Infinox executive for four years, has left and switched to competitors, EXINITY, and is the new senior vice president of EXINITY in Dubai.He has served as the INFINOX regional manager and is responsible for setting up the Infinox Branch in Lisbon, Portugal.

Isabellamannucci has joined Tradingenation from Infinox. In the past year, she is responsible for selling institutions in the Latin American region in Infinox.

Michaelo'sullivan was previously the chief technical officer (CTO) of Infinox.HANTECMARKETS has announced that Michaelo'sullivan has been hired as a technical strategy director.

Leeholmes has more than 12 years of experience in the field of foreign exchange and derivatives.Before changing Hantecmarkets, he served as a member of the executive management of Infinox.

DanyMawas jumped from Infinox and hopped Raisefx, who used to be an Infinox global talent retaining supervisor.

Richardperry announced the position of market analysts that had left Infinox.The loss of Infinox's personnel is likely to mean that this operating condition has a serious problem!Of course, it is not ruled out that some high -level personnel jumping is for personal reasons.However, if a securities company's high -level high -level hopping is frequently changed, investors should be vigilant, carefully evaluate the business status of the platform, and pay attention to the performance and financial situation of the platform.Once the problem is serious, then investors should consider making money as soon as possible to find other investment opportunities to avoid people's wealth!

2. The problem of regulatory licenses is serious

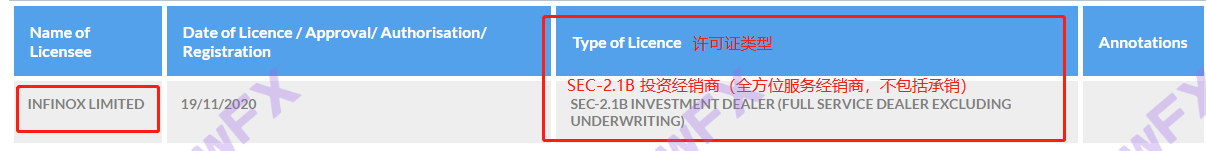

Through MT4/5 search, there are two companies used to trading in Infinox: InfinoxLimitedAs mentioned earlier, the supervision announced by Infinox also includes the authorization supervision of Bahamas (SCB).

