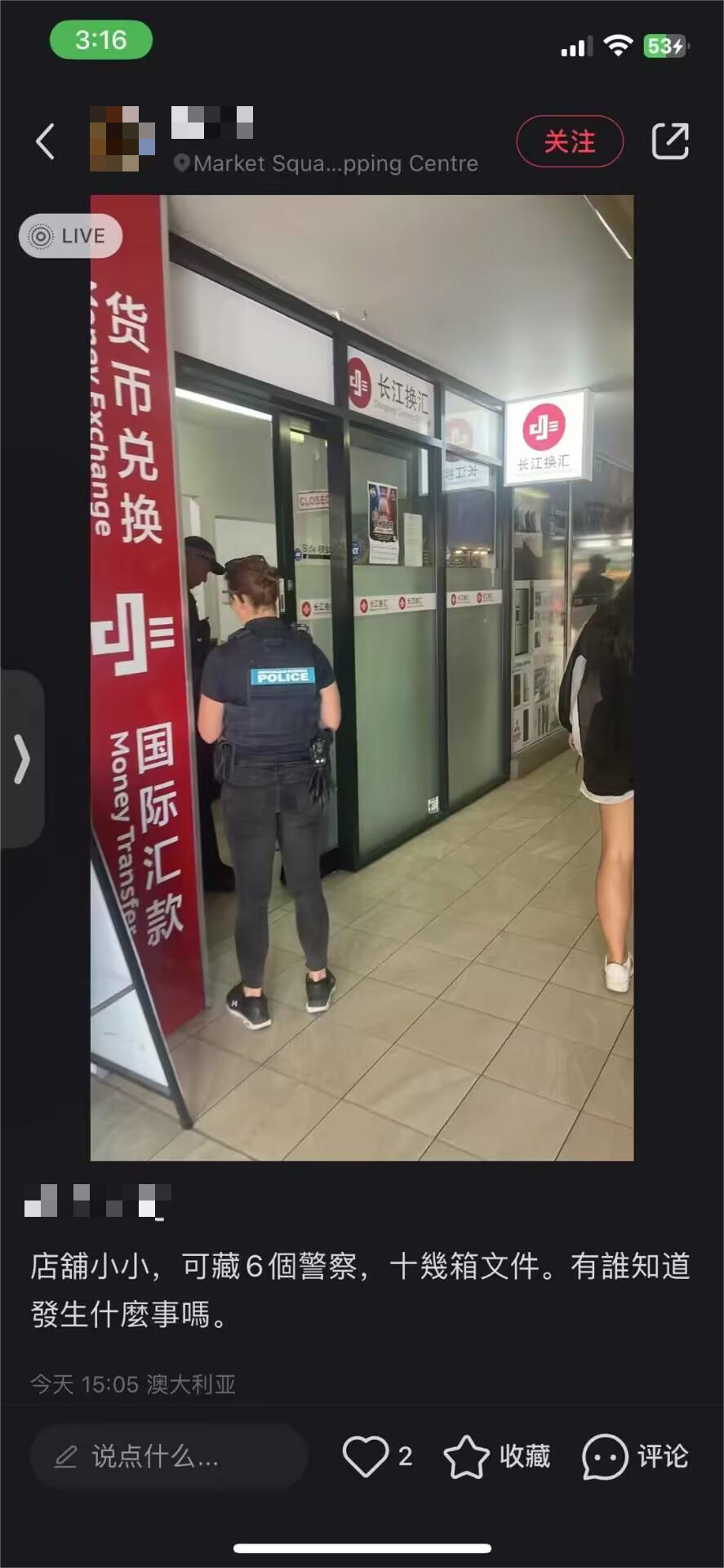

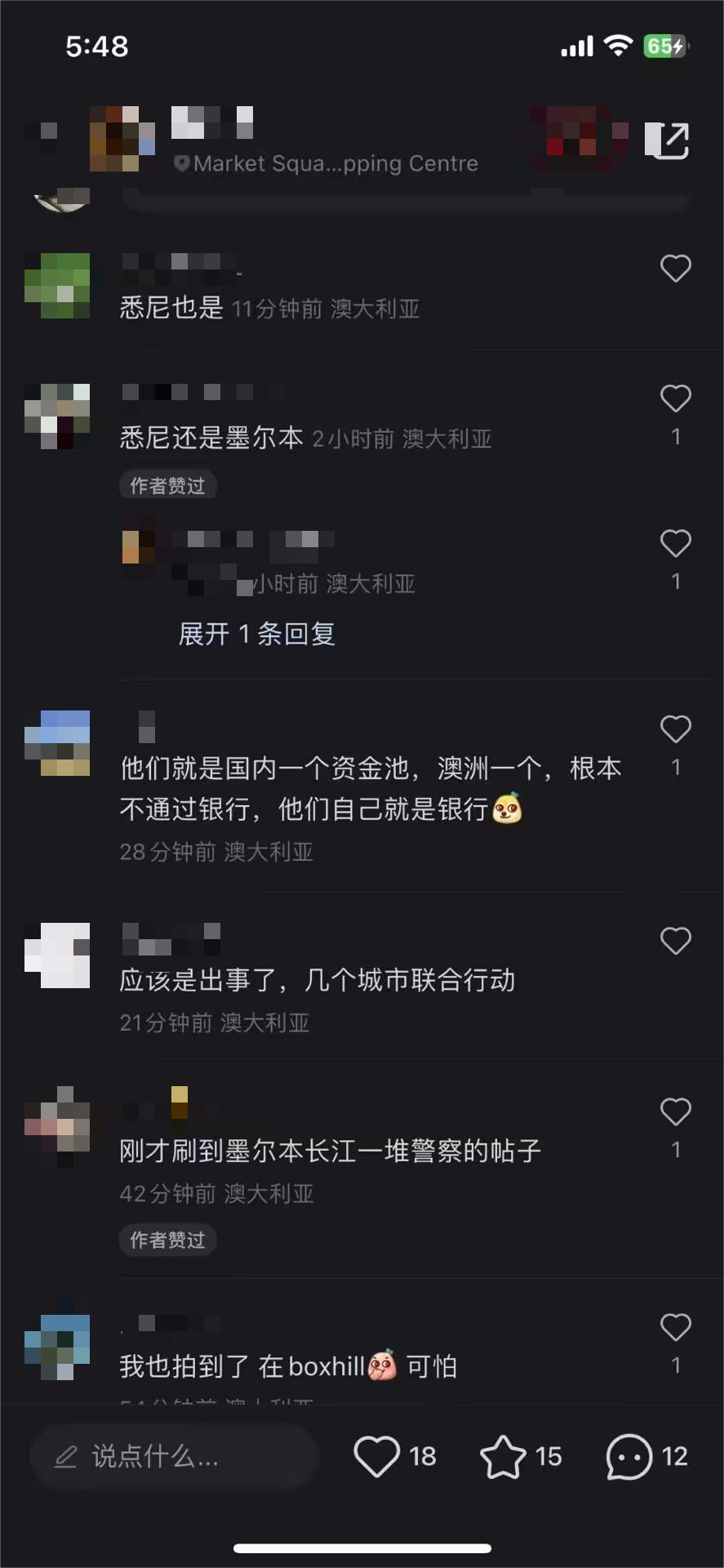

Today's detectives arrived at the line report, Puhua Securities's parent company Yangtze River exchange in Australia's offline stores were controlled by the Australian police!It is said that the police in several cities acted at the same time, and a single store had a dozen boxes of documents. What happened?Intersection

Some investors say that Puhua Securities has funding pools in China and Australia, and all transactions are not passed by banks!

Such obvious violations, Puhua Securities played very 6!This involves the purpose of unauthorized fund -raising, unusual financial activities, and manipulating markets!

Subsequent detectives will continue to follow up with the investigation of the Yangtze River exchange. Today, I will understand the issue of its platform -Puhua Securities.

Puhua securities supervision loopholes are huge!

