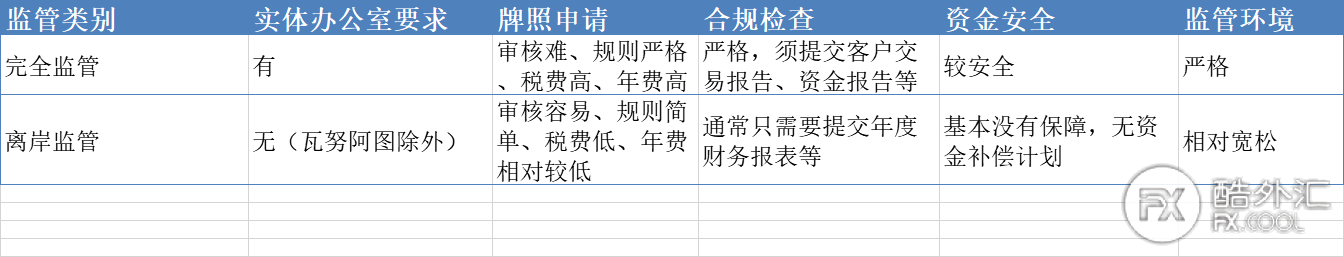

At present, the platform's supervision can be divided into two types in broad sense. One is complete supervision. The supervision and license system are quite strict, such as the British, Australia, and Cyprus we are familiar with.The other is the offshore supervision that has been in recent years. This kind of regulatory environment is relatively loose. For example, Vanuatu, Mauritius, Belipitz, Seychelle, which are more common now are offshore supervision.

The difference between complete supervision and offshore supervision

The main difference between complete supervision and offshore supervision is whether it is required to set up a physical office.Most of the complete regulatory agencies are compulsory to apply for the company to have physical offices in the local area, and must hire a certain number of employees (including company directors and shareholders), and even require some employees to be residents at that time, as well as taxes.The operating costs of brokers are relatively much higher.The offshore regulatory agencies will not force the platform to have physical office sites and employees, as long as they submit some costs.

In addition, more regulatory agencies have more requirements for licensed personnel, including expenses, minimum capital requirements, due diligence investigations/appropriate candidates for directors and shareholders of the company and company, and the principles of appropriate candidates.in:

In terms of expenses: including application fees, activation fees and annual fees, etc., and the minimum capital requirements of licensed companies are significantly higher than that of offshore supervision institutions;

The review procedures for offshore regulators are simple, and the regulations in all aspects are relatively loose. Therefore, the qualification requirements and compliance inspections of the platform will not be too strict.

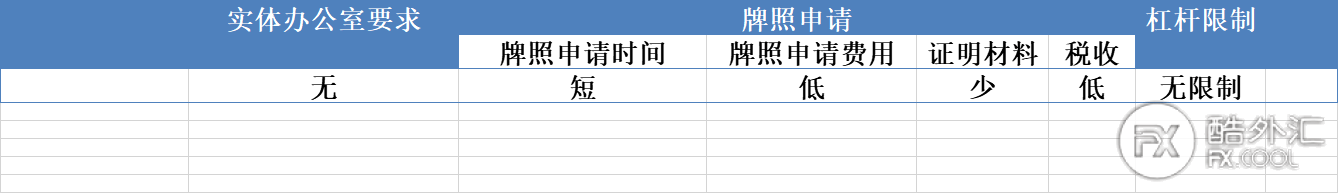

In addition, in terms of restrictions on licensed platforms, the restrictions of offshore regulators are relatively loose.The most prominent point is that in terms of leverage limit, the upper limit provided by the platform provided by the offshore platform can be as high as 500: 1, 300: 1, 200: 1.So many high -leverage platforms will choose offshore supervision.

In general, full supervision is much more reliable than offshore supervision.The offshore regulatory license is basically not guaranteed to the customer's funds. If the platform runs, the investor's money can hardly take it back!IntersectionSo everyone has to be vigilant and try not to invest in the platform of offshore supervision!IntersectionHere, I know that Brother will take stock of some offshore supervision issues to help everyone make choices!

1.Admiralmarkets Edie Mai

AdmiralSSCLTD is indeed authorized by the Seychel Financial Services Authority (FSA), but this license is a offshore regulatory license. The funds are not guaranteed at all!Intersection

2. Brokerage Anzocapital's head capital

This problem platform is the high leverage mentioned earlier. This problem platform is as high as 1: 500. The high leverage is a double -edged sword, and there are still a few people who can hold high leverage.

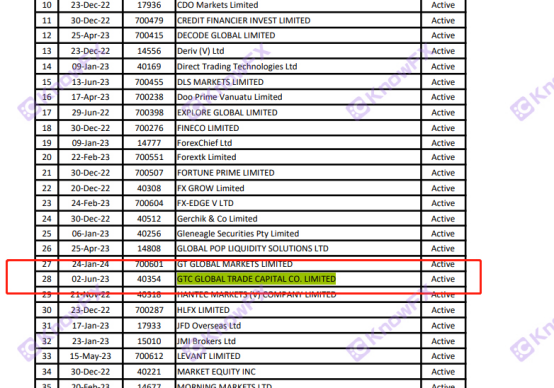

3.GTC Zehui Capital

The so -called four -place regulatory cards of this problem platform. The UAE, Mauritius, and Hong Kong are all invalid supervision. Only Vanuatu, but also offshore supervision!IntersectionIntersectionThe only effective supervision is offshore supervision!Intersection

4.Wetrade Zhonghui broker

Before mentioning off -shore supervision, San Vincent did not supervise the exchange circle, not to mention the offshore supervision.IntersectionStack buff!Intersection

These are the problem platforms for the offshore supervision compiled by my brother. The problem platform is often very keen on offshore supervision. One is high leverage, and there is a simple review and loose terms.When choosing a platform, everyone should try not to choose the platform for offshore supervision to avoid stepping on the pit!Intersection

导言:在当今的投资领域里,我们时刻都需要保持警惕,因为投资市场的复杂...

海汇国际诈骗案深度解析:资金盘DRCFX复出传闻背后的真相导言:近年...

据“富途”官方消息:富途拟于2023年5月19日起在中国境内线上应用...

海汇国际资金盘风云再起?DRCFX即将复出,8亿惊天大案细节大揭秘!...

提问:Moomoo资金盘割韭菜:提现不到账,危机初现要懂汇温馨提示:...