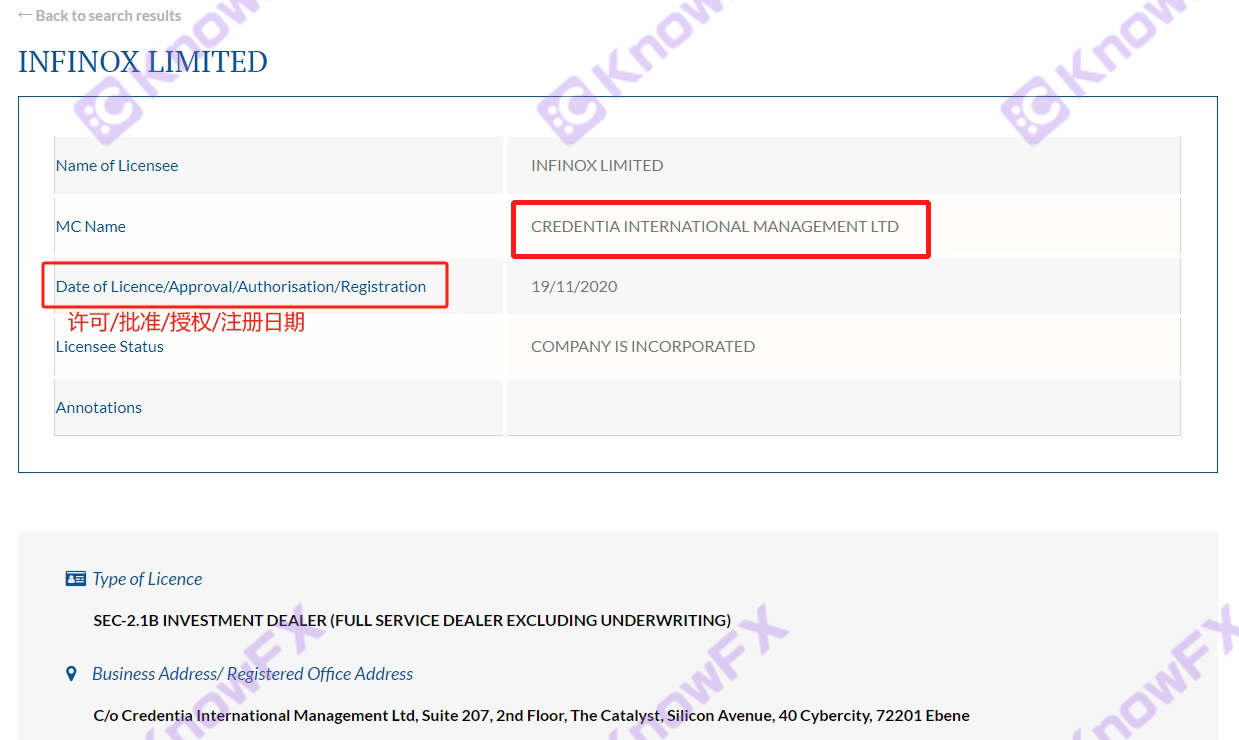

(1) Mauritius business is suspected to be contracted

The regulatory information in Mauritius shows that InfinoxLimited is an authorized license, that is, AR licenses, which are not directly supervised by the Mauritius Financial Commission.

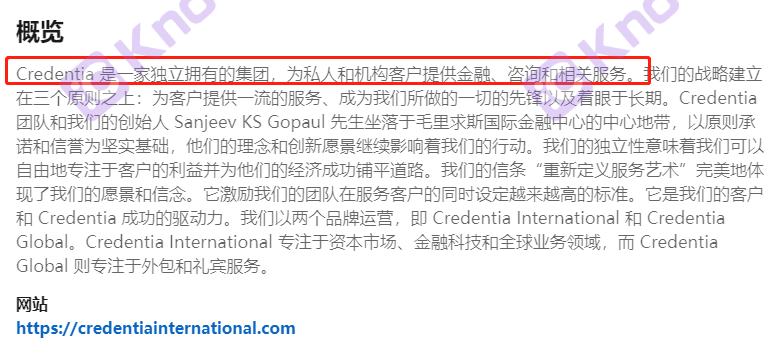

The authorized company CredentiaInternationalManagementltd focuses on the outsourcing and ritual service of the capital market, fintech and global business.It is likely that some of Infinox's business in Mauritius is operated by the company on behalf of the company?