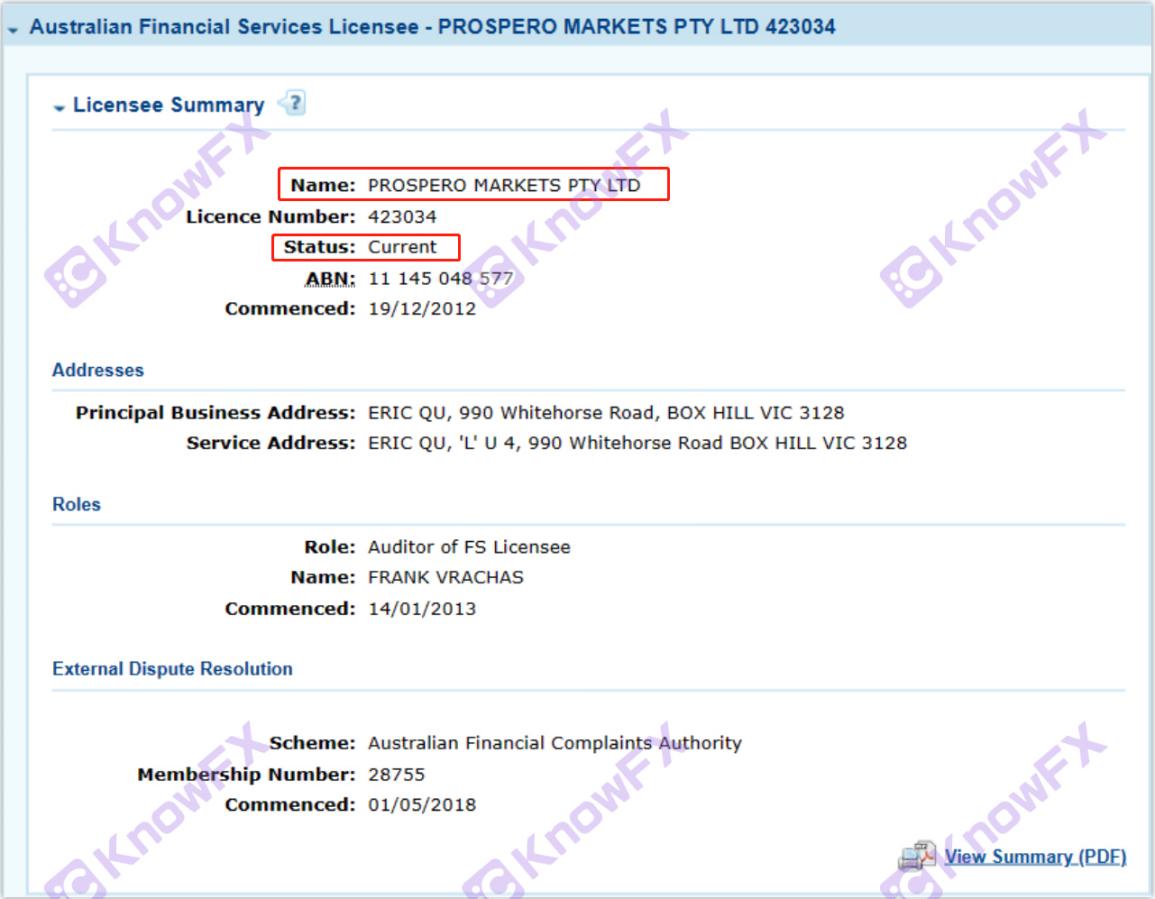

There are two companies in Puhua Securities' actual transactions, namely ProsperomarketSptyltd (Australia) and ProsperomarketSCompanylimited (New Zealand Corporation).

Australia ASIC is forbidden to receive overseas customers

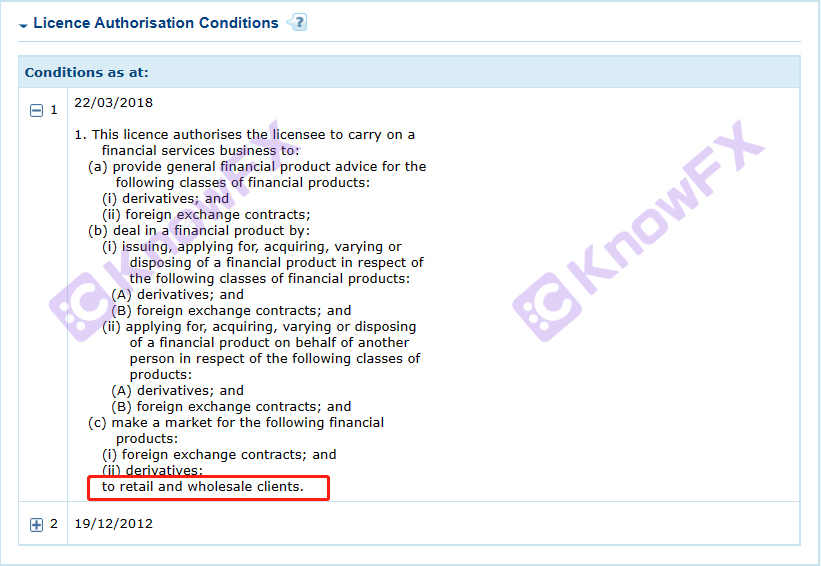

After verification by detective, ProsperomarketSPTYLTD does hold ASIC licenses and is regulated by it, which can provide services to retail and institutional customers.

However, in April 2019, ASIC announced a series of new regulations!The new regulations stipulate that: foreign exchange and difference contracting brokers under the supervision of ASIC prohibit the acceptance of overseas customers (the spearheads of this rule point to mainland China and EU customers), and the current overseas customers' accounts must also be closed in limited time.

Faced with the new regulations, Puhua Securities will set a different approach to conduct all the customer accounts on a non -regulatory company for transactions!This is the New Zealand company to be said to the second point.

No New Zealand Corporation has no supervision!

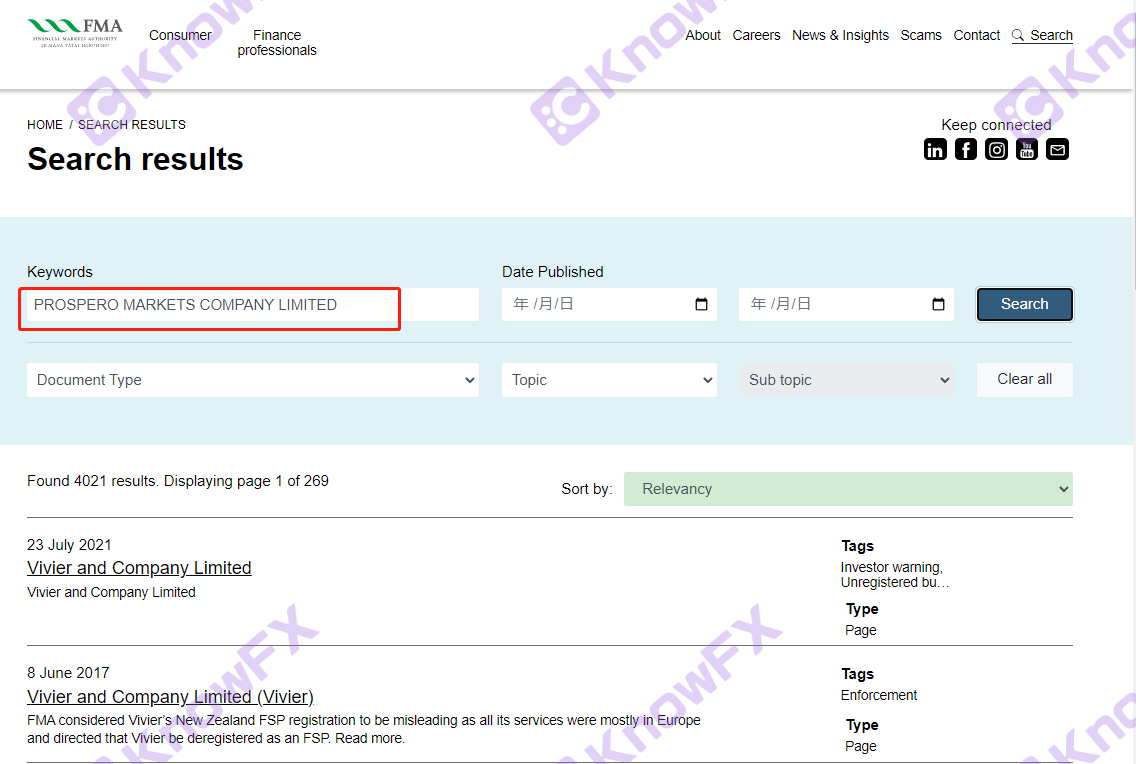

Whether it is the official website of the New Zealand FMA or the official website of the New Zealand FSP, no detective found the supervision information of the ProsperomarketScompanylimited trading company!This also shows that Puhua Securities uses a non -regulatory company to trade, and the company does not even have basic registration information!