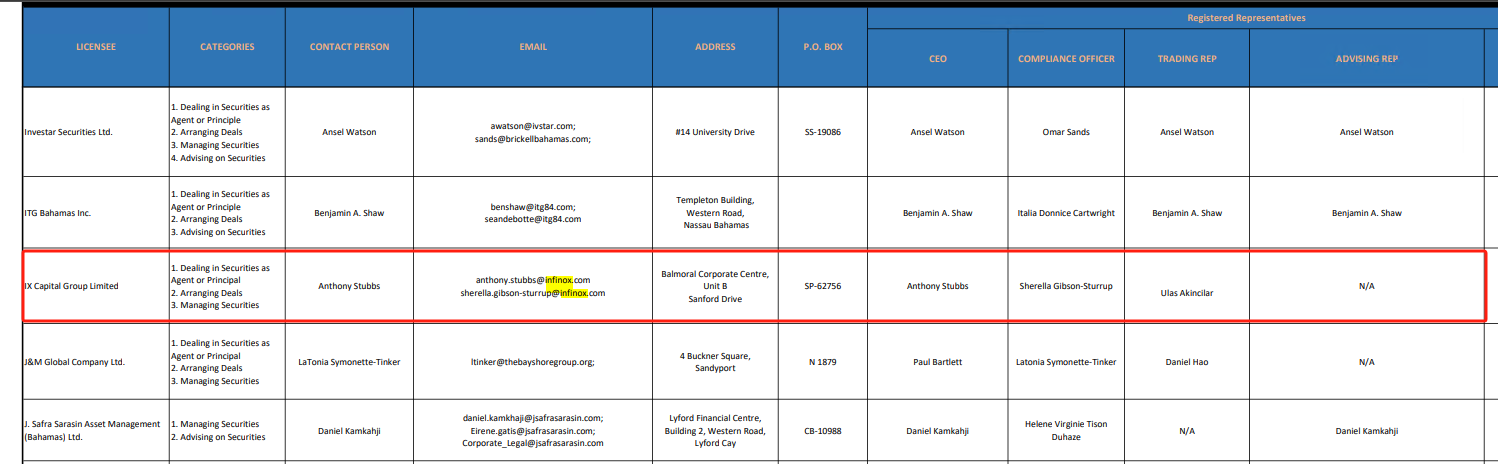

(2) There is no transaction in the Bahama license

Search through the official website of Bahamas, and the company named Infinox's authorized company name: ixcapitalGrouplimited.Its scope of business includes: buying and selling securities as an agent or client, arranging transactions, and managing securities.The business scope of this license does not clearly mention that foreign exchange transactions can be performed. This also shows that the company of IXCAPITALGROUPLIMITED, if retail and institutional foreign exchange activities, are over -limited operations.However, it seems that INFINOX has not used it for transactions, and we have seen it for a while.

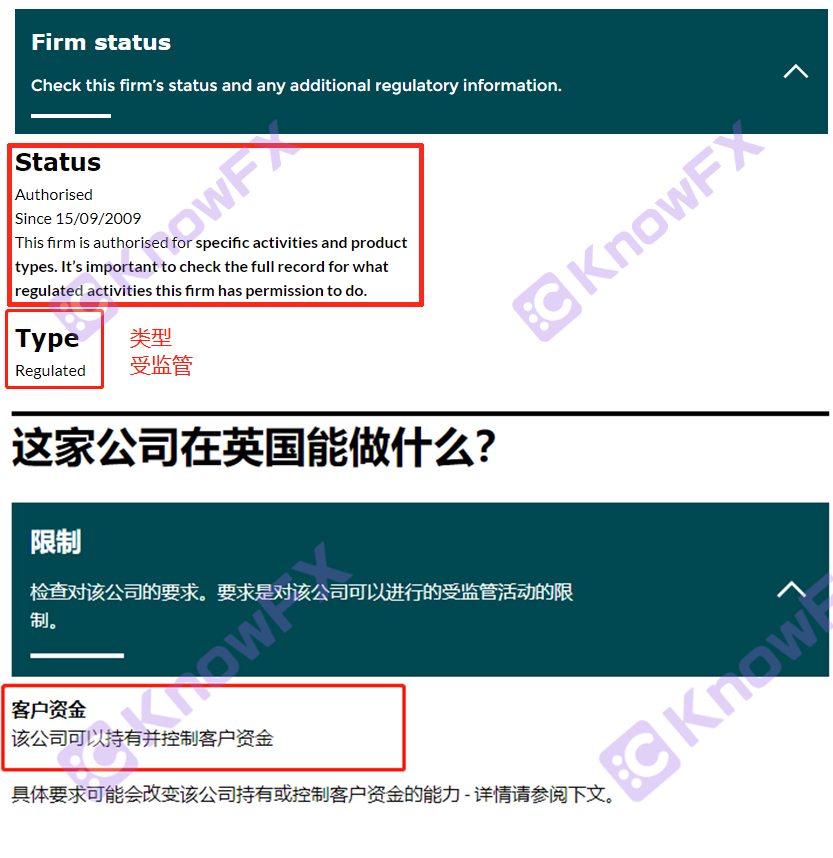

(3) The British license is suspected to be a vase role

The survey results show that Infinox British InfinoxCapitalImited holds the British FCA authorized financial license.But I do n’t know why, this big license is not reflected on the official website?

Detective guessed that this license existed only infinox to reassure investors.After all, the process of opening overseas accounts for domestic users is very complicated and cumbersome. According to legal conditions, institutions are not allowed to conduct agency.Therefore, Infinox uses InfinoxCapitalImited to apply for MT4/5, which can only play a role of a vase for Chinese people.

Sure enough, it was found that the account of the detective was opened under Mauritius.This also confirms the previous speculation of the detective, and Infinox's Mauritius license supervision is relatively weak, then investors may involve the risk of misappropriation of funds here!

Detectives hereby call on investors to face the brokerage company Infinox to be vigilant, do not easily believe, and avoid losses from funds.

Infinox article in the past:

导言:在当今的投资领域里,我们时刻都需要保持警惕,因为投资市场的复杂...

海汇国际诈骗案深度解析:资金盘DRCFX复出传闻背后的真相导言:近年...

据“富途”官方消息:富途拟于2023年5月19日起在中国境内线上应用...

海汇国际资金盘风云再起?DRCFX即将复出,8亿惊天大案细节大揭秘!...

提问:Moomoo资金盘割韭菜:提现不到账,危机初现要懂汇温馨提示:...