Investors, please immediately check whether your account is opened in this company. If so, please pay for it immediately!

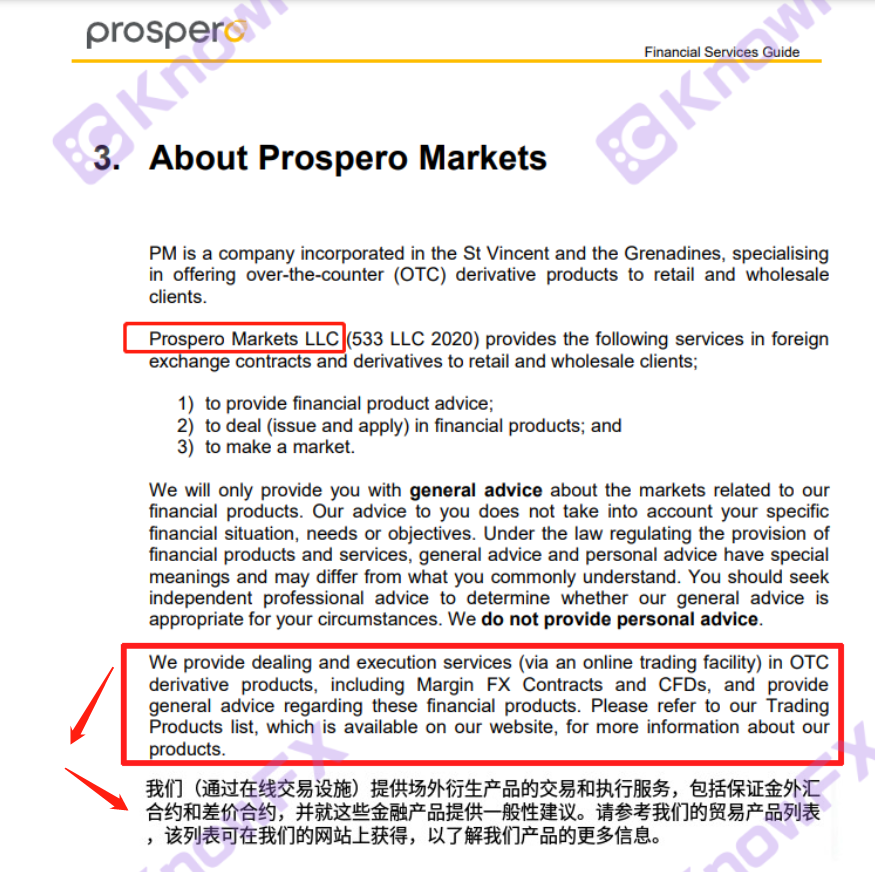

(3) Saint Vincent is used to provide services to global customers?

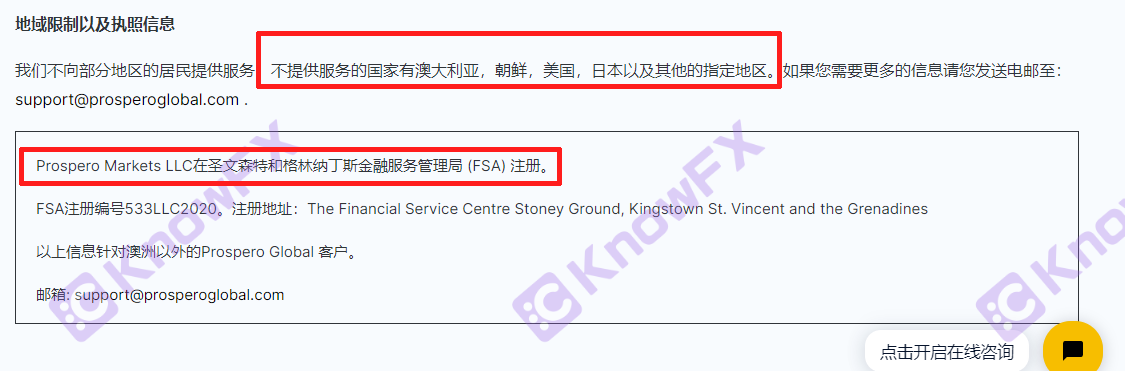

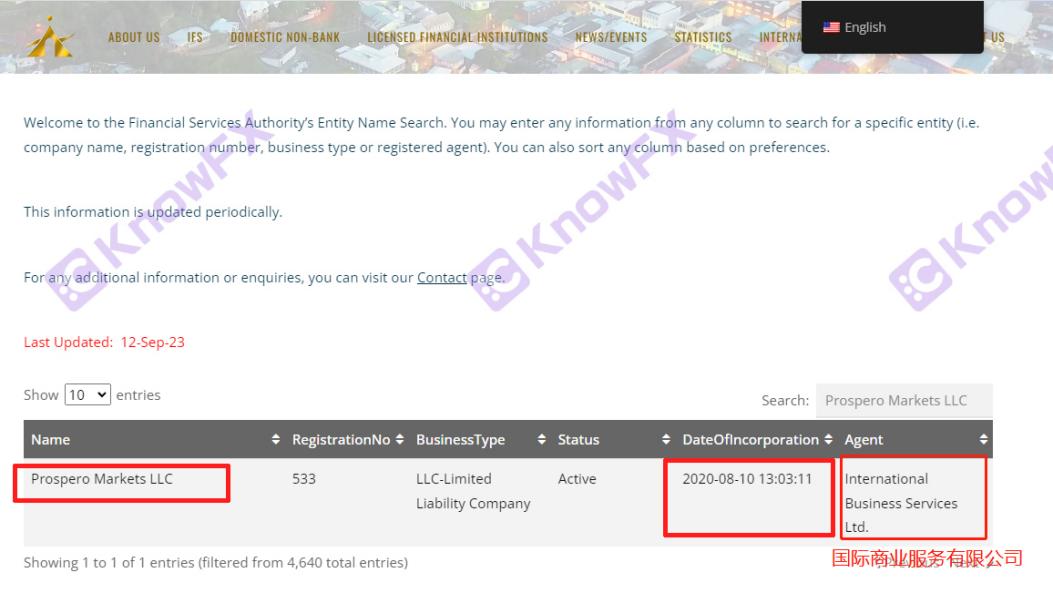

The official website of Puhua Securities also mentioned the company's company Prosperomarketsllc, and emphasized that the company was used to provide services to global customers (except Australia, North Korea, the United States, Japan, and other designated areas).

San Vincent has not regulated foreign exchange detectives that have emphasized many times, and Puhua Securities is less than 3 years old.This company's use is likely to be a means of money laundering in Puhua Securities!

In addition, the detective found that Puhua Securities emphasized on the official website that Australian companies only received local customers in Australia. Is the rest of the customers opened in New Zealand or St. Vincent?No matter where you are, there is no supervision!In addition, the combination of investors said that Puhua Securities' transactions are not passed by banks.In addition, its mother company Yangtze River exchange was investigated today, and investors who traded on the platform, please immediately pay money!IntersectionIntersection

Investment needs to be cautious, please brighten your eyes!

If you need to check the platform, disclose clues, and complain, please scan the code to add a detective QQ to disclose the news!

You need business cooperation, please scan the code and leave the aircraft number to cooperate!

Query platforms, complaints, more information, please download the Hui APP

导言:在当今的投资领域里,我们时刻都需要保持警惕,因为投资市场的复杂...

海汇国际诈骗案深度解析:资金盘DRCFX复出传闻背后的真相导言:近年...

据“富途”官方消息:富途拟于2023年5月19日起在中国境内线上应用...

海汇国际资金盘风云再起?DRCFX即将复出,8亿惊天大案细节大揭秘!...

提问:Moomoo资金盘割韭菜:提现不到账,危机初现要懂汇温馨提示